Everyone knew that Tesla was going to lose money in Q1 and Q2 because their volume is always lower in the first half of the year. The big question was, could Tesla make a real profit in the final two quarters to eclipse their cumulative YTD losses of $600 million? Could Tesla possibly eke out a real annual profit minus the regulatory credits for the first time in it’s lifetime? Well, at the close of business today, we found out that the answer to that question is “No”.

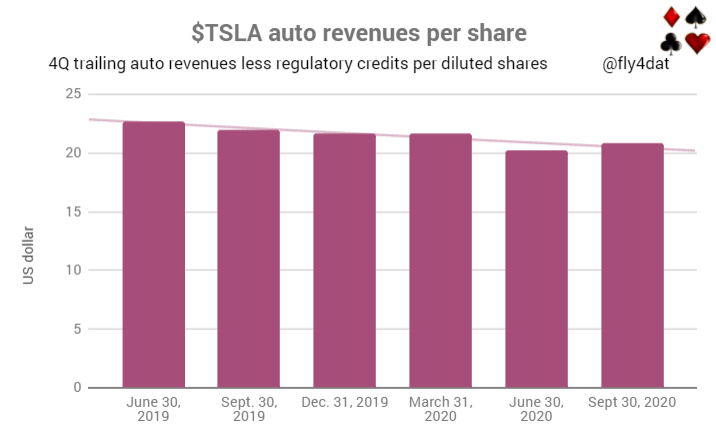

I evaluate Tesla minus the regulatory credit revenue because Tesla admits it’s going away. Those credits are like government stimulus checks. It’s nice when that free money comes in the mail, but you can’t budget long-term on those.

I expected that Tesla would turn in small profits for Q3 and Q4 that were real. Meaning they were in the black even after subtracting the credit revenue. I was wrong. My theory was that the small Q3 and Q4 profits would be outweighed by the huge losses in Q1 and Q2.

But the news today turned out to be far worse than I expected. Because even with record deliveries, Tesla didn’t turn a small profit but experienced another significant loss. If Tesla can’t turn a profit with nearly 140,000 units shipped, when can they? Tesla Bulls have been saying for years that Tesla just needs to grow more and they will be profitable. Musk proves them wrong every quarter. Tesla has finally achieved their annual 500K run rate and they’re still losing money. This company is structurally unprofitable.

The problem is demand. Tesla was forced to cut prices to move metal. Yes, Tesla had record deliveries but that’s because Tesla reduced their selling prices. Making matters worse, even with reduced prices, Tesla didn’t sell nearly as many cars as they had hoped and finished the quarter with tens of thousands of unsold cars and factories running at reduced capacity. The bigger that Tesla gets, the bigger their problems become.

I’ve been saying for a long time that Tesla never grows into profitability because they cut prices faster than they gain efficiencies. They just proved me right yet again. This is a formula for never ending losses. If Tesla hadn’t cut prices so drastically in the last 24 months, they would be profitable without the regulatory credit revenue. If demand was strong, Tesla wouldn’t have had to mark down their cars.

And this is as good as it’s going to get for Tesla. They’ve peaked. If Tesla couldn’t turn a real profit in 2020 it’s never going to happen. Competition in Europe and Asia is finally starting to take a bite out of their market share. Car & Driver magazine reported this month on how there is no EV revolution happening. Sales of EVs in China last year were down 4.0% and EV sales in the United States are projected to be only 4.9% of total market share by the year 2025. In fact, IHS Markit expects that in the year 2030 87% of all new cars sold with have some form of gas powered motor.

So if gas vehicles aren’t going anywhere soon and 50 new electric vehicle models are coming to market by 2023 what’s going to happen? That means the EV market is going to get divided by many more players. More bad news for Tesla. Even now the new Volkswagen ID3 has started kicking the Model 3’s butt in Europe.

RSS Feed

RSS Feed