The article is below.

|

Why You Shouldn’t Buy ANYTHING From Tesla Electrek had another absolutely horrifying example of why you shouldn’t buy anything from Tesla. This comes right after the example of the people driving their brand new Tesla Model Y on the highway and the roof flew off. A few years ago buying a Tesla was kind of cool. Now that everyone knows about the horrible quality of these glitchy rattle traps, they’ve devolved into rolling embarrassments for the owners. Thankfully prospective EV buyers will have other options to choose from soon.

The article is below. Tesla just reported ground-shaking bad news that undercuts one of their pillars of support. Demand for their cars isn’t what everyone thought. As reported by Tesla, they have a capacity to build between 170 to 190 thousand cars per quarter. And yet, Tesla only delivered 139,000 cars this quarter. What happened? Tesla gave recent guidance that they were on track to hit their annual 500,000 cars delivered in FY 20 when every other auto maker cut their guidance due to Covid. So according to Tesla, they didn’t anticipate Covid being an issue a few weeks ago.

Tesla’s Battery Day was a total dud and yet Business Insider’s Matthew DeBord can’t wait to rush to Tesla’s defense. He may as well just call himself a blogger at this point because there is a total lack of journalistic integrity with his reporting on Tesla. Is he not under any obligation to discuss the background on this supposed “expert”?

I’m starting to wonder if there isn’t a lot more to this than meets the eye when it comes to DeBord and Tesla. Thanks to Twitter user @StultusVox for proving a little background below into the horribly slanted reporting by Matthew DeBord. I hate to be a told you so, but I told you so. If you were to read the all the tech web sites that cover Tesla. You’d think that Tesla has had a year of profitability. You’d be wrong. Without subsidies, there are no profits. You’d also think that cash flow was finally moving in the right direction, you’d be wrong again. And the S&P 500 just sided with me by excluding Tesla from their index.

Credit Analyst Delivers Scathing Evaluation of Tesla After Predicting Valeant and WeWork Scandals8/26/2020

Vicki Bryan is the CEO of the Bond Angle and gave an amazing view to TC’s Chartcast into how dispassionate bond credit analysts evaluate businesses. Basically, you have to ignore what the CEO says and look at what they do and study the hard numbers. I found her storytelling about Valeant Pharmaceuticals and WeWork riveting. But wait until she gets to Tesla.

David Trainer published a devastating critique on the wisdom of owning Tesla stock at these valuation levels.

In a ridiculous piece written by Matthew DeBord for Business Insider. Matthew thinks that the secret to Tesla’s upward stock movement is due to “love”.

Tesla’s stock and the national debt have one thing in common, cooler heads know that they’re destined for big trouble at some point in the future, but no one really knows when they’re going to explode.

Within days of writing about how it appears that Tesla’s poor build quality and horrendous customer service is taking it’s toll on sales, this pops up on YouTube. A devastating critique of it’s paint quality by professional detailers.

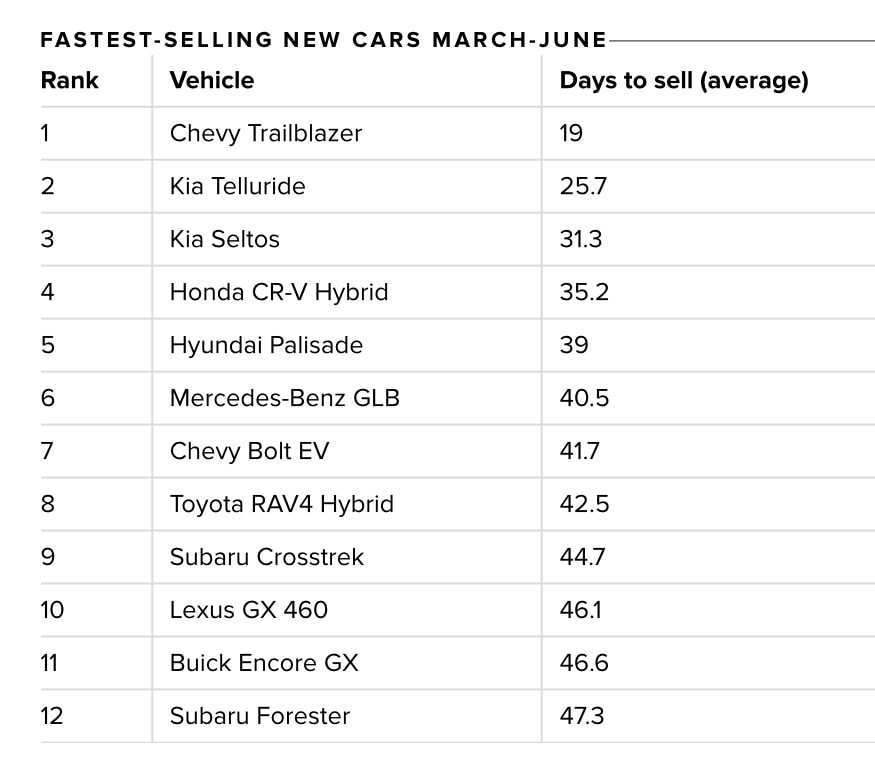

It’s amazing to what lengths the tech press will go to spin any piece of news about Tesla as positive. Even when the opposite may be true. This week the headlines are all over about the Tesla Model 3 as being “the fastest selling used car”. But almost everyone omitted the other side of the story. Tesla new car sales are collapsing.

|

Categories |

RSS Feed

RSS Feed