|

In early 2019 Tesla had a close scrape with death, and yet you never saw a single word about it in all of the tech blogs that cover Tesla. We now know this to be true from an unlikely source. Musk himself. In the past week he’s dropped an interesting tidbit about him wanting to offer the company to Apple at a tenth of the current value.

The funny thing about Tesla’s bubble valuation is that you can see that this company is very poorly managed. Musk tells himself that since Tesla’s stock price is high, that he must be doing something right. Well, Bernie Madoff made the same argument for decades until it all caught up with him.

Maybe The Traditional Auto Makers Know What They’re Doing After All In a surprising admission this week, Musk said that he was open to merger talks with the right auto company. After lambasting traditional automakers for years and stating that Tesla was revolutionizing the auto manufacturing world…now this? Ha! This is just too funny.

On Nov 22nd I wrote about how Tesla’s stock price has been carried for the past year on the prospect of future inclusion into the S&P 500. Here is an excerpt of what I said:

Judging from some of what I’ve seen written by people who think that Tesla is good investment, there is a misunderstanding of what constitutes a stock bubble. It seems that many Tesla believers think that if the stock price is going up, that this must not be a bubble. When in reality, this is just a bubble doing what a bubble does.

I’ve always agreed with Warren Buffet’s motto on what makes a company an attractive investment. Which is, look for companies that have good products and great management teams. But when you look at Tesla, you see the exact opposite. You see a company that is poorly managed and has terrible products. And you could go one further, they also have terrible service. It’s a perfect storm of a company.

The Consequences of Cars Spending Much More Time in the Garage Tesla’s has an army of writers and influencers who, for various reasons, do their best to prop up this disappointing company in the face of perpetual bad news. Back in 2019 Tesla announced the closure of most of their retail stores in the face of imminent bankruptcy. This group of dishonest cheerleaders said that this was just another genius stroke by Musk. Musk later backtracked on the full store closure plan after getting an emergency loan. But did you hear a peep from the cheerleaders on how Musk made a mistake or Tesla looked close to collapsing? If that doesn’t show the hypocrisy of the media I don’t know what will.

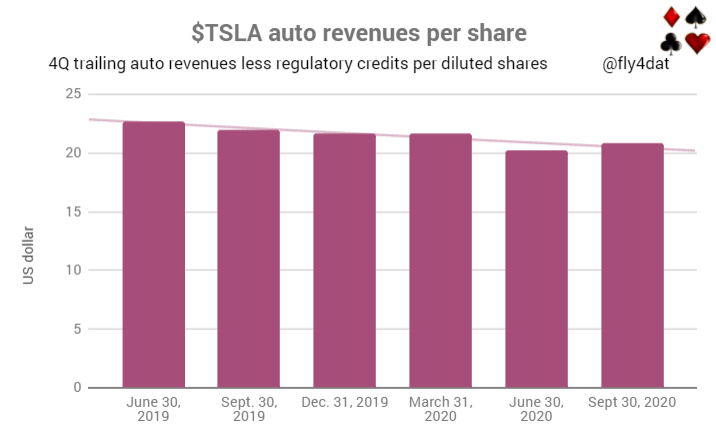

It’s now official. The Bears were right that Tesla is structurally unprofitable. Tesla’s Q3 “profit” was $331 million which includes regulatory credit revenue of $397 million. That means that in a quarter of record deliveries, Tesla still managed to lose $66 million. Tesla has already admitted that the regulatory credits are going to be phased out in the future, so everyone has to evaluate their results based on the sale of cars, not receiving government largesse.

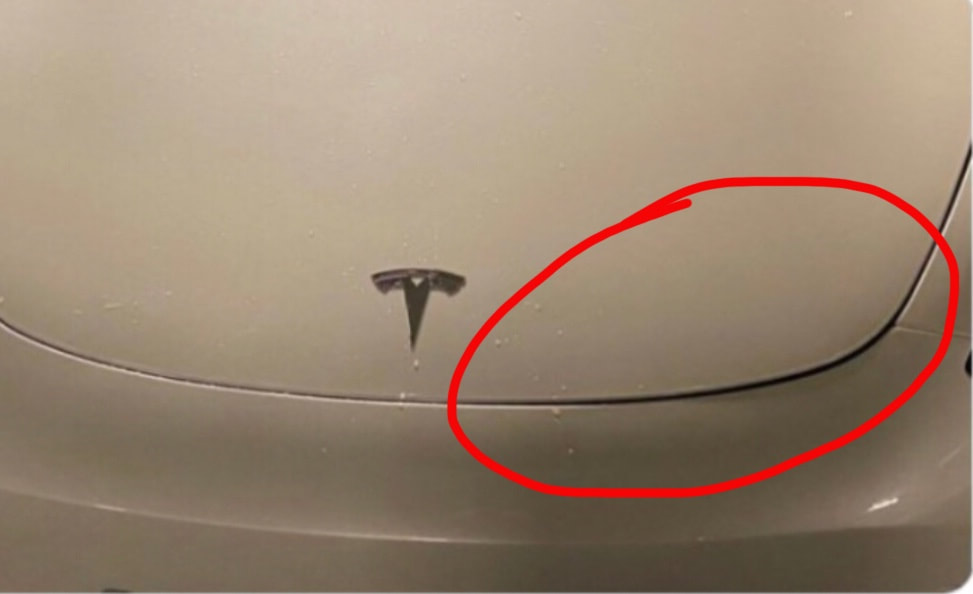

Tesla’s recent price cuts are such an obvious red flag that it’s hard to believe anyone might actually think that these price cuts are a positive sign for Tesla. I wanted to add a little to what I wrote yesterday regarding what these price cuts mean.

|

Categories |

RSS Feed

RSS Feed