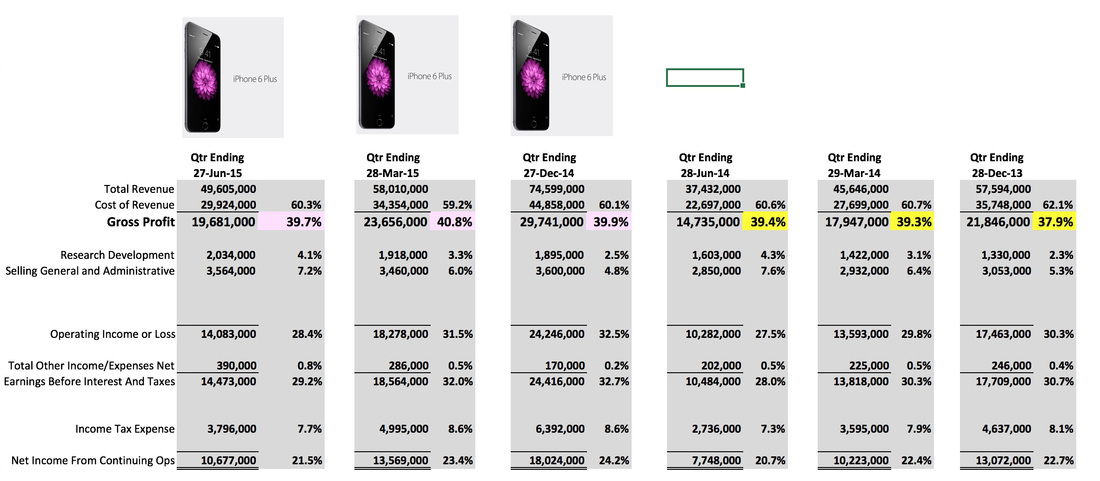

Remember Tim Cook’s comment last quarter when he dropped the info that the Apple Watch was going to be pulling in below average gross margins? I ran some numbers and came to the conclusion that the watch would have to exert over a one point drop in the corporate average to justify Tim’s comment. Q3 2015 came in at 39.7% which was three tenths higher than the previous year of 39.4%. However, Q3 2014 was before the launch of the golden goose that is the iPhone 6 Plus. Apple’s gross margins would have been up even without the 6 Plus because the iPhone is simply a larger piece of the mix. But the 6 Plus magnifies the impact by driving up the average selling price with it’s $100 higher price tag. Look at the 2015 vs 2014 gross margin spread for Qs 2 and 1 and compare it to the spread for Q3.

Q1 2015 - 39.9%

2015 up 2 full points. Q1 2015 was the first full quarter for the 6 Plus.

Q2 2014 - 39.3%

Q2 2015 - 40.8%

2015 up 1.5 points

Q3 2014 - 39.4%

Q3 2015 - 39.7%

2015 up .3 points. Now we add the Apple Watch to the mix and any favorable impact from the 6 Plus was almost wiped out.

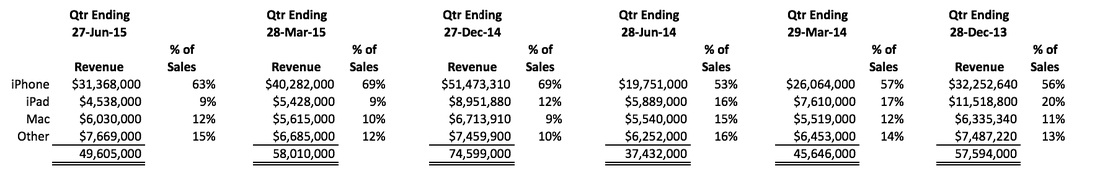

Something has definitely changed in Apple’s mix to cause their gross margin spread over 2014 to go down significantly. Tim mentioned that the watch’s gross margins were below average so we already know that this is part of it but there could be other factors at work here too. If you look at the revenue mix, the high margin iPhone and iPad were down whereas Mac and Other was up. Also, the sale of high margin A5 devices is winding down but I'm not sure how noticeable in the corporate average that would be.

Overall, Apple reported a solid quarter. Wall Street wasn't too impressed since Apple's market cap is actually lower at the end of the week than at the beginning prior to the earnings release. However, the stock price is based on future projections not past performance. And by my math, Apple would have to sell an average of 96 million iPhones per quarter over the next twenty years to justify the current stock price. So any drop in the stock price is really more of a reflection on analyst models than anything else.

RSS Feed

RSS Feed