Does the Price of AAPL Matter to Apple?

That’s why Apple reaching it’s first period of negative growth is so important. Everyone was trying to ride this elevator as high as it would go and get off before it stopped. The longer you stay on, the greater the reward. But if you stayed on too long you absorbed the full impact of the price correction. Well, in Q2 the bell finally rang and the elevator stopped.

A similar dynamic is at work with the value investors. They all want to buy Apple stock. They know it’s a good solid business with healthy margins and a great management team. But they don’t want to buy in too early or they’ll dilute their returns. They want to wait as long as possible while the growth stocks sales are pushing the price down. You don’t want to buy in at $100 when you could possibly get it for $90 next week. They’re gleefully watching the price go down and calculating their entry point. Once they all jump in the price should stabilize.

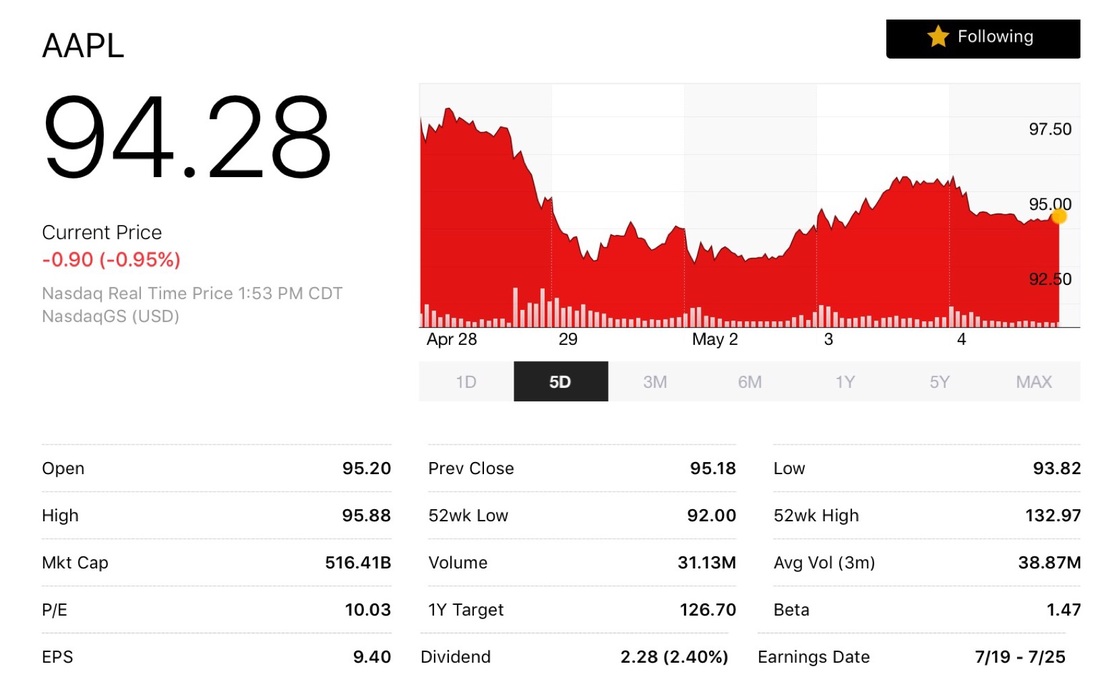

Apple’s been on a downward slide since last Tuesday’s earnings release because they’re in this awkward middle period where the growth funds are selling off and the value funds are waiting for the stock to go down further. I’m guessing that once the stock does stabilize it’ll go up sharply as all the value funds decide it’s time to get in before the price goes up further.

But the only thing that is certain about the stock market is that nothing about it is certain.

RSS Feed

RSS Feed