Credit Analyst Delivers Scathing Evaluation of Tesla After Predicting Valeant and WeWork Scandals8/26/2020

Vicki Bryan is the CEO of the Bond Angle and gave an amazing view to TC’s Chartcast into how dispassionate bond credit analysts evaluate businesses. Basically, you have to ignore what the CEO says and look at what they do and study the hard numbers. I found her storytelling about Valeant Pharmaceuticals and WeWork riveting. But wait until she gets to Tesla.

David Trainer published a devastating critique on the wisdom of owning Tesla stock at these valuation levels.

In a ridiculous piece written by Matthew DeBord for Business Insider. Matthew thinks that the secret to Tesla’s upward stock movement is due to “love”.

Tesla’s stock and the national debt have one thing in common, cooler heads know that they’re destined for big trouble at some point in the future, but no one really knows when they’re going to explode.

Within days of writing about how it appears that Tesla’s poor build quality and horrendous customer service is taking it’s toll on sales, this pops up on YouTube. A devastating critique of it’s paint quality by professional detailers.

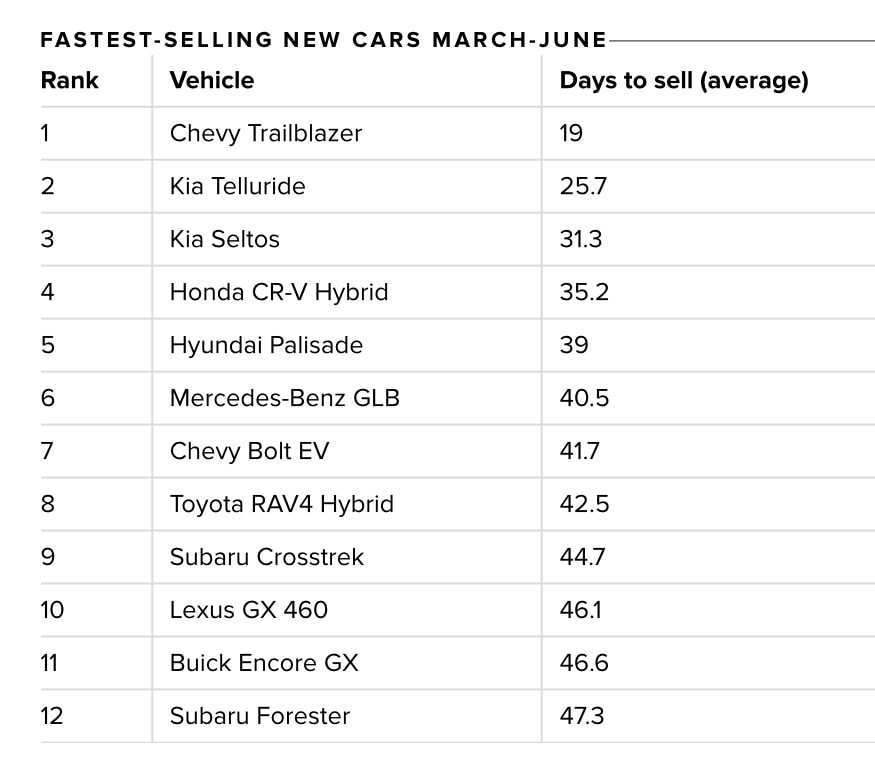

It’s amazing to what lengths the tech press will go to spin any piece of news about Tesla as positive. Even when the opposite may be true. This week the headlines are all over about the Tesla Model 3 as being “the fastest selling used car”. But almost everyone omitted the other side of the story. Tesla new car sales are collapsing.

|

Categories |

RSS Feed

RSS Feed