|

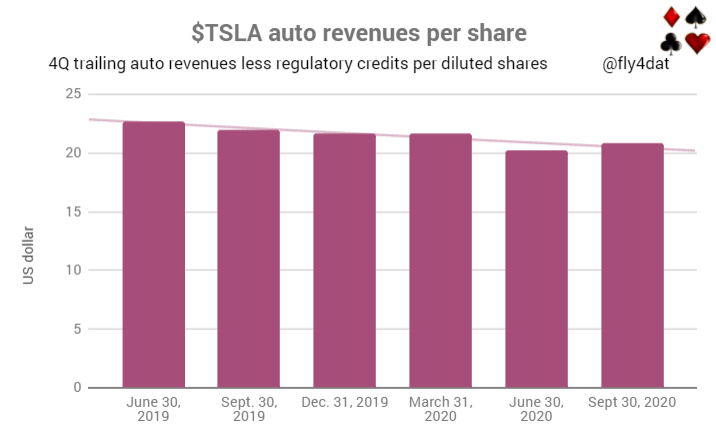

It’s now official. The Bears were right that Tesla is structurally unprofitable. Tesla’s Q3 “profit” was $331 million which includes regulatory credit revenue of $397 million. That means that in a quarter of record deliveries, Tesla still managed to lose $66 million. Tesla has already admitted that the regulatory credits are going to be phased out in the future, so everyone has to evaluate their results based on the sale of cars, not receiving government largesse.

Tesla’s recent price cuts are such an obvious red flag that it’s hard to believe anyone might actually think that these price cuts are a positive sign for Tesla. I wanted to add a little to what I wrote yesterday regarding what these price cuts mean.

Why You Shouldn’t Buy ANYTHING From Tesla Electrek had another absolutely horrifying example of why you shouldn’t buy anything from Tesla. This comes right after the example of the people driving their brand new Tesla Model Y on the highway and the roof flew off. A few years ago buying a Tesla was kind of cool. Now that everyone knows about the horrible quality of these glitchy rattle traps, they’ve devolved into rolling embarrassments for the owners. Thankfully prospective EV buyers will have other options to choose from soon.

The article is below. Tesla just reported ground-shaking bad news that undercuts one of their pillars of support. Demand for their cars isn’t what everyone thought. As reported by Tesla, they have a capacity to build between 170 to 190 thousand cars per quarter. And yet, Tesla only delivered 139,000 cars this quarter. What happened? Tesla gave recent guidance that they were on track to hit their annual 500,000 cars delivered in FY 20 when every other auto maker cut their guidance due to Covid. So according to Tesla, they didn’t anticipate Covid being an issue a few weeks ago.

|

Categories |

RSS Feed

RSS Feed