These headlines have been coming in fast and furious over the past couple of weeks and if I was an Android user they'd be making me nervous. It appears that foreign hackers were able to successfully penetrate U.S. Government servers and steal all personnel data on every single employee.

|

CNET reports: Hack affected every single federal employee, union says

These headlines have been coming in fast and furious over the past couple of weeks and if I was an Android user they'd be making me nervous. It appears that foreign hackers were able to successfully penetrate U.S. Government servers and steal all personnel data on every single employee. Tuesday's keynote for the developers conference did not disappoint. There were a lot of things I'm happy to see coming but when I think back after a couple of days, these were the most memorable.

Opening Video - Ha! That was the best opening video for a corporate keynote ever. Bill Hader's clever performance managed to work in all those app references and be funny without resorting to R-rated comedy. To whomever put that together, job well done. El Capitan – What a name. If naming the next version of OS X after a granite structure doesn’t say “stability,” I don’t know what does. Yeah, it’s a bit awkward to say, but from a messaging standpoint it was spot on. And the fact that the underlying performance enhancements are going to apply to old hardware is amazing. The market knows that Macs sell for a premium over Windows based PCs, but Apple is also demonstrating that there are real benefits to buying from a company who tailor makes the OS to its hardware. Like getting efficiency and battery improvements years after purchase. iOS 9 – Split window multi-tasking for my iPad Air 2! Yes!!! 'Nuff said. Proactive - Everyone knows what it's like to try and use web services when you have a bad or slow cellular connection. Adding a predictive assistant to the device sounds like a great idea on two fronts. One, you get the performance boost of it being locally on your phone instead of sending data to a server across the country and waiting for a response. And two, you enjoy the privacy that there isn't a server somewhere storing all your data. Apple is fast becoming the better choice for people who enjoy Google services. News App – Conspicuously showcasing a blog like Daring Fireball during the News App demo was a sign that Apple is trying a new tack and going after the tastemakers. The opposite of what they did with The Daily, the first ever iPad-only news app. Back during The Daily’s launch in 2011, they went for mass-market appeal through the use of original news with lots of embedded media that would hopefully attract the masses. It never happened. Now Apple is allowing popular bloggers to upload their content. Brilliant decision. There is a much better chance that these bright comets will have a nice long tail of an audience that will follow. Apple Music – The biggest story to me with Apple Music is the three months free. Everyone I know who does streaming said that after they "tried" it they got hooked. Apple is primarily going after the huge market who hasn't started streaming yet. Three months is long enough to hook someone for life, and if you don’t see the value in streaming after three months of use, then I doubt six months or longer is going to make a difference. Imagine the hundreds of millions of people who have yet to sign up with any service. Apple isn’t looking to convert the Spotify fans. Poaching users from rival services doesn’t make any financial sense until the low-hanging fruit is all gone. I've heard more than a few comments regarding how Apple is pricing the leather bands for their new Apple Watch. It seems hard to believe that a leather band could cost $150 dollars. Somehow Apple was able to make a much larger leather case for the iPhone 6 and it's priced at $45. Or you could go down to your local JC Penney and get a decent leather jacket for about $150. So what's the deal for $150 for a little strip of leather?

It’s amazing to me that Google is willingly falling into playing the role of the business villain that we’ve all seen in countless kids movies growing up. You know, the one where the evil Acme Corporation has a seemingly harmless yet hypnotic product that at some point in the future will be switched on and turn all the consumers into mindless slaves to the corporation.

There are two kinds of people in the world. Those who like wearing a watch and those who don’t. I’m not talking about smart watches, just regular dumb watches that only tell you the time and date. I’ve always loved wearing a watch. I appreciated the convenience of being able to look down at my wrist to see the time and never have to look for a clock on the wall. And who wants to dig their iPhone out of their pocket when they need to know the date? That takes too long. I value that data, so it was worth it to me to wear a gadget on my wrist to have easy access to it. Some people are just now discovering this.

It's nice to see the operations guys getting a little press now and then. This piece by Dan Frommer over at Quartz highlights the guy behind Tim Cook that keeps things moving.

Apple's Jeff Williams made your iPhone and watch and now he's ready to talk about it. It's said that if you want to know how clean a restaurant's kitchen is, take a peak into the restroom. The thought is that if management can't keep a part of the restaurant clean that customers will actually visit, what condition will parts of the restaurant be that you can't see? The manufacturing equivalent to this rule of thumb is this: If you want to know how well a company executes on it's standard procedures to make or deliver products, ask what their cycle count accuracy is. A well-disciplined manufacturing organization with effective leadership will always possess high inventory cycle count accuracy. I've seen it many times. But a break down in the chain of command at any point with any procedure will always filter down into the cycle count. Receiving isn't doing their inspections or counts? Planning cutting corners with work orders? Supervisors on the floor not enforcing policies? Customer service screwing up sales orders? It doesn't matter where it happens but the buck will always stop on cycle count day. Whether you're managing a company, investing in a company, or looking to purchase a company, it doesn't matter. You need to know that piece of data. And if the relevant parties don't want to tell you the answer, that may be all you need to know. If I could ask Jeff Williams just one question regarding Apple's operating metrics that would be it. What is your cycle count accuracy? No single question tells me more. The Apple blogosphere had a collective head explosion recently when the study from IHS Technology reported that it only cost $84 to make the Apple Watch Sport. Instinctively, everyone knew that just didn't add up. And surprisingly, Tim Cook gave us a big clue to as to how much it costs them to make the Apple Watch. He literally came out and said that the margins wouldn't be as good as the rest of the product lineup. He even went a step further and said that he's never seen anyone even come close to estimating what Apple's products actually cost (he's probably never read MY blog).

Accountants always follow one specific rule. When an outside auditor asks you for information you give the absolute minimum that is required while still satisfying the request. An example would be that if you are asked to provide sales for a particular period, you don't give information pertaining to any other period. Why? Because comparing different periods allows you to see trends and anomalies. This will trigger more questions and requests for more information. Meaning more work for you.

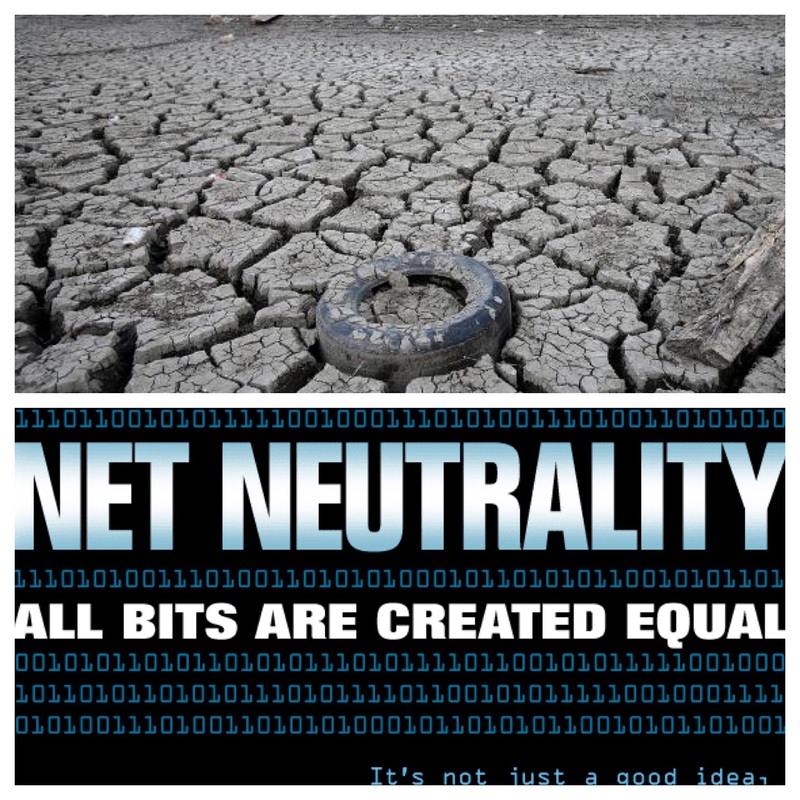

While watching coverage of the California drought and the state government's predicament with how to handle the farming industry's use of water, it occurred to me that this is a similar situation to the net-neutrality debate.

In California, there is a huge underground reservoir of water that is used both by large industrial and small residential customers. Whether you're watering your almond trees or brushing your teeth, it all comes from the same source. The problem that California is dealing with is that most of the water, approximately 70%, is being used by relatively few users, and there is nothing that they can do about it. These are the farmers who have senior water rights and have been shielded by any efforts to curb their water usage. The cost accountant inside me always had a problem with "net neutrality". The world of activity based costing is one in which every resource you consume has a price tag attached. And that price tag ultimately has to be passed on to the customer. If a company is asking for preferential service from a vendor, say next-day-air delivery for a package versus two-day shipment, he can get it for a higher price.

I bought my first MacBook in the fall of 2012 when the 13" Retina MacBook Pro debuted. I remember the thing that stuck out to me the most on what makes Apple special was the MagSafe 2 connector. I remember seeing it for the first time and being astounded that a laptop manufacturer had gone through the time and expense of designing a power connector that wouldn't destroy your laptop. If someone tugged on the cord, the magnet would give way. If you held the cord close to the power port, it clicked into place just where it needed to go. Genius! Here was a company that truly sweats the details and wasn’t afraid to add cost to the laptop if it made sense.

It's always important to manage a business based on where you want to be long term versus falling into the trap of only deciding what you need to do in the short term. When I worked for the Batesville Casket Company I spent most of my time modeling what our business would look like in the next five years with various volume assumptions and trying to summarize what type of assets we'd need, or not need, to operate profitably at those levels. It wasn't much different from the proverbial farmer who needed to keep his eye on a tree in the distance so his furrow gets plowed in a straight line.

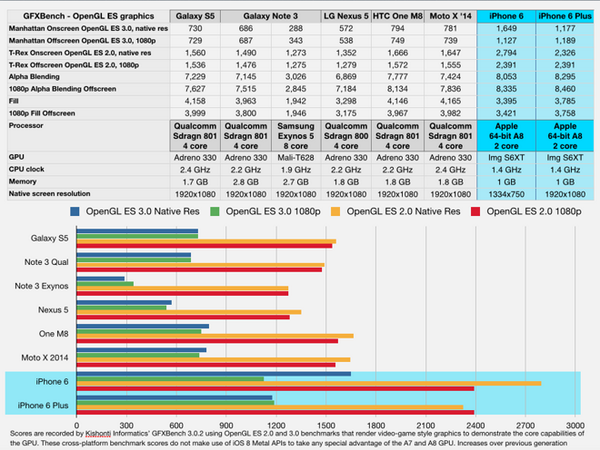

I haven't seen a better side-by-side comparison of two companies who illustrate the two sides of that coin than Apple and Samsung. You may not always agree with the changes that Apple makes to their devices, but in hindsight everyone can see where they were going. Samsung on the other hand, puts their finger in the air and tries to guess where the market is going in the next year, so that they can beat everyone there. Apple Insider's Dan Dilger writes about the consequences of the decision's made at the two companies here... Samsung Galaxy S6 delivers poor graphics performance vs Apple's iPhone 6 When the Wall Street Journal reported a little over a week ago that Apple had a two hundred person group working on auto development, shockwaves were felt in automotive headquarters all over the world. Could Apple really be contemplating on making a bold move into a wholly new industry? Should they?

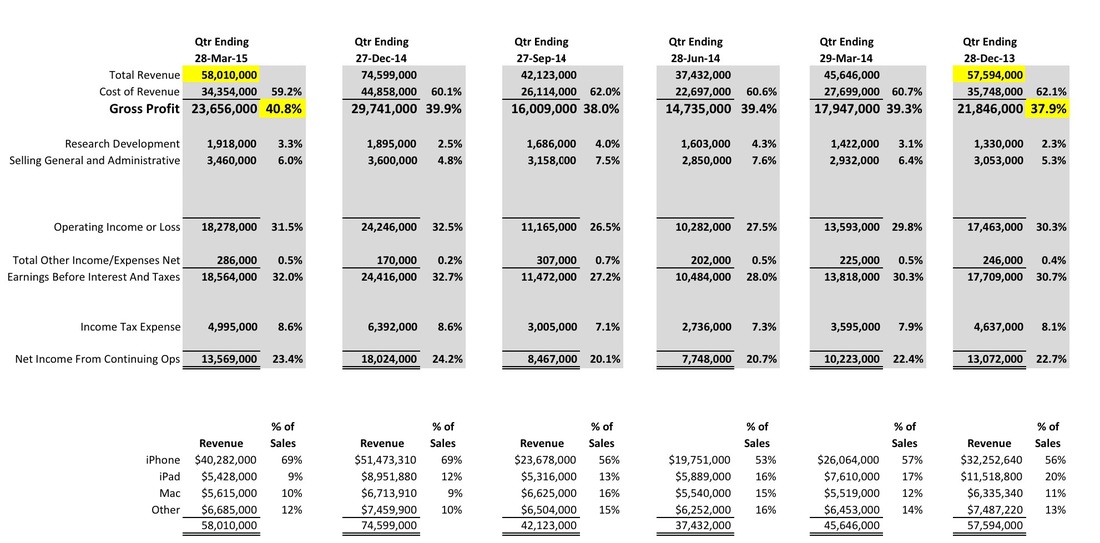

I thought in light of the news, it would be interesting to compare the latest quarterly earnings releases from Apple, GM, and Ford. GM is coming off of one of their best quarters in a long time, but even so, the comparison is eye opening. Some quick thoughts on Apple's big "Spring Forward" event on Monday.

ResearchKit: This is a brilliant move. Apple already had a beachhead in hospitals and this further drills into the medical community. Apple found that the value of peer pressure via apps like iMessage is incalculable. They spider out in a way like a gift that just keeps on giving. ResearchKit not only finds a fresh new medical market but it will harness that social energy that pressures people to buy or switch to iOS. Apple is demonstrating a thoughtful approach to stealing customers away from the competition, meanwhile Samsung slaps on a curved screen that has everyone scratching their heads in puzzlement. MacBook: The new MacBook is going to move Mac margins up. Way up. My earlier thoughts on what Apple is aiming for have been confirmed. Apple has learned a thing or two from manufacturing iOS devices on how to design products that both inspire desire in consumers and satisfy the shareholder's need for a return. And now the iOS team has been holding clinics on how to design with cost in mind. Everyone in manufacturing knows one thing, complexity equals cost. The more parts you have, the greater the cost. The new MacBook has no more moving parts, only one 12" model versus multiple sizes, reduced ports, etc. All this is going to add up to reduced cost of manufacturing. They even did away with the glowing Apple logo on the lid. But this MacBook doesn't just take away features to reduce cost; it actually enhances the user experience where it counts. Travelers lugging their MacBooks in backpacks from one concourse to another at the airport will appreciate the lighter two-pound weight, and those who found the resolution of the old MacBook Air unacceptable will fall in love with the new display. Then there are the new inventions of the Force Touch trackpad and butterfly keyboard. The Force Touch trackpad continues with the theme of reducing cost by taking out movable parts but gives something in return to the user: enhanced functionality. Nice. Apple Watch: Not much to say on this one. We learned the prices and got to see some more day-to-day functionality, but the jury is still out on whether it's compelling enough to sell at the level that Apple needs it to. Based on preliminary estimates, I had calculated that the Apple Watch needs to sell about 21 million units to justify its existence. I don't think I'm even going to get one. I'm a huge believer in getting my notifications on my wrist, but I can get all that through my much less expensive Pebble. Also, working in an office most of the day, I don't really like using Siri, I'd rather type. Which entails using my phone, not my watch. And did I recently hear that the Pebble is greatly improved? But if Apple would like to send me a review unit, I'd be happy to try it out and compare. Outside of the financial press you don’t usually see a lot of ink spilled regarding a company’s latest quarterly income statement. Which is understandable considering that unless you own a piece of the company all anyone cares about are the products. So I found the considerable buzz surrounding Apple’s Q1 results quite amazing. You couldn’t stand in the check-out line at Walmart without listening to people around you talk about the fact that Apple had made more money than any company in a single quarter, ever.

But what was even more surprising was the fact that no one was discussing the really interesting part of what was revealed. iPhone gross margins. Officially, Apple doesn’t discuss product line profitability so as to not give away any competitive advantages. But an interesting set of circumstances occurred in the Q1 2015 earnings that revealed more than Apple may have liked. iPhone sales more than doubled from one quarter to the next which allows us to make certain assumptions we could’t before. A lot has been made in the tech and financial press recently about the fact that Apple’s record setting quarter has left them with a pile of cash and investments that is $178 billion dollars high. As I contemplated on what Apple should do with it, I felt that any discussion on where the money should be spent needs to be preceded by who it really belongs to. Ultimately, does Tim Cook get to decide what to do with that cash or do the stockholders?

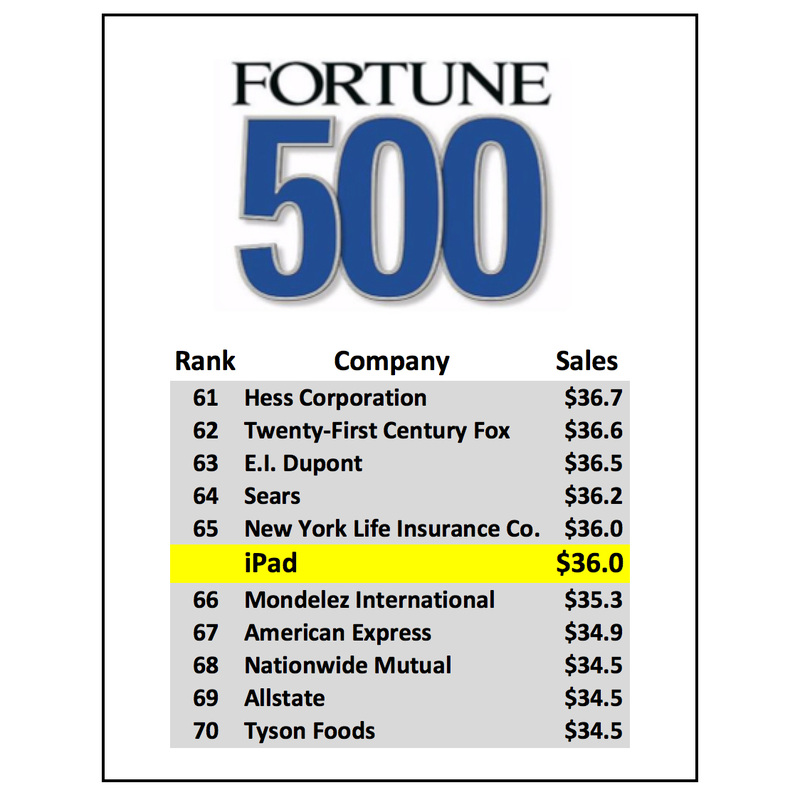

When Apple reported their record setting Q1 earnings last week, the financial world's collective jaw hit the ground. It was said that Apple reported the largest profit in the history of mankind and that was no exaggeration. But there was one area in which Apple failed to show an increase, the iPad, which kicked off a week of hand wringing and articles questioning the iPad's purpose or future. There are a number of analysts questioning the iPad's long-term viability.

Which started me thinking. If the iPad were a stand-alone business, what other companies would have similar volume? The iPad is overshadowed by the iPhone like Danny Devito standing next to Shaquille O'Neal. Sure, next to the most profitable product in the history of mankind the iPad looks almost like a failure. But is that fair? At less than 13% of Apple's revenue the iPad falls behind the iPhone in the pecking order, but selling almost 22 million units in a quarter of ANYTHING would be a huge feat for a typical company. So, if we take the reported Q1 earnings for the iPad and annualize them, we come to $35.96 billion. The iPad's volume alone would have been good enough to rank #66 on the 2014 Fortune 500 list. Not too shabby. That beats the entire revenue stream of American Express and Tyson Foods and falls within spitting distance of Sears and DuPont. Sometimes it's funny to hear people discuss a product for whom they clearly are not the intended market. Kind of like listening to adults review a kids movie. The fact that a 55-year old movie critic may dislike a ninety minute cartoon doesn’t mean that the target market of five to seven year olds won’t clamor to see the movie and enjoy every minute of it. The rumored large screen iPad Pro falls victim to this set of circumstances.

People who don't spend a huge amount of time collaborating around spreadsheets strain to come up with probable use-case scenario’s for a larger iPad. They probably have as much desire for an “iPad Pro” as Martha Stewart would a jacked-up, camouflage clad, 4-wheeler. In my last blog post regarding how Fedex flexes their labor to deal with volume peaks, I mentioned something that was too good to let go. The gigantic building housed many "cells" which were groups of employees sorting packages by destination. The more packages they had to get through, the more cells they activated. There were one or two office gals who did nothing but contact each cell every fifteen minutes to get a count of how many packages they had processed in the previous fifteen minutes. Before the day started, Fedex had calculated how may packages needed to be processed every fifteen minutes per cell if they expected to get through the day’s backlog. If the cell was falling behind, they'd immediately start shifting labor from cells that were ahead or start calling in additional workers who were on call to come in. Why would Fedex, one of the largest most successful companies in the world, have people manually calling each cell to get a count of their packages processed? Wouldn’t it make more sense to automate that somehow? Couldn’t a company with the resources that Fedex has figure out a way to employ a software system of electronic eyes and sensors to give the command center a real-time information dashboard?

On the morning of the iPhone 4 release day in July 2010 I was walking through FedEx's second largest distribution hub in the world, located in Indianapolis, Indiana. The hub manager was proudly describing how FedEx can flex their labor to make sure that they didn't ship anything late. It was fascinating. The gigantic building housed many "cells" which were groups of employees sorting packages by destination. The more packages they had to get through, the more cells they activated. There were one or two office gals who did nothing but contact each cell every fifteen minutes to get a count of how many packages they had processed in the previous fifteen minutes. Before the day started, Fedex had calculated how many packages needed to be processed every fifteen minutes per cell if they expected to get through the day’s backlog. If the cell was falling behind, they'd immediately start shifting labor from cells that were ahead or start calling in additional workers who were on call to come in.

I've been listening to the rumors swirling hot and heavy over the last week regarding a potentially new MacBook Air with drastic design changes. I'll let the tech geeks expound on whether or not the changes are a step forward for mobility users, but from a financial perspective almost every single rumored change would make this a less expensive unit to build.

1. Replace two models, a 13" and an 11" with a single 12" model. This is huge and the benefits go in two different directions. One, you get increased purchasing power by consolidating your volume into one model. Apple should be able to negotiate lower prices for those components like the chassis that used to be split into two different sizes. And two, the depreciation charges for machinery and tooling will be less for one model and spread over more volume. 2. Only one USB port. I did financial analysis for Gateway's return center in Sioux Falls, SD and I remember that one of the biggest causes for laptops to be returned for warranty repair was broken ports. Customers constantly break them. Cords get yanked at an angle, someone walking by snags the cord, or they're full of sand. Only one port port on a MacBook will yield reduced warranty costs. My thinking is that without the cost of the extra 2, 3 or 4 ports, Apple can design a single port that is more durable. It may be more expensive at the unit level, but less than paying for 2-4 cheaper ports. 3. No Cooling Fan - This reduces the complexity of manufacturing and therefore the cost. No longer does the manufacturing plant have to purchase, store, and assemble the cooling fan. The one change that may trigger an increase in cost is the change to a retina screen. But the cost savings from everything else should more than offset that increase. And the retina screen would give marketing something new to focus on as opposed to taking things away. In fact, if the rumors are true, this is exactly the laptop that I'd advise Apple to build if they asked for financial advice on improving the 2015 MacBook Air Income Statement. Costs could come down $200 per unit and Apple could split that with the customer cutting another $100 off the price simultaneously goosing volume. Increasing volume and cutting costs at the same time, nice. I may be a little late to this party but I had somebody just last week try and convince me that Apple is making $500 profit from every iPhone 6 Plus that gets sold. The insinuation was that Apple was somehow needlessly gouging the public for profit sake. Now, I’m certainly not against maximizing profit, but I get paid to analyze product costs for a living and there’s more to the picture here than meets the eye.

If you're an avid runner like me, than you already know how hard it is to find good wireless headphones. Currently, you have to choose which of the following two qualities are most important to you, because no single set of headphones will give you all three.

1. Solid sweat resistance 2. Good sound 3. Great price I simply found it humorous that as I was pondering what Google is spending a billion dollars a month on in SG&A that the following article from Business Insider's Steven Tweedie flashed across my RSS reader.

The Best Google Campuses Around the World Perfect timing. I'm not insinuating that Google SG&A spending is out of control. I just have trouble adding up in my head what they are doing with all that money. But seriously, I'd hope that the Google board of directors knows full well where that 12 billion dollars went last fiscal year. In my earlier analysis comparing the income statements of Apple and Samsung Electronics one big thing really jumped out. Selling, General, and Administrative (SG&A) costs are much lower at Apple than they are at Samsung. How does Apple do it? And it seems like nobody but the pencil pushers really notices.

|

Robert PerezManufacturing and distribution analysis since 1993. Perezonomics is available in Apple News

Archives

October 2024

|

RSS Feed

RSS Feed