|

The Nikkei Asian Review dropped a bomb on iPhone lovers today when they predicted that Apple was going to move to a three-year product cycle versus the two-year cycle it’s on now. This is big news considering that not only did Apple critics not see this coming, a lot of them are calling for Apple to move to a yearly refresh. A move that I tried to take a look at a couple of weeks back. I would summarize that analysis with a big “Don’t hold your breath.”

So, is Apple going to go the way of Blackberry and be left in the dustbin of history? Quite doubtful. I actually agree with Marco Arment’s piece stating that if the market swings hard towards devices that lean heavily on intelligent assistance that Apple is in big trouble. But I’d also agree with anyone that stated that if our planet were to run out of water tomorrow that the human race faces extinction. The statement would be true, but I wouldn’t lose any sleep over it.

I wonder how many of Apple’s iPhone users over the last three years have defected to Android with the number one reason being Google Maps and its transit features? Apple knows full well the importance of maps and is probably loathe to ever make that mistake again. But this got me to wondering if the Didi Chuxing deal isn’t really more about getting the jump on mapping in one of their most important markets.

9To5Mac reports the following:

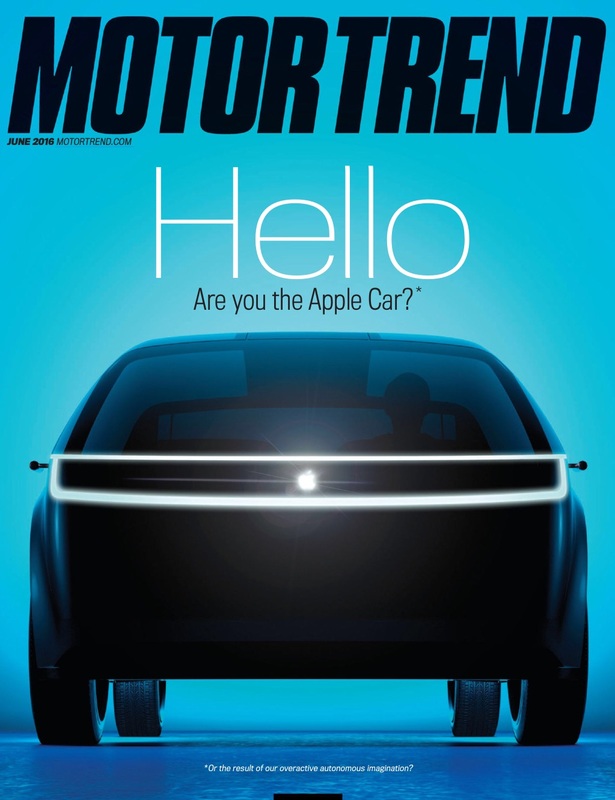

Tim Cook rules out Apple becoming a mobile carrier, saying it lacks the expertise So Apple surveyed the lay of the land in the world of mobile carriers (MVNO) and decided it wasn’t for them. This further cements my view that Apple is either not working on a full-fledged car, or if they are, that they will ultimately decide to stop developing one. Tim stated that Apple doesn't want to go somewhere that it lacks expertise. There are so many area's in building a full car in which Apple lacks expertise that any partnership in which they entered into would become more of their partners car and not Apple's. If their partner develops 90% of the car could Apple even call it the "Apple Car"? Would any potential partner ever agree to that? The other similarity between MVNO carriers and automotive manufacturing is that various regions have their unique rules. It’s why American’s often don’t get cars offered for sale in Europe and vice versa. Tim said that Apple likes to pursue opportunities that they can do globally. If Apple were to supply auto companies with strategic components that would be global. Creating right-hand vs left-hand drive cars and dealing with crash standards in Europe versus California? Not really. Even if they don’t ship a complete car Apple IS well-suited at becoming an automotive supplier of certain components. Coincidentally, today 9to5Mac also reported this story showing that Apple is working on something automotive related. Apple granted patent for iPhone-based car key, including limited/temporary keys Very interesting. With Google introducing their new Google Home last week the whole subject of the home base station is back in the news. A subject that I find perplexing.

Google I/O just finished last week and as is usual the press is oohing and aahing over vaporware that isn’t even being shipped yet. They of all people should know that the demo is always a magnitude of ten times better than what we end up with.

I have a hard time believing that Apple will ever ship an “Apple Car”, Project Titan not withstanding. I don’t doubt that they’re working on a car or something automotive related, but in the end Apple will conclude that shipping an Apple branded car is not the business for them.

Greater minds than mine can debate whether or not Apple can or should offer a completely new iPhone every single year. Whether or not this would increase iPhone sales volume for Apple or if it’s even possible is beyond me.

What I can do is estimate what the impact of an annual refresh would have on the iPhone product line income statement. When you are trying to guess what Apple may or may not do in the future it sometimes helps to attach a price tag to their various options. I’ve actually read more than once from journalists who think that Apple should purchase Tesla and put Elon Musk into the CEO chair. What a terrible idea.

So what does Apple do after their iPhone market matures? The same thing everyone else does.

Tesla apologists make a huge mistake in taking comfort in the fact that the Model S boasts larger gross margins than you would see from a traditional automaker. But the truth is that if they understood the various levels of the income statement and the difference in business models, they would probably start thinking of getting rid of their Tesla before it’s too late. I don’t think that services is the panacea for Apple that many do but I don’t discount their importance to Apple in selling more iPhones and iPads. In 2010 after dealing with the headaches of getting my own music onto my Creative Zen, I finally cried uncle and purchased my first Apple iPod Touch. iTunes made the device more desirable.

Kirk McElhearn on the latest episode of The Committed podcast made an excellent point regarding Apple’s iTunes. That is, the reason that Apple was able to get the record companies on board was due to the havoc that Napster was wreaking on their world and there is no one playing that role now. The presence of a clear and present danger caused these disparate nomadic bands to crown someone king. That is the missing ingredient this time around with Apple’s efforts to try and get some kind of TV service off the ground. There is no clear villain. Netflix? A respectable business that pays them fees? That’s a toothless tiger. BitTorrent? An arcane system full of land mines. Too small. It’s hard to imagine Apple ever getting the deals necessary with the media companies to offer a low-cost TV subscription unless there is a Napster-scale threat. That would be a wholesale digital looting by the public that is rampantly stealing any TV show that they want and cancelling their cable subscriptions. I don’t think the Apple Watch was ever about trying to find the next big thing. It very well may be, but not in the way that everyone thinks.

Re/code is reporting that SAP and Apple are teaming up to integrate iOS into their corporate ERP business management software. Now THAT’S what I’m talking about.

The smartphone absolutely exploded like Tribbles on a starship because what people really wanted was the Internet. They weren’t buying a fancy phone. In their minds, they were buying their Facebook newsfeeds, tweets, and sending photos to Grandma. Does anyone else remember that glorious moment you logged on to the Internet from a car for the first time? It was like being young Spiderman discovering that you could crawl up walls. Also, unlike your home PC, you didn’t have to fight over it with your spouse. It was all yours.

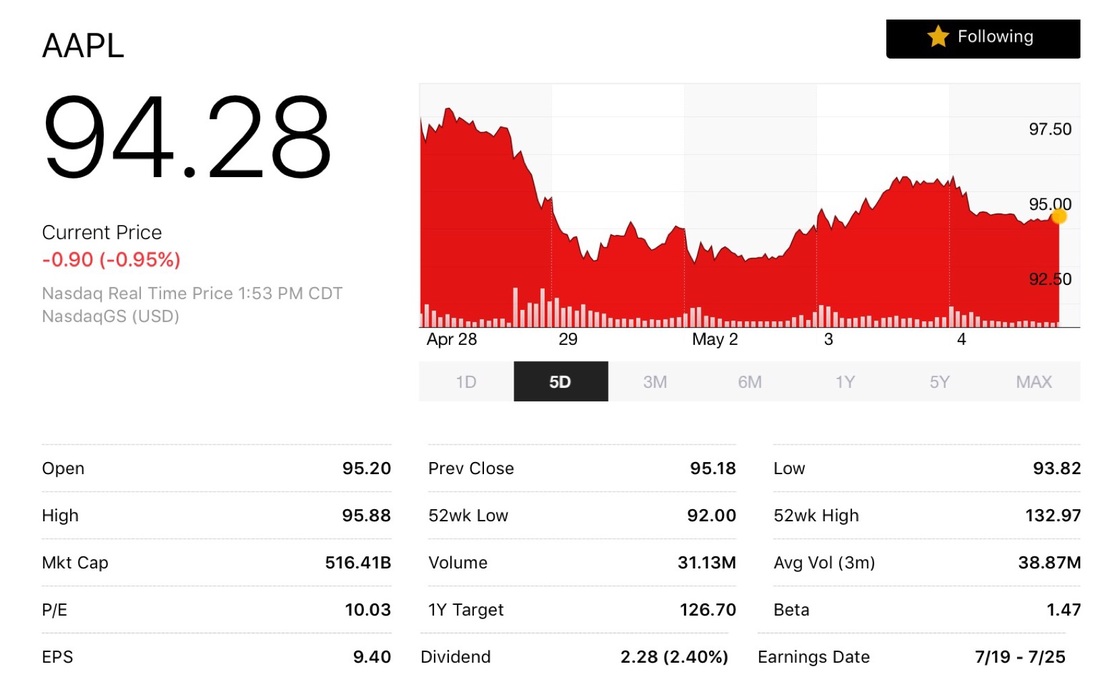

I’ve written before how AAPL is transitioning from a growth stock to a value stock.

Does the Price of AAPL Matter to Apple? That’s why Apple reaching it’s first period of negative growth is so important. Everyone was trying to ride this elevator as high as it would go and get off before it stopped. The longer you stay on, the greater the reward. But if you stayed on too long you absorbed the full impact of the price correction. Well, in Q2 the bell finally rang and the elevator stopped. A similar dynamic is at work with the value investors. They all want to buy Apple stock. They know it’s a good solid business with healthy margins and a great management team. But they don’t want to buy in too early or they’ll dilute their returns. They want to wait as long as possible while the growth stocks sales are pushing the price down. You don’t want to buy in at $100 when you could possibly get it for $90 next week. They’re gleefully watching the price go down and calculating their entry point. Once they all jump in the price should stabilize. Apple’s been on a downward slide since last Tuesday’s earnings release because they’re in this awkward middle period where the growth funds are selling off and the value funds are waiting for the stock to go down further. I’m guessing that once the stock does stabilize it’ll go up sharply as all the value funds decide it’s time to get in before the price goes up further. But the only thing that is certain about the stock market is that nothing about it is certain. There are two factors that apply to both Android and Apple that should give their investors pause.

1. Most of the world is already on Android. 2. 75% of Google’s search revenue comes from iOS. Knowing these two facts you’d think that the tech press would be spilling barrels of ink on how Google had better think of the next big thing fast. Google’s two avenues to increase ad revenue are approaching the end of the runway and none of their moon shots seem to show imminent promise. One of these two companies has diminished growth prospects and it’s not Apple. Even if Apple did decide to simply double-down on the iPhone business and ignore getting into any complementary markets, they would have plenty of room to expand. They could still wage a two front war of both stealing device market share from Android and stealing the search business on the iOS installed base. Device sales could still double over the next five years and iOS search could explode. Both of these endeavors would come at Androids expense. So even though the public hand-wringing over Apple’s first speed bump in Q2 has been grossly over done I think it’s a testament to what a juggernaut the iPhone has been. Kind of like a New England Patriots team getting their first loss after winning the first 12 games of the season is notable whereas the Detroit Lions losing another one isn’t. |

Robert PerezManufacturing and distribution analysis since 1993. Perezonomics is available in Apple News

Archives

October 2024

|

RSS Feed

RSS Feed