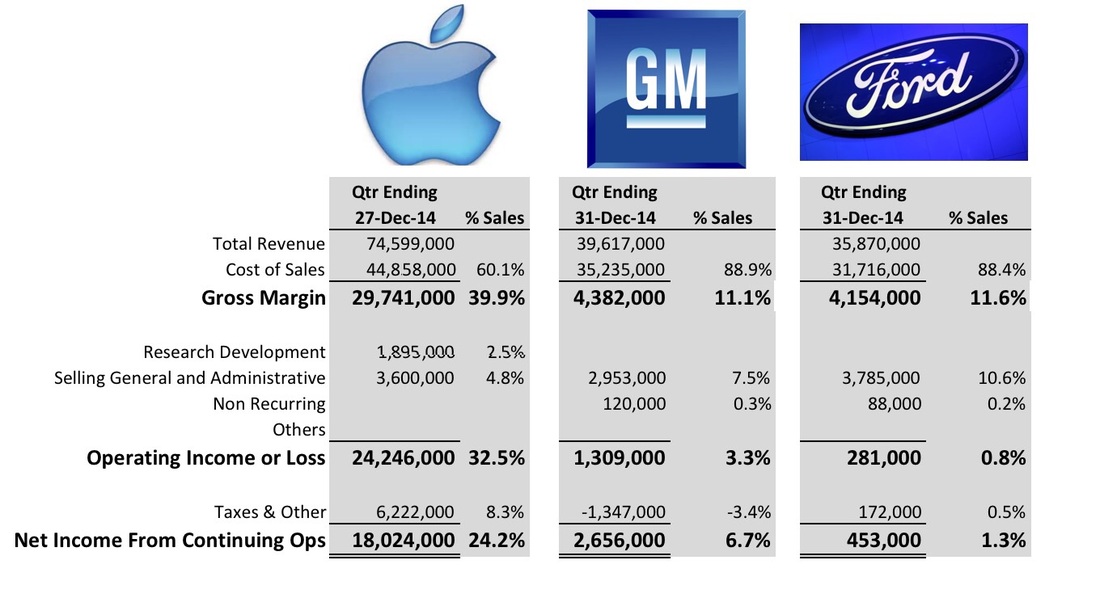

I thought in light of the news, it would be interesting to compare the latest quarterly earnings releases from Apple, GM, and Ford. GM is coming off of one of their best quarters in a long time, but even so, the comparison is eye opening.

GM sold 2.5 million vehicles and Ford sold 1.5 million compared to Apple's 74.5 million iPhones and 21.4 million iPads. This is interesting but I don't think there are many conclusions that can be made based on volume alone. They are different markets. On the other end of the spectrum, Walmart bested Apple and brought in $119 billion in revenue in their most recent quarter at a 25% gross margin on exponentially greater unit volume than Apple.

The big story here is gross margin percentages. American automakers are spending over 88 cents of every dollar just to pay for materials, labor, and overhead. Manufacturing automobiles is a complex, gargantuan process that is very expensive. I used to work in the automotive industry and the reasoning behind this is simply the number of parts that need to be coordinated and the controls that have to be put in place to meet quality control tolerances. But otherwise, manufacturing is the same in the auto industry as it is everywhere else. There is just more of it. I don't see any reason why a company like Apple couldn't dive in. There is nothing special about manufacturing automobiles other than needing a Niagara Falls sized cash fountain.

If Apple decided to build a car and wanted to maintain it's famously fat gross margins where would they need to price it? If you take the average transaction price for a vehicle in 2014, $33,000, you can calculate the average cost based on GM and Ford's reported cost of sales of around 88%. That's a cost of $29,238 in material, labor, and overhead. I'm going to inflate this by 20% due to Apple's history of choosing premium materials and also factoring in their much smaller scale. Apple just isn't going to have the purchasing power advantage that they possess in the phone business. They will have the opposite situation and pay low volume premiums. That leaves us with Apple paying just over $35 thousand for a comparable vehicle. If they target their current gross margin of 39.9% they would need to price that vehicle at $58,379. Wow, a $25 thousand dollar premium. And this is if Apple stayed with the tried and true technology of the internal combustion engine. If they decide to go with the notoriously high cost electric technology, the premium would go even higher.

It's amazing to me that GM and Ford have gross margins so low, on par with commodities, when there is so much research and design involved. A Chevrolet Impala has countless engineers and passionate designers who painstakingly draw every curve, and yet, it can't pull in any more profit than fertilizer? If GM and Ford are making healthy margins on Suburban's and F-150's than they must be losing money on many if not most passenger vehicles. Would auto customers who have been trained to get highly engineered products at cost be willing to pay Apple a design premium? Something they've thus far denied to GM and Ford?

It would seem that the customers for a future Apple Car would probably not be current GM and Ford customers for the most part. There are customers who today are willing to pay a design premium for what they perceive as a better engineered car but they are going to BMW and Mercedes Benz. Though once you dive into this deep end of the pool, you start to grapple with what kind of fashion statement your customer is looking to make. Lo and behold, Apple is dipping their toe into the water and tackling "luxury fashion" head-on with their newest product, the Apple Watch Edition which starts at $10,000. This would be the same pool of customers who would be willing to make a statement with their choice of automobile and pay a hefty premium. Is there some kind of long term strategy in place here?

It remains to be seen whether or not Apple is going to invade the auto market but the smoke is getting thicker. Teenagers today might be shocked to discover that Apple wasn't even in the phone business until 2007. Apple successfully entered a stale new market and revolutionized it in a spectacular manner. As Julius Caesar once said, "Veni, Vidi, Vici".

RSS Feed

RSS Feed