|

I went into this movie not wanting to like it but walked out loving it. It's refreshing to see a movie aimed at adults that relies on intelligent dialogue and facial expressions to convey drama and move the story. You'd think that two hours of people standing around talking might get a little boring, but you'd be wrong. I was captivated right from the beginning, and it didn't let up until the credits started rolling. Even the pre-movie commercial chiding the audience to put away their phones made me smirk considering who this movie was about. In fact, I had the hardest time in memory finding a good place to go to the restroom because there were no boring parts.

Wow, so sales are up 22.3% and $9.4 billion from the same quarter a year ago and margins were up too. If this was another routine quarter for Apple then I suppose if I won the lottery every three months that would become routine too. Routine, but no less amazing.

A few items of note from today's earnings release. David Pierce from Wired had an interesting read on the background behind how Microsoft's new Surface Book came to be.

Microsoft Surface Book - Behind the Scenes Panos Panay's quest for the "Ultimate Laptop" stands in stark contrast with the quest of PC makers who are in search of lowest possible manufacturing cost. PC makers won't ever make this level of effort. If Microsoft doesn't do it, it's not getting done. Today's news about Tesla's Model S losing it's Consumer Reports recommendation reminds me of one of the things that has bothered me about Tesla.

Consumer Reports Pulls it's Recommendation of the Tesla Model S How can they handle service and support on the scale that they need to? If they don't increase their sales by an exponential amount they'll be out of business in five years. But in order to get to the sales level that they need to, they'll need to start working on a nationwide infrastructure of service stations to handle warranty work. This would be enormously expensive. Bet the farm expensive. They can't do it slowly or they will bleed to death but to do it quickly would mean draining their cash reserves. This would leave them dangerously vulnerable should investors turn off the money spigot. I'm impressed with the Surface Book that Microsoft unveiled a couple of weeks ago. From a hardware perspective it hits the hybrid sweet spot closer than the iPad Pro. You have a real keyboard attached to the screen for when you sit at your desk to power out some text, and you can detach the screen and grab the pencil to take with you to a conference room for some note taking. Furthermore, it's made from premium materials instead of plastic.

If Carly Was a Terrible CEO Than Apple is Having it's Worst Year Since the Financial Crisis10/12/2015

I found this link humorous because it's the same logic used to smear Carly Fiorina's tenure while she was at HP.

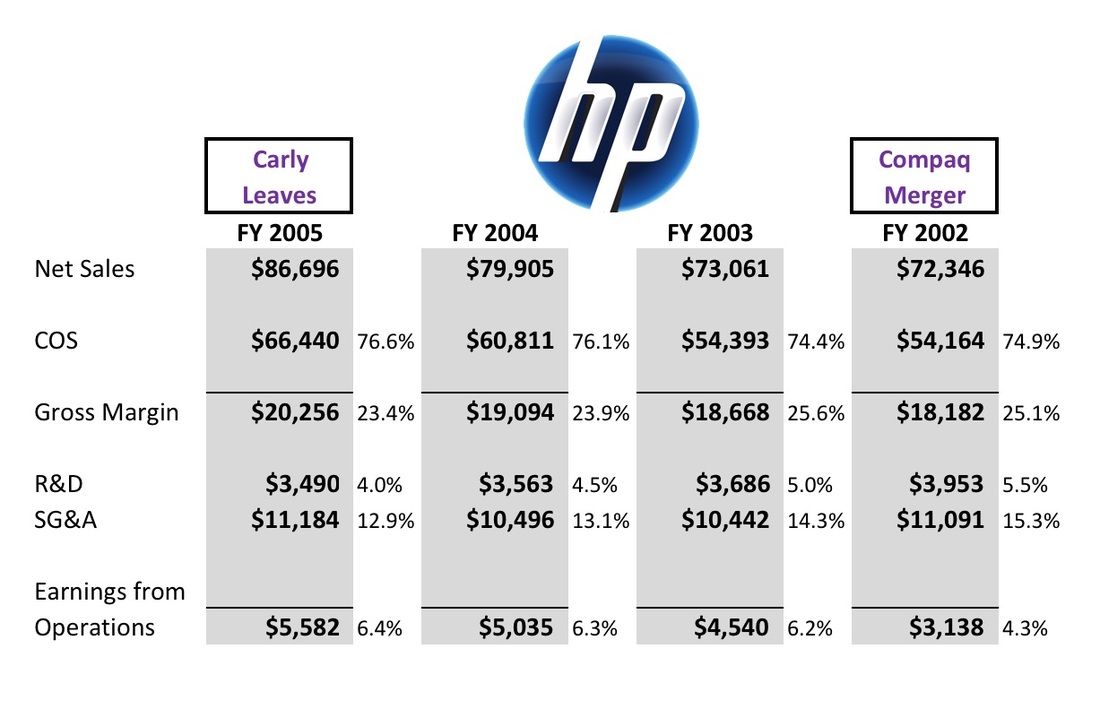

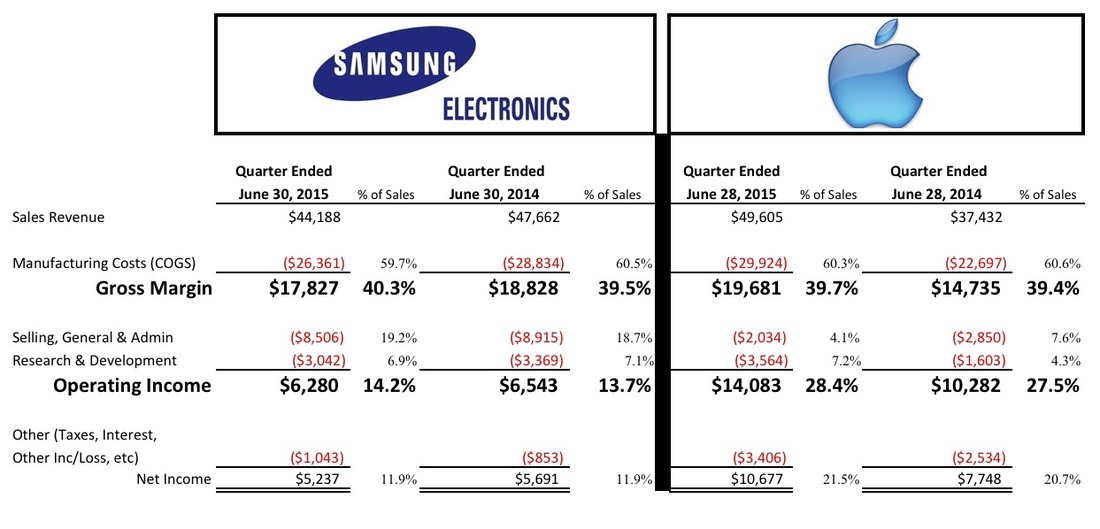

CNBC reports today that Apple is having it's worst year since the financial crisis of 2008. Is it true? Yes, the "empirical evidence" clearly shows that this is the worst year for returns if you're an Apple shareholder since the crisis of 2008. Is Tim Cook doing a terrible job? Should the board get rid of him? Of course not. In fact, just like HP while Carly was there, Tim Cook could point to four years (since he took over) of income statements that show increased revenues and profit margins. That would be the first place I'd look when assessing company leadership. The only reason Andrew Sorkin or Jeffery Sonnenfeld keep going to the stock valuation data is because that is all they've got. All of HP's financials make Carly look great. Stock valuations are important too. I'm not trying to minimize that. I'm just saying that after a stock market crisis you could cherry pick the data to even make the CEO of the most profitable company on the planet look bad. If investor expectations get too high, they will need to be corrected. This is an error that Tim Cook wouldn't manage and can't do anything about. Neither could Carly. When comparing income statements between Samsung and Apple you can’t help but notice one huge difference between the two companies. That even though Samsung and Apple are comparable in size when it comes to revenue, Samsung spends over four times more on Selling, General, and Administrative costs than Apple. I don’t have any inside information as to the detail behind Samsung’s SG&A. But typically what I’ve found when digging into income statements is that the selling costs make up the bulk of this category.

People often think that financial statements are boring because all they ever see is a single statement presented without any historical context or comparisons. That’s like watching only one game in the NFL season and declaring it a snooze. You gotta know who’s hot and who’s not. Are they headed for 4-0 or 0-4? How is their big rival doing? Add in a few elements and you have yourself an edge-of-your-seat thrill ride.

Okay, maybe financial statements will never be that exciting, but they can still benefit from adding in some historical context and rivalry. Let take another look at Apple’s Q3 2015 earnings release. The most recent available. Only this time, I’ve added Samsung Electronics right next to it. Also, I’ve thrown in the same quarter from the previous year so you can get a sense for which direction each company is headed. |

Robert PerezManufacturing and distribution analysis since 1993. Perezonomics is available in Apple News

Archives

October 2024

|

RSS Feed

RSS Feed