http://www.businessinsider.com/analysis-iphone-6-plus-costs-prices-and-profits-2014-9

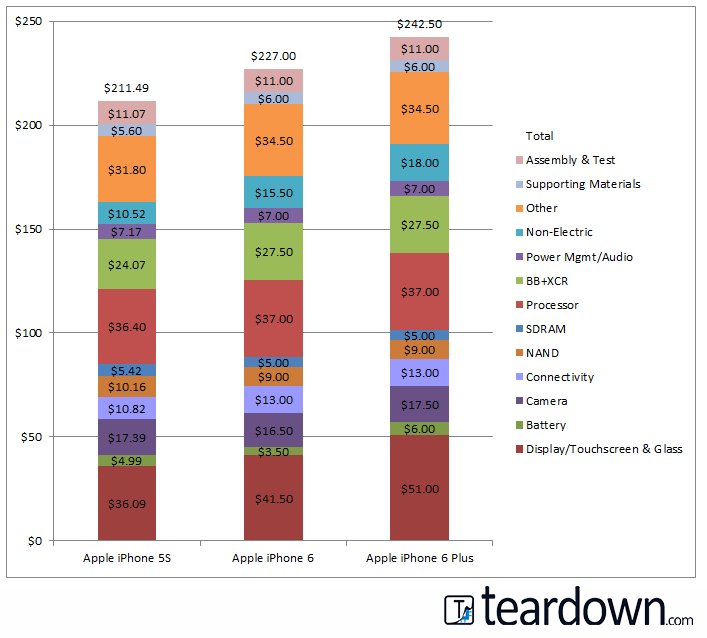

Sales - (Component Costs + Labor) = Initial Profit

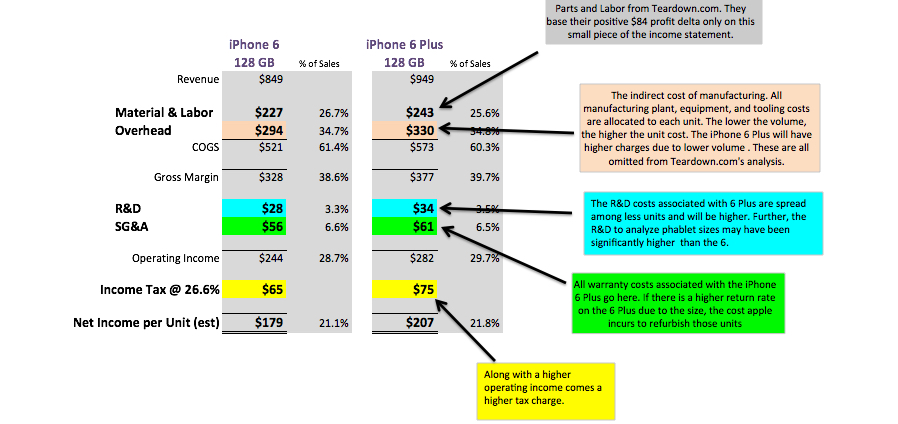

Apple’s manufacturing overhead costs are enormous. We can back into this because of three other data points.

- Their reported overall Cost of Goods Sold is around 61% of Sales

- iPhone and iPad sales in 2014 was nearly 70% of total revenue

- Material and labor can be quantified which leaves OH as the only missing variable

I raise the point of Apple’s overhead because this is entirely missing from the Business Insider article. That’s like writing a recipe for a peanut butter and jelly sandwich that omits jelly.

So does the iPhone 6 Plus warrant a $100 premium? By my quick calculations, that extra $100 leaves Apple with a slightly higher margin than the iPhone 6. No, I didn't try to back into that number. It looks to me like Apple financial analysts made the case that if they didn't raise the price on the 6 Plus that there was going to be some serious income statement consequences. I doubt anyone outside of finance wanted to raise the price. In any case, I think they probably nailed it.

It’s entirely possible that IHS never meant to imply that Apple pockets an extra $84 and that the tech journalists went for the flashier headline all on their own. It wouldn’t be the first time that occurred. For the sake of IHS’s credibility, I hope that’s what happened.

RSS Feed

RSS Feed