I highly recommend reading the entire piece. It systematically dismantles the Bull case for Tesla all in one spot.

The law of unintended consequences has a funny way of catching up to people who think that they’ve concocted the perfect plan. Tesla stock has seen some highly unusual action when it comes to futures buying and selling. A skeptical mind would say that there is behind-the-scenes manipulation at play.

But in any event, the unintended consequence of the stock price getting way too far ahead of the fundamentals is that some of the institutional investors may decide to get out of Tesla. Even if you believe that Tesla can do everything that they said they would, how much upside is left at this point? Recent history shows that companies who are admitted to the S&P 500 suffer declines after the short-term bump.

Back when Tesla was an overvalued $300 stock, it was these institutions which kept out of the fray which helped Tesla’s stock price stay somewhat stable. And now, if they leave, it’s going to leave the stock to short-term players who will bail when the momentum stops. That won’t bode well for Tesla’s long-term stock price stability.

All the Tesla stock holders who are waiting for the S&P 500 bump have got to be sweating bullets about now. The smart money wants to reap the S&P bump but get out before all of the bad news hits. But it looks like it’s going to be a very close shave.

Unlike Apple, Tesla has no real profits to support the stock price. And some of the moves that Tesla made to fabricate the fake profits came at the expense of future quarters. So a return to mega-losses is highly probable. Tesla’s sky-high valuation is doomed when that happens.

The upside of Tesla’s stock price getting away from fundamentals is that nothing is preventing the upward price movement. The downside is that when the momentum stops, nothing will stop the downward price dive.

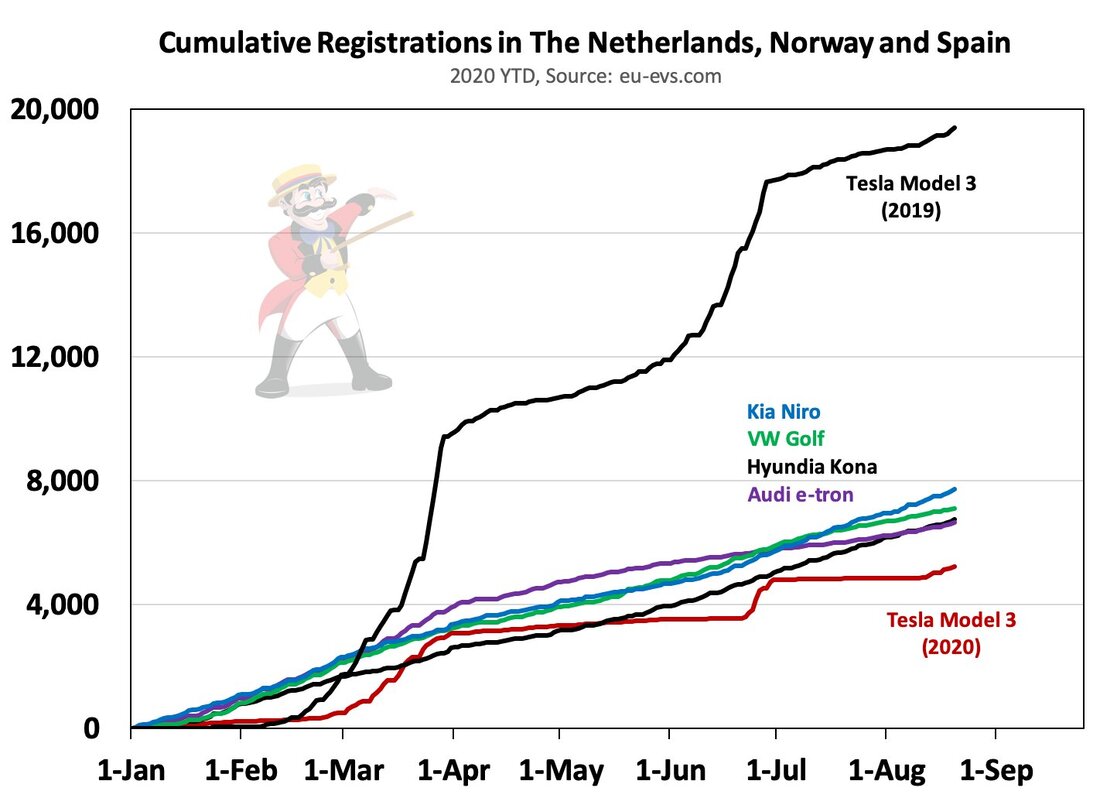

It’s gonna get ugly after some of these institutional investors get out of Tesla, the losses start piling up again, and it becomes more widely known how Tesla’s growth is stalling all over the world. We could easily see a 1-for-5 reverse stock split. Meaning that the price drops 80% and your 5 shares are worth what 1 used to be.

RSS Feed

RSS Feed