But what was even more surprising was the fact that no one was discussing the really interesting part of what was revealed. iPhone gross margins. Officially, Apple doesn’t discuss product line profitability so as to not give away any competitive advantages. But an interesting set of circumstances occurred in the Q1 2015 earnings that revealed more than Apple may have liked. iPhone sales more than doubled from one quarter to the next which allows us to make certain assumptions we could’t before.

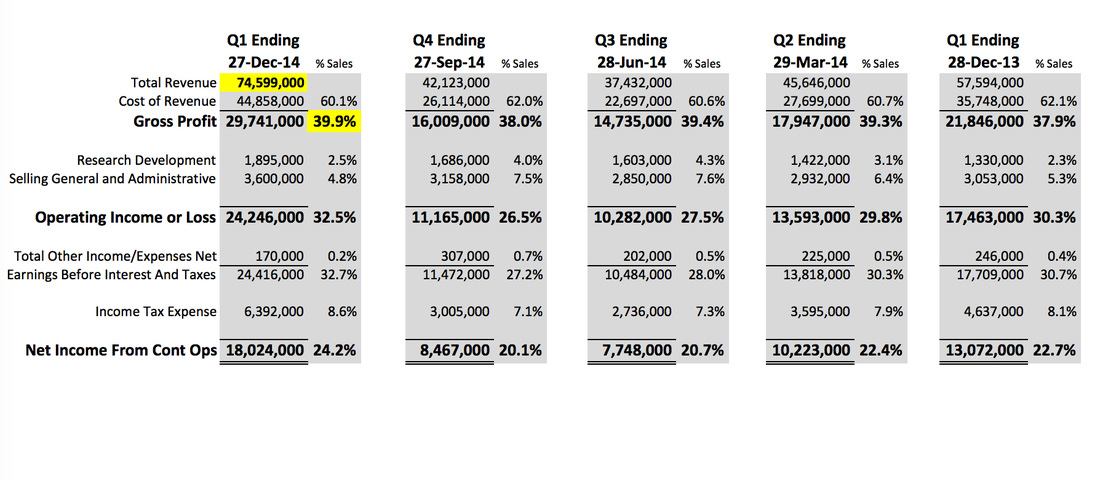

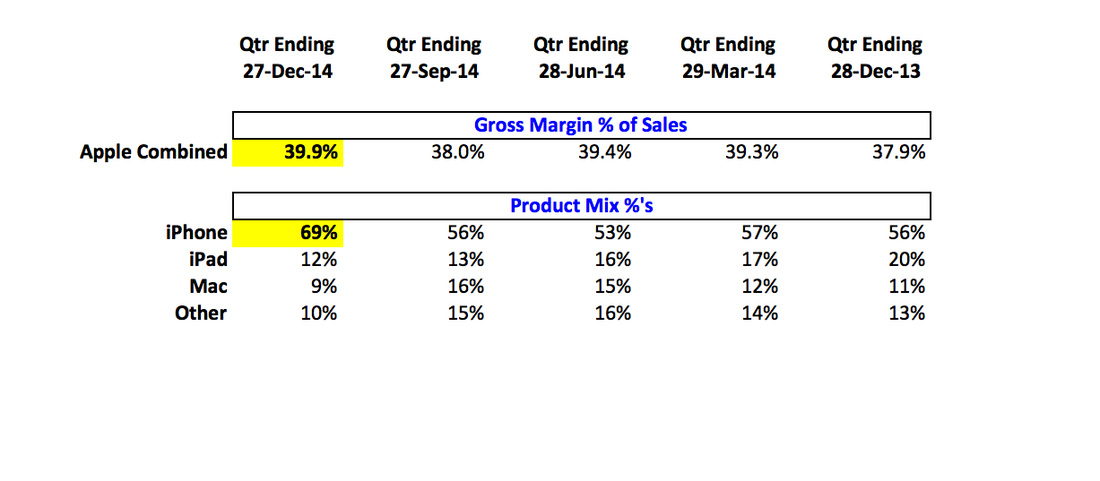

This happened to Apple in Q1. There was an almost two full point increase in Gross Margins in Q1 which was accompanied by the addition of a "new guy", the iPhone 6 sales bump. Normally these kind of margin changes get lost in the product mix ups and downs from quarter to quarter. But Q1 saw such a huge move from the iPhone that we can reasonably say that the margin shifts must be due to the iPhone product line.

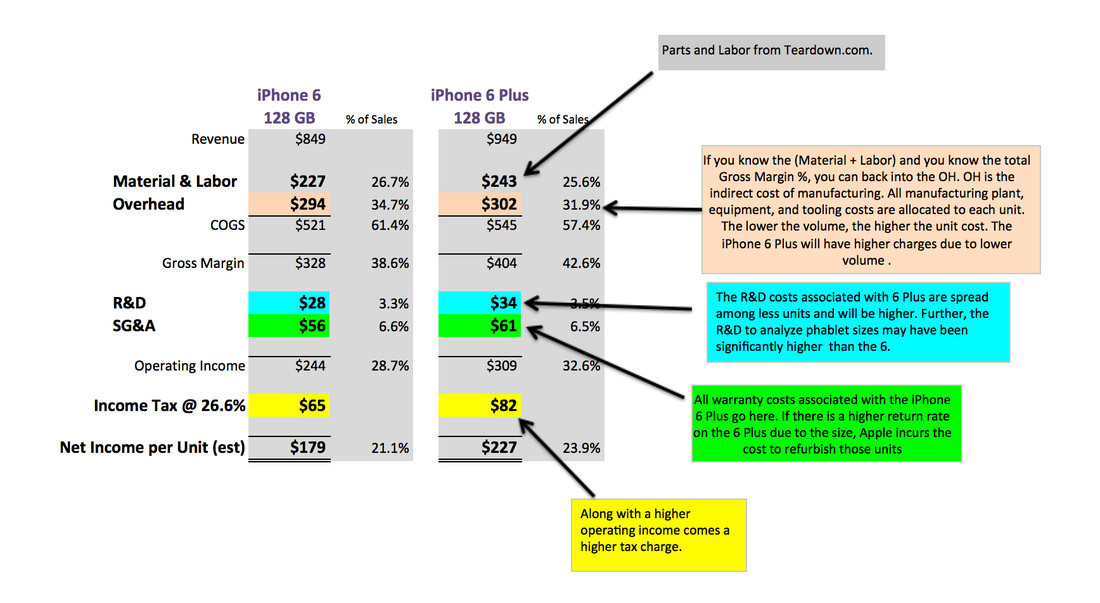

So what does this tell us about the iPhone product line? Once again, there is a very conspicuous “new guy” who we can reasonably say is responsible for the majority of the increase. We know that the iPhone combined gross margin percentage is up by 2.7 points, but if you could isolate this to the 6 Plus only it would be even higher than the 2.7 points. It would be closer to 4 points. The iPhone 6 Plus is bringing in about $77 dollars more than the iPhone 6 in gross margin. Net profitability after taxes is probably about $48 dollars more. No, Apple isn't making four hundred dollars of pure profit from every 6 Plus sold, but it has garnered a healthy bump in profitability.

This is do or die time for the Galaxy. Upper management let the current phone launch probably because plans were too far along to change without major delays, but if sales aren’t healthy within the first 30 days there is going to be some major shakeups happening. I stand by my previous prediction that we will probably see Samsung moving away from expensive displays after the Galaxy S6 and Note 4. The public has not rewarded Samsung thus far for absorbing the hit in margins. And from a financial analysts point of view, Samsung continues to make all the wrong choices.

Meanwhile, Apple continues to reap the harvest laid down by the simple proposition of building the best product possible without needless gimmicks.

RSS Feed

RSS Feed