CNBC reports today that Apple is having it's worst year since the financial crisis of 2008.

Is it true? Yes, the "empirical evidence" clearly shows that this is the worst year for returns if you're an Apple shareholder since the crisis of 2008. Is Tim Cook doing a terrible job? Should the board get rid of him? Of course not.

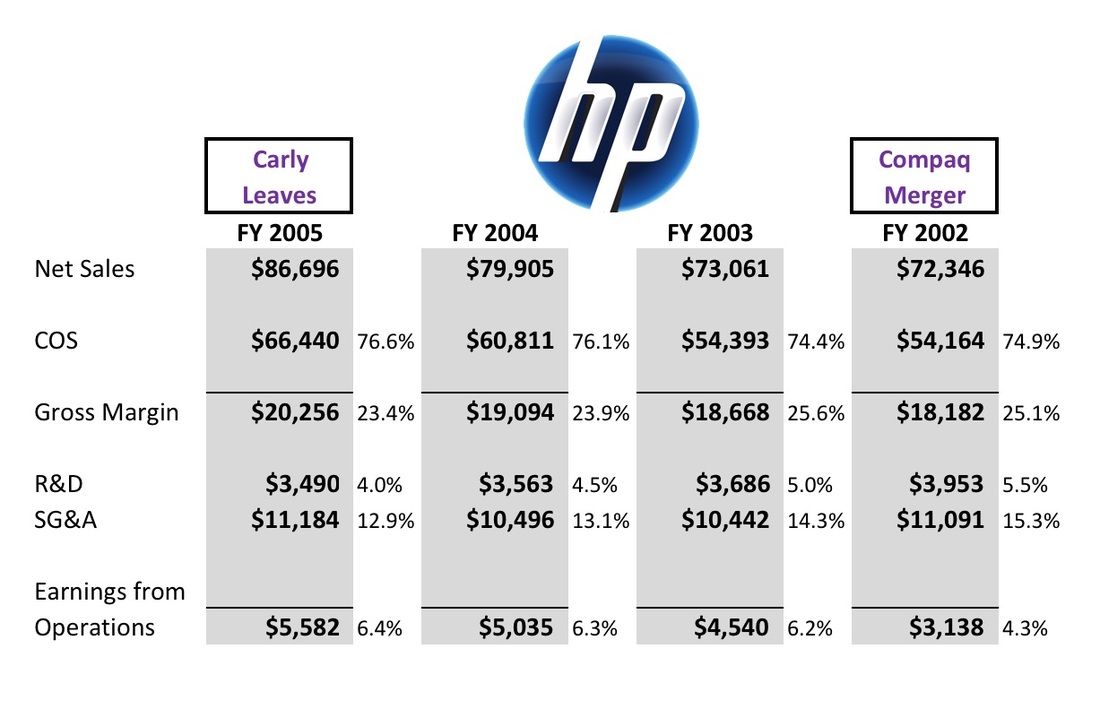

In fact, just like HP while Carly was there, Tim Cook could point to four years (since he took over) of income statements that show increased revenues and profit margins. That would be the first place I'd look when assessing company leadership. The only reason Andrew Sorkin or Jeffery Sonnenfeld keep going to the stock valuation data is because that is all they've got. All of HP's financials make Carly look great.

Stock valuations are important too. I'm not trying to minimize that. I'm just saying that after a stock market crisis you could cherry pick the data to even make the CEO of the most profitable company on the planet look bad. If investor expectations get too high, they will need to be corrected. This is an error that Tim Cook wouldn't manage and can't do anything about. Neither could Carly.

RSS Feed

RSS Feed