|

Apple gets a lot of criticism for deriving so much of its revenue from only the iPhone. Besides the fact that this is like criticizing someone for only dating one Victoria's Secret supermodel, there is a lot of reward that comes with this risk.

Mark Spiegel wrote in a letter recently to investors why he's short on Tesla.

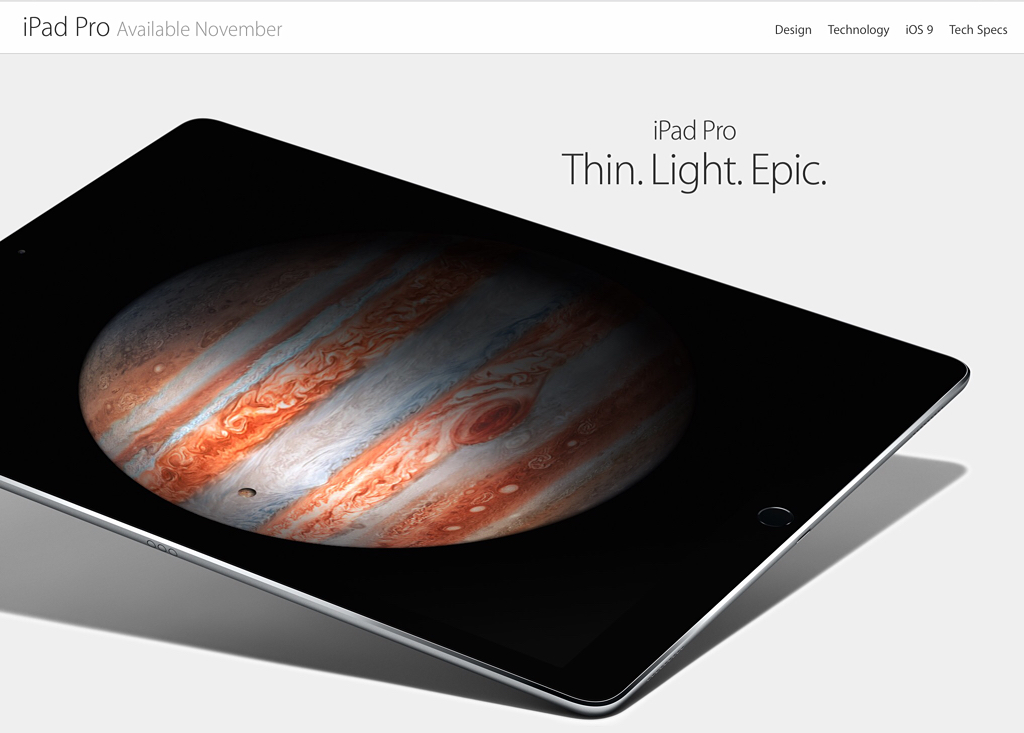

Wow, the sheer volume of links he included is astounding. It's only a matter of time before the stock bubble bursts but that may not be until after the Model 3 is launched. The Model 3 will be the project that pushes Tesla to the point of no return. Up until now, and including the Model X, Tesla is able to mitigate their losses through high margin product sales. The Model 3 will go in a new direction that ushers in lower margin products that MUST be made up for through much higher volume. When those unit sales don't materialize the stampede will occur. Until that happens, this stock is riding on hope. There seems to be some genuine consternation going on in the tech world over just when does the iPad Pro makes sense. Let me make this easy for everyone, it makes perfect sense as an enterprise laptop replacement for most office workers.

The kernel of all the uneasiness with the iPad Pro seems to stem from two facts:

I'm not exactly sure why a company like Tesla Motors seems to garner perpetually glowing praise from the press. They are like a football team that finishes every year with an 0-16 record. They produce mediocre products and sell them at a loss. Anybody could be the CEO of Tesla if results like that get you adoring news coverage. If the media crucified Carly Fiorina for "running HP into the ground" when HP increased profits every year then they should absolutely tar and feather Elon Musk for leading Tesla into the wilderness on a suicide mission. But instead the press seems to bend over backwards to find any positive angle to the never ending bad news story that is Tesla. Instead of doing the investor community a service and reporting the facts as they truly are, it is almost as if reporters are accomplices to an elaborate masquerade. There must be a lot more to this story behind the scenes than what we know.

When the iPad Air 2 was released everyone had the strange sense that it was somehow "over-powered" or meant for something greater. The A8X chip was the first time that Apple had ventured beyond a dual-core SOC and even a year later it is still one of the most powerful chips on the market. Coupled with a doubling of the RAM to 2GB it seemed like something else was on the way. And sure enough, when all the new multi-tasking features of iOS 9 were unveiled, it all made sense. The greater processing power and memory made split screen multi-tasking and picture-in-picture possible. I once heard something from Martha Stewart that I never forgot. She never spends more time in the actual making of the food then what she is going to spend eating it. The basic idea was that if you have some friends coming over on Friday night, it's ok to spend an hour or so preparing the meal since you are going to spend an hour or so having a social dinner. Whereas if you are going to wolf something down over the sink, just grab a loaf of bread and some cold cuts.

Ben Bajarin writing for Techpinions.com is predicting that Samsung will be out of the mobile phone business in five years.

Samsung will be out of the smartphone business in five years. It's hard to argue with his reasoning since Samsung has shown absolutely no ability to reverse their sales decline. However, I don't think it's so cut-and-dry that they either prosper or exit completely. If I was advising Samsung I'd counsel them to adapt to market conditions. That would entail working backwards from their expected average selling price and desired profit margins to see what they can afford to produce. You'd think they would have done this by now but they have stubbornly refused to do so. Their current strategic plan of putting in high-cost features to attract new buyers and grow market share isn't working. If it was, they wouldn't need to spend so much in advertising in conjunction with cutting prices to unload their inventory. I went into this movie not wanting to like it but walked out loving it. It's refreshing to see a movie aimed at adults that relies on intelligent dialogue and facial expressions to convey drama and move the story. You'd think that two hours of people standing around talking might get a little boring, but you'd be wrong. I was captivated right from the beginning, and it didn't let up until the credits started rolling. Even the pre-movie commercial chiding the audience to put away their phones made me smirk considering who this movie was about. In fact, I had the hardest time in memory finding a good place to go to the restroom because there were no boring parts.

Wow, so sales are up 22.3% and $9.4 billion from the same quarter a year ago and margins were up too. If this was another routine quarter for Apple then I suppose if I won the lottery every three months that would become routine too. Routine, but no less amazing.

A few items of note from today's earnings release. David Pierce from Wired had an interesting read on the background behind how Microsoft's new Surface Book came to be.

Microsoft Surface Book - Behind the Scenes Panos Panay's quest for the "Ultimate Laptop" stands in stark contrast with the quest of PC makers who are in search of lowest possible manufacturing cost. PC makers won't ever make this level of effort. If Microsoft doesn't do it, it's not getting done. Today's news about Tesla's Model S losing it's Consumer Reports recommendation reminds me of one of the things that has bothered me about Tesla.

Consumer Reports Pulls it's Recommendation of the Tesla Model S How can they handle service and support on the scale that they need to? If they don't increase their sales by an exponential amount they'll be out of business in five years. But in order to get to the sales level that they need to, they'll need to start working on a nationwide infrastructure of service stations to handle warranty work. This would be enormously expensive. Bet the farm expensive. They can't do it slowly or they will bleed to death but to do it quickly would mean draining their cash reserves. This would leave them dangerously vulnerable should investors turn off the money spigot. I'm impressed with the Surface Book that Microsoft unveiled a couple of weeks ago. From a hardware perspective it hits the hybrid sweet spot closer than the iPad Pro. You have a real keyboard attached to the screen for when you sit at your desk to power out some text, and you can detach the screen and grab the pencil to take with you to a conference room for some note taking. Furthermore, it's made from premium materials instead of plastic.

If Carly Was a Terrible CEO Than Apple is Having it's Worst Year Since the Financial Crisis10/12/2015

I found this link humorous because it's the same logic used to smear Carly Fiorina's tenure while she was at HP.

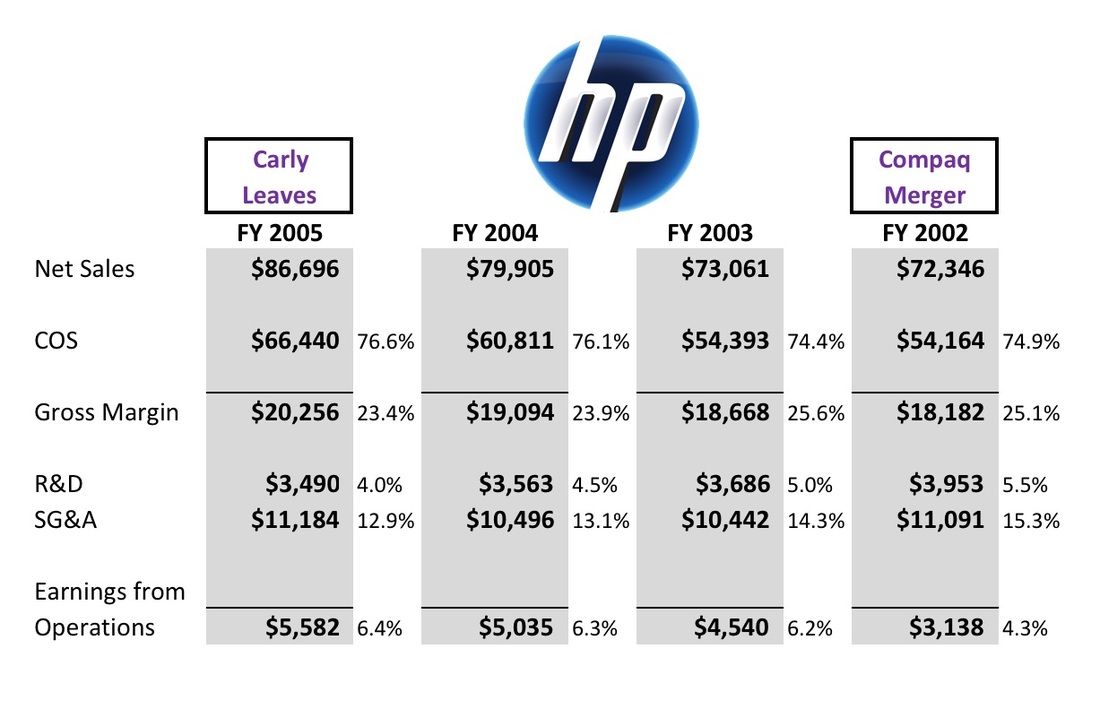

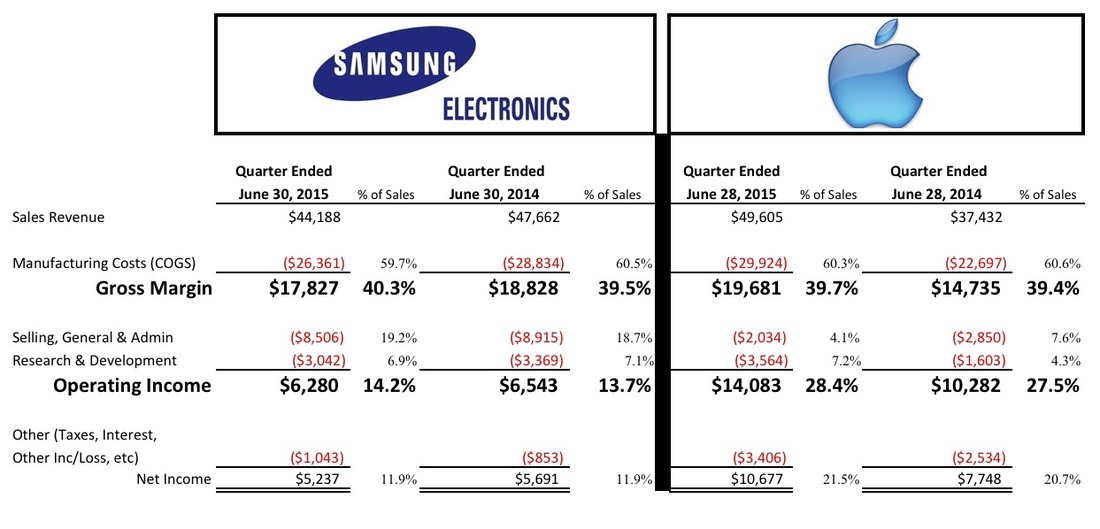

CNBC reports today that Apple is having it's worst year since the financial crisis of 2008. Is it true? Yes, the "empirical evidence" clearly shows that this is the worst year for returns if you're an Apple shareholder since the crisis of 2008. Is Tim Cook doing a terrible job? Should the board get rid of him? Of course not. In fact, just like HP while Carly was there, Tim Cook could point to four years (since he took over) of income statements that show increased revenues and profit margins. That would be the first place I'd look when assessing company leadership. The only reason Andrew Sorkin or Jeffery Sonnenfeld keep going to the stock valuation data is because that is all they've got. All of HP's financials make Carly look great. Stock valuations are important too. I'm not trying to minimize that. I'm just saying that after a stock market crisis you could cherry pick the data to even make the CEO of the most profitable company on the planet look bad. If investor expectations get too high, they will need to be corrected. This is an error that Tim Cook wouldn't manage and can't do anything about. Neither could Carly. When comparing income statements between Samsung and Apple you can’t help but notice one huge difference between the two companies. That even though Samsung and Apple are comparable in size when it comes to revenue, Samsung spends over four times more on Selling, General, and Administrative costs than Apple. I don’t have any inside information as to the detail behind Samsung’s SG&A. But typically what I’ve found when digging into income statements is that the selling costs make up the bulk of this category.

People often think that financial statements are boring because all they ever see is a single statement presented without any historical context or comparisons. That’s like watching only one game in the NFL season and declaring it a snooze. You gotta know who’s hot and who’s not. Are they headed for 4-0 or 0-4? How is their big rival doing? Add in a few elements and you have yourself an edge-of-your-seat thrill ride.

Okay, maybe financial statements will never be that exciting, but they can still benefit from adding in some historical context and rivalry. Let take another look at Apple’s Q3 2015 earnings release. The most recent available. Only this time, I’ve added Samsung Electronics right next to it. Also, I’ve thrown in the same quarter from the previous year so you can get a sense for which direction each company is headed. Yale professor and longtime friend and advisor to Bill Clinton, Jeffery Sonnenfeld, has been a one-man attack machine lately. His hit pieces against Carly Fiorina have been widely circulated and quoted by journalists without the financial background to see how preposterous they are. You can make a lot of accusations about Carly Fiorina, and some of them would be valid, but the assertion that she did a terrible job of leading HP computers through the PC wars of the early 2000s would not be one of them.

While I was working with Gateway Computers in the early 2000’s, my friends and I got endless comedic material from the fact that Gateway department managers didn’t regard upgrading five-year-old or older laptops as very important. Such irony that Gateway spent millions of dollars trying to convince people that they needed the latest models with their faster chips and larger hard drives and yet internally decided that five-year-old models were perfectly adequate to get the job done. And you know what? As much as we hated to admit it, we knew Gateway was right.

Yoni Hessler of BGR gets so much wrong today in an article trying to argue that Tesla is not losing money on their cars that the sheer audacity of the claim the Model S is profitable is astounding.

Let's start with the assertion that the Model S has margins that are "some of the best across the entire auto industry." Gross margins, what is left over after your manufacturing costs are deducted, are only a piece of the puzzle. There was no way I was going to allow someone to deduct $9.99 per month from my bank account in perpetuity. I'm the guy who crunched the numbers on a financial comparison of streaming versus purchasing (iTunes vs Spotify), and it just didn't make sense for someone like me to stream because I don't listen to music enough to make it pay off. The math says that unless you are constantly discovering and acquiring new music, just buy a few songs now and and you will come out ahead. But people aren't usually in acquisition mode. They tend to spend most of their time with their main library, and when they are in the mood for something different they will explore new artists to sprinkle into their staples. And the larger the library, the less of a need you will have to explore.

But I do love the feeling of beating the system. You know those offers you see from various companies who say you can use their services for free for a period but at the end they will start charging you? I love those. It's not that hard to setup a reminder in your calendar to cancel something on a future date so why not enjoy something for nothing? Free magazines, free food, free movies, I get them all and I never pay a penny for any of it because I'm good about canceling right when I need to. It's like taking candy from a baby. So Apple just reported their first quarterly earnings which included sales of their new iPhone accessory the Apple Watch. Did it go as I expected? Almost exactly.

Remember Tim Cook’s comment last quarter when he dropped the info that the Apple Watch was going to be pulling in below average gross margins? I ran some numbers and came to the conclusion that the watch would have to exert over a one point drop in the corporate average to justify Tim’s comment. Q3 2015 came in at 39.7% which was three tenths higher than the previous year of 39.4%. However, Q3 2014 was before the launch of the golden goose that is the iPhone 6 Plus. Apple’s gross margins would have been up even without the 6 Plus because the iPhone is simply a larger piece of the mix. But the 6 Plus magnifies the impact by driving up the average selling price with it’s $100 higher price tag. Look at the 2015 vs 2014 gross margin spread for Qs 2 and 1 and compare it to the spread for Q3. Tim Cook let out a juicy little tidbit during the analyst's conference call this week when discussing Apple Watch sales. Said Tim, "On the watch, our June sales were higher than April or May. I realize that's very different than some of what's being written, but June sales were the highest, and so the watch had a more of a back-ended kind of skewing."

This comment from Tim seemed to really surprise some people, so I'm not quite sure that everyone understands the financial structure that Apple has to follow. It may be helpful at this point to explain how U.S. GAAP (Generally Accepted Accounting Principles) defines a "sale". I never understood the appeal of the BMW 3 series until I drove one for myself. It was like seeing a color movie for the first time or getting my first taste of ice cream. From that day on, I didn't want to drive anything else. It’s hard to explain why and only someone who appreciates precision driving would understand. If you just want a smooth ride from point A to point B then it doesn’t matter what you drive. And judging from the number of new Corolla's and pickup trucks getting sold every year that would include quite a few people. But if you can appreciate the comfort level of a 50/50 weight balance, brakes with linear “feel”, and a tight suspension on a low center of gravity, you will know what it means to really drive. And don't get me started on the beauty that is BMW's turbocharged inline-six engine.

The Chinese stock market implosion and NYSE shutdown this week gave Apple’s stock price quite the roller coaster ride with two days of huge losses and a gigantic recovery on Friday. At the closing bell Friday the 10th, Apple Stock was priced at $123.28 per share.

This got me to thinking again about how high Apple is valued these days. With a share price at $123.28 Apple has a market capitalization of $710.22 billion. In theory, the market capitalization represents the present value of all of Apple’s future earnings. It’s kind of like a lottery winner deciding to take the lump sum payout versus getting checks for the next twenty years. Apple’s “market cap” is the lump sum payout of all their future profits. The stock price is simply the full market cap divided by outstanding shares of stock. As I laid out in my earlier article, I'm a big believer in the need for a larger iPad. But the iPad Pro has two big problems:

1. There is no vocal constituency clamoring for one. 2. Most users would never buy one for themselves. There is no vocal constituency for the iPad Pro for two reasons. First, the most likely users are busy business people who don't participate in the global naval gazing that is Twitter. Second, a lot of these future users don’t even yet know that they want one. So, Taylor Swift persuades Apple to pay royalties to artists during Apple Music's free ninety-day trial, and a new meme is born. One where she can solve world hunger and bring about world peace. Who doesn't love a good meme?

But what really happened? Could Apple instantly turn on a dime like that, assuming that this was not all a pre-planned publicity stunt? Based on my prior observations with high-stakes corporate negotiations, I think so. Here is what I think happened. |

Robert PerezManufacturing and distribution analysis since 1993. Perezonomics is available in Apple News

Archives

October 2024

|

RSS Feed

RSS Feed