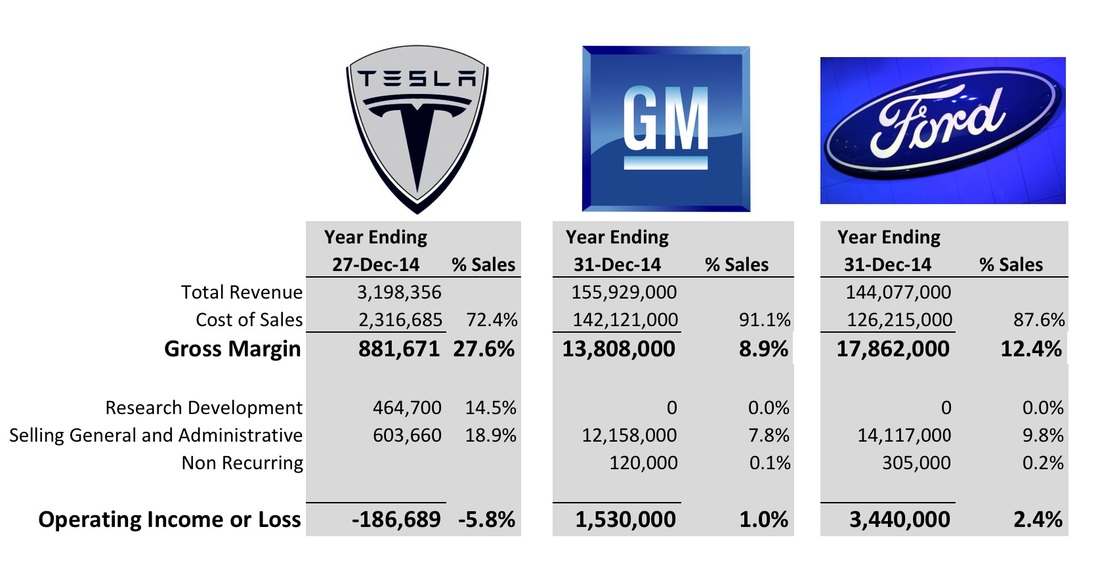

Actually diving into Tesla's financials without the media's propaganda full-court press will give anyone an eye-opening view. It must be why Bob Lutz recently came out and said that the emperor has no clothes. If you compare Tesla's income statement to GM and Ford for the most recent full year, there are some things that stand out.

Gross margins are high which would normally be a good thing. The problem here is that Tesla isn't achieving high gross margins because of manufacturing efficiencies or material volume discounts. They're charging lofty prices in an attempt to cover their massive SG&A (selling, general, and administrative). And those high prices are holding down sales volume. Even GM or Ford could have comparable high gross margins if they wanted to raise prices and let sales volume implode. But then they'd be in the same trouble that Tesla is in.

Tesla itself knows they have a demand problem

In July of 2014 Elon Musk told Shareholders that they'd have the capacity to ship 100,000 cars in 2015. As of the third quarter of 2015, they had sold about 32,000 cars. If they have a fourth quarter beyond all their wildest dreams they might just eke out 50,000 cars. So if they really had the capacity to produce twice what they are selling would there still be a two month wait? Something doesn't smell right.

Don't let Tesla's waiting lists or Elon's promises fool you. If they really thought that there was a pent-up demand for their cars then they'd do what they said they would do and willingly scale up their manufacturing facilities to increase capacity. There wouldn't be such long lead times and sales would be much higher. More volume is the tonic that would cure all their ills. But growing their manufacturing capacity would mean additional investments in high-cost machinery and equipment and permanently increasing their overhead costs. The resulting increase in sales would more than offset these additional costs, and profit margins would go up. However, does Tesla really believe people want to buy their vehicles? This seems to be a bet that Tesla is unwilling to take, because it appears that they've throttled their expansion plans. Why?

So you can see Tesla's predicament. If they lower their selling price in an attempt to spread their fixed costs over larger volume, they could end up with the worst of both worlds if the customers don't materialize. They would then have low margin sales coupled with a high SG&A burden. A recipe for disaster.

Tesla is doing exactly the opposite of what they should do if they believed that they had hot products with good demand. Product pricing is like merging onto the highway. You pick your spot and GO. That means Tesla should price their vehicles based on where they will likely be in the future with a successful volume ramp-up. If they price their products above that financial mode,l then they may never achieve market penetration. If they price below that model, then they may never be able to raise their prices again and be stuck in a low-margin business. If they don't have a model, then they are as good as dead since they have no idea what they're doing.

So if Tesla had a good financial model, they would price their vehicles where they could sell 100,000 cars annually and leverage their fixed costs. They haven't done that. I can only conclude that Tesla is pessimistic about future demand or that they expect their service and support costs to explode. If either is the case, then they are doing exactly what I'd advise them to do. Keep their prices as high as possible in an attempt to minimize the bleeding. It's better to bleed a slow death than to bet the farm and go belly-up overnight. At least if they die slowly, then they have some time to try some "Hail Marys" (Model X anyone?) or secretly shop the company around to potential buyers.

Tesla offers nothing new

So what is Tesla's central problem? I have no issues with the rather attractive Tesla Model S as a car outside of it being expensive, inconvenient for long trips, and a nightmare when the battery needs to be replaced. My problem is with the business plan underneath it all. It's based on pure faith that Tesla can somehow convince people on a large scale to buy inconvenient vehicles.

Ultimately, the products that companies sell are a gateway to something else that the consumer actually wants. You don't want to spend money on a camera--what you are really after is pictures of your kids. Even with cars, we don't want to spend thousands of dollars on a mechanical marvel. What we really want is to be able to get to work in the morning or the freedom to visit friends and family.

So when I boil down my biggest problem with Tesla, it is this. It isn't offering the consumer anything new. We already have relatively cheap convenient access to transportation. Adding yet another car company to the mix who thinks that they have a better mousetrap is nothing new. Simply being another new car maker in a crowded market alone would be daunting enough. But Tesla has the added challenge in that their vehicles cost three times the average price of an automobile and you need to go eat dinner while it charges up? Wow, that is truly stepping into the boxing ring with one hand tied behind your back.

When the smartphone was introduced it offered something new to the consumer that they couldn't get anywhere else. The internet in their pocket. Prior to the smartphone the Internet was something you checked after your arrival home in your downtime. We were all blown away at the thought of being able to get live maps in our cars or uploading pictures to Facebook while still sitting in the stands. The smartphone was a revolutionary product that clearly offered something that our flip phones or PCs couldn't. What does the Tesla Model S bring that is new? Are we getting to our destination any faster or cheaper?

Elon Musk thinks he's revolutionizing the auto industry. I'm sure the inventor of the first electric stove thought that he was changing the world too. But consumers don't care what powers their appliance, they just want their eggs sunny side up or to visit Grandma on Thanksgiving Day. No, I take that back. If they find out that an electric stove would need to have its battery recharged after every meal and stop working after seven years, they would start to care. So the Model III isn't going to save Tesla either unless it can significantly undercut everyone else in price to make up for its inconvenience factor. Regular Americans have a word for people who can afford a new get-to-work car and keep another car for leisure weekend trips. Rich.

Altruism isn't going to save Tesla

Is Tesla banking on the fact that people will want to do their part to get America off of foreign oil? Never mind the fact that any electricity that isn't generated from oil is derived from dirty coal? If there is one thing that can be consistently proven about the American consumer it is this. That they are looking out for number one. They won't buy your product just because it's made in America or because it's good for the environment. Your new product had better either be less expensive or deliver something new that is worth acquiring.

Service and Support

Regarding service and support, remember a couple weeks back when Consumer Reports removed Tesla from their list of recommended vehicles? It sparked an investor panic as they perceived the first cracks in the dam starting to show. I found Elon's response to be less than reassuring. He tweeted that the issues that caused Consumer Reports to drop the Model S from its list pertained to earlier models and had been taken care of. Here's the problem with what he said. You don't know what costs lie in wait for you on the new products. I have many years of experience in measuring and analyzing product defect costs, and I can tell you for a fact that with every new product revision come new issues. And you don't know what those new issues are until time has passed and customers start complaining. The new stuff will always look less problematic at the outset because it's new. But as time goes on and those products start to age, the issues will rear their ugly heads. It's a never ending battle. So at best, Elon was half truthful with what he said, or at worst, outright dishonest with the investors. I'm to the point where I discount anything Elon says. You can't trust his statements and instead have to do your own homework.

Make-to-Order Needs to Go

Tesla currently is a make-to-order company because they are trying to conserve their cash. It's common for new companies to get into serious cash flow problems because they've sunk too much money into inventory. If Tesla was actually making a profit on their vehicles, I'd be okay with this business model, but they're not. Many small niche manufacturers can make build-to-order work because they are charging enough for their products to make a comfortable profit. But Tesla is losing money and will continue to do so until they either raise prices or grow volume. Tesla is in a kind of no-man's-land where they have the pricing and gross margins of a small boutique manufacturer but carry the massive SG&A of a large-scale company that lives or dies by volume. They have to choose one or the other. Since they are already arguably too high on the pricing front, that leaves growing volume.

Growing volume would necessitate having inventory on hand for the customer to purchase. Does anyone actually think that Toyota, GM, or Ford wants to have acres of unsold cars sitting on their dealer lots? Of course not. But they're forced into doing it because they've learned the hard way that as customers shop they will pick the car that is available versus the one that isn't. Currently Tesla is selling to die-hard fans who are willing to patiently wait months for delivery, but the general public isn't going to be so understanding. If you're on the fence between buying a Tesla Model S and something like a Porsche Cayman GT4 that you could be cruising in by dinner time, guess who's going to get the sale? Tesla is going to lose out on a huge chunk of sales just because they don't have cars available for impulse buys. If Tesla wants to run with the big dogs, they need to learn to play the game.

Gateway computers was famous for their cow spotted computer boxes and "Country Stores". Our stores were actually just showrooms where you could see and touch the merchandise, but you had to place an order and wait a couple of weeks for your PC to be delivered. What we increasingly found though was that customers were leaving our Country Stores and going across the street to Best Buy and picking up a comparable computer because they didn't want to wait. If it's the same price why wait? Because Gateway was a much lower-volume producer than Dell or HP, our efficiency savings from doing a build-to-order model was getting outweighed by their material purchasing advantage. I only bring up the Gateway example to counter the Tesla apologists who think that somehow Tesla's build-to-order model makes them invincible. It doesn't and is actually hurting them. Tesla is in the same position as Gateway in that any efficiencies derived from build-to-order are outweighed by volume advantages by the competition. And we all know how well that worked out for Gateway.

But All Those Investors Are a Sign of Confidence, Right?

Wrong. In fact, many of those same Tesla investors expect that Tesla could very well go bankrupt. So why do they leave their money in Tesla stock? Let me introduce you to the concept of diversified risk. These high-risk investors make their money by placing their bets on multiple high-risk companies. They know full well that most of the bets will fail, but if one out of ten has spectacular returns, it more than outweighs the nine failures. A stock can only go down so much, but there is no ceiling on how high it can go. They are hoping that Tesla turns out to be the goose that lays the golden eggs. But if it isn't, that's ok because they'll cut their losses and see which one of their other improbable bets turns out to be the breakout hero. Some other company will go up high enough to outweigh the beating that they'll take on Tesla. They know that Tesla is a long shot, but that is why the potential reward is so high. With great risk comes great reward.

Where Does Tesla Go from Here?

They could admit defeat and raise their prices. Higher prices would cause their sales to shrink even further, but at least they might finally evolve into a self-sustaining entity. Although, that would also mean that Tesla would have to forever give up on its dream of revolutionizing the auto industry and be content with remaining a niche automaker.

They could secretly court a buyer. They would need to find a company with pockets deep enough to carry them through market penetration until they hit critical mass. But finding anyone who believes that the mainstream public is ready to go with electric vehicles on a large scale could be a tough sell.

Whatever happens, Tesla can't afford to keep doing what they're doing now. Eventually, they will run out of other people's money, and they'll be gone in five years. Something has to change because right now Tesla is on the road to nowhere.

RSS Feed

RSS Feed