I had written only 3 weeks ago that Tesla’s Q2 “profit” was a mirage because Tesla is actually including subsidy government credits as part of their income. However, at the time I didn’t have a sense as to how bad Tesla’s real situation might really be. But in Tesla’s 10-Q there were references to accounting changes which were made in Q2 that caused Tesla to include subsidy credits which it hadn’t received yet. Tesla accrued future subsidy credits that it hopes to sell in the future.

Now boasting a “profit” that was contingent on subsidies was bad enough. That’s like saying you can balance your budget as long as the government sends you a $1,200 stimulus check. But what Tesla did is even worse. It’s like they said they were able to balance their budget if they include the $1,200 stimulus check and estimate that they’ll receive two more by the end of the year. So with the estimated $3,600 stimulus money, they were able to balance their budget in this one quarter.

Of course, the natural questions become:

- What if those stimulus checks don’t come?

- If you can only turn a profit with subsidies, does that mean you are guaranteeing future losses since you pulled them forward?

The answer to both of these questions is this, large future losses.

The next 60 days are going to be quite busy for Tesla. Tesla will be admitted to the S&P 500 and then Tesla needs to raise more capital. This needs to happen before they have to report their Q3 results which will probably be horrific. I’m guessing that the Q3 earnings release will be the beginning of the end for Tesla. How long it’ll take I don’t know but Tesla is near their peak and then it’s all down hill after that.

The main thing propping up this stock is the S&P 500 carrot. After Tesla is included into the index, they’ll reach their all time high as various funds adjust their holdings. Then the decline will start to happen. But even if Musk can pull another rabbit out of his hat, it only delays the inevitable. There is only one thing proven to boost stock valuations long-term, sustainable profits.

Tesla’s stock price is like a rock on a hillside that wants to obey gravity and roll down hill. That’s because the valuation isn’t based on real profits. Apple’s stock price is like a kite floating on the wind. It goes up naturally and with no effort by Tim Cook at all. A company like Apple has a solid foundation because it’s based on profitable, high-quality products, and a good management team. Tesla is 0 for 3 on these fronts.

Instead, the Tesla stock valuation is based on Musk’s promises and story-telling. All of Tesla’s big-name hires in the last 5 years have all quit the company. They can’t seem to attract any new talent. In order to augment volume and keep the factories running, Tesla has been dropping prices steadily. This alone is unsustainable. And despite over ten years building cars, Tesla seems to have quality problems that are worse than ever. For Tesla, the 3 items that stock valuation is dependent upon are all missing.

Every day when Musk gets up in the morning, he has to get back to work at pushing that rock up the hill. Because if he doesn’t it’ll start to roll back down. It actually sounds like some sort of eternal punishment. And the higher the stock price goes, the harder it is to push that rock uphill. I actually kind of feel sorry for Musk. He’s caught in a web of his own doing and there seems to be no way out. Tesla has probably lost another $70 million in the 3 weeks since we looked at their Q2 results and they’re getting close to running out of cards that they can play.

At best, Tesla was a $50 stock before the split, now it’s a $10 stock. After we’re past the S&P 500 bump and the investors are barraged with non-stop bad news about declining sales, shrinking market share, and quality problems, the true valuation will eventually assert itself.

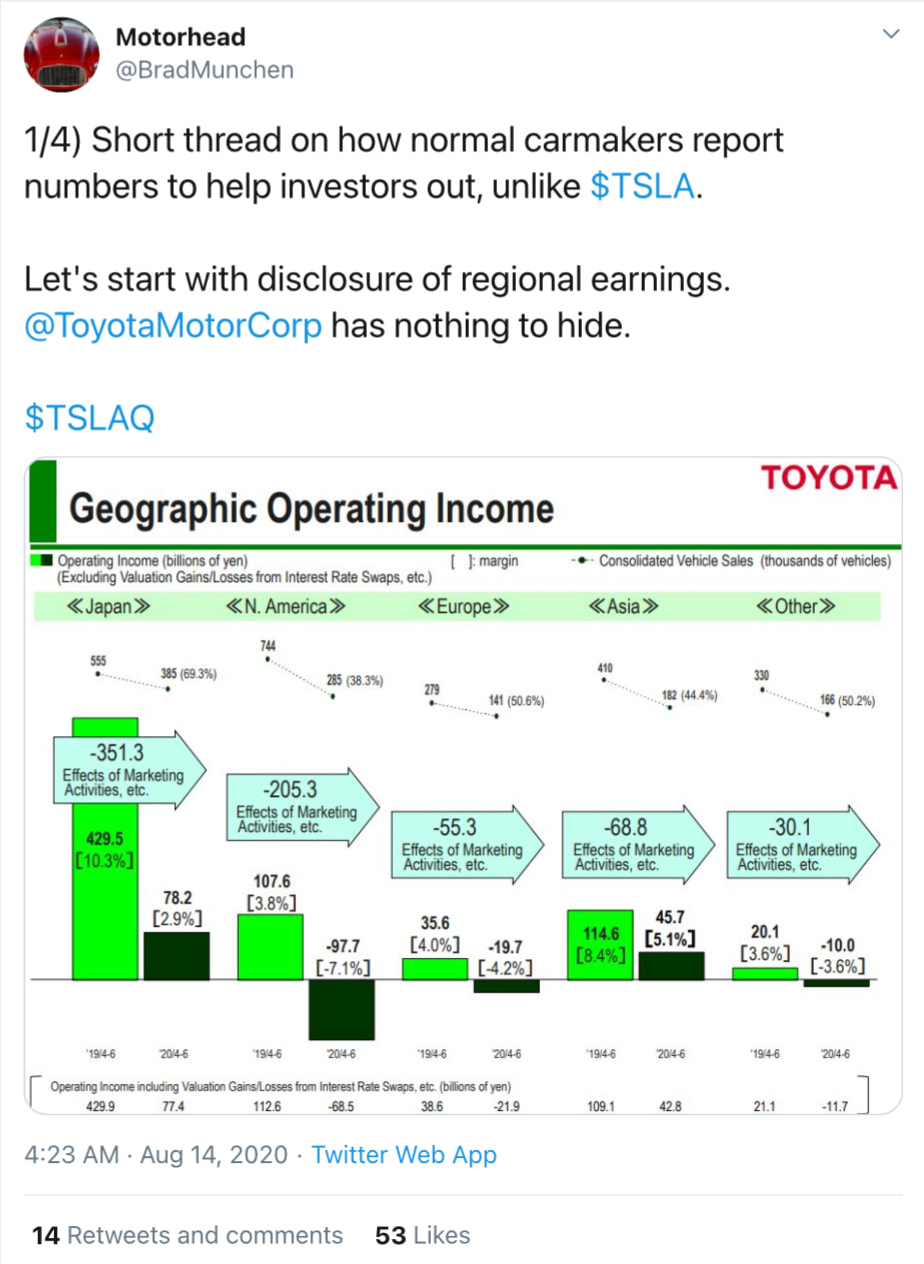

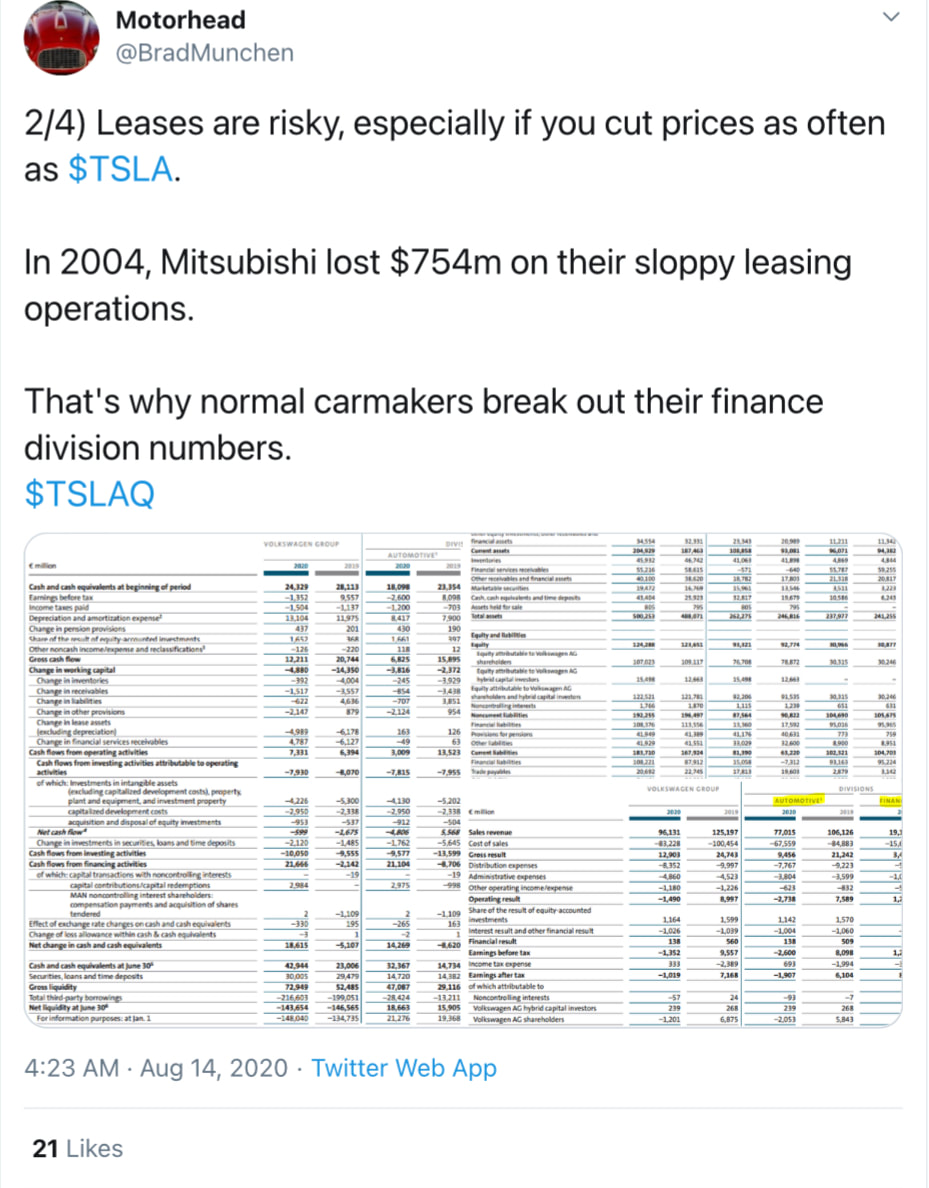

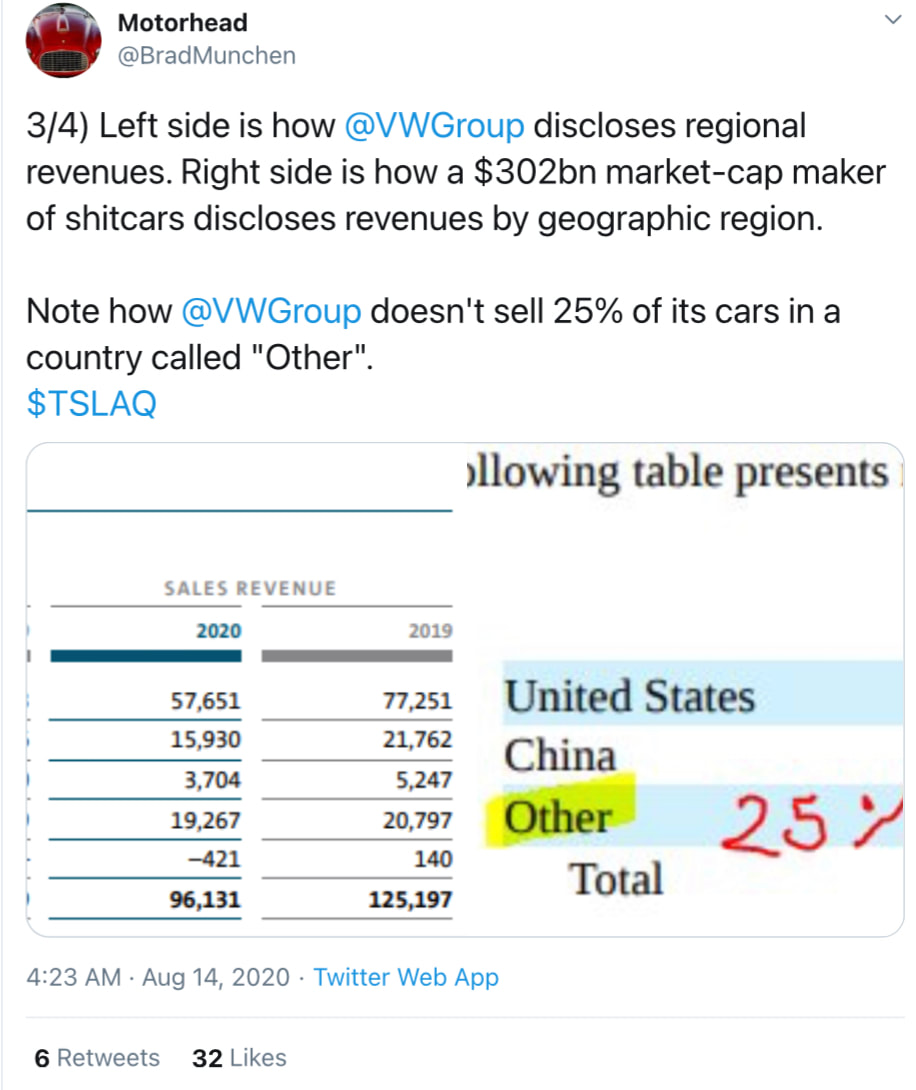

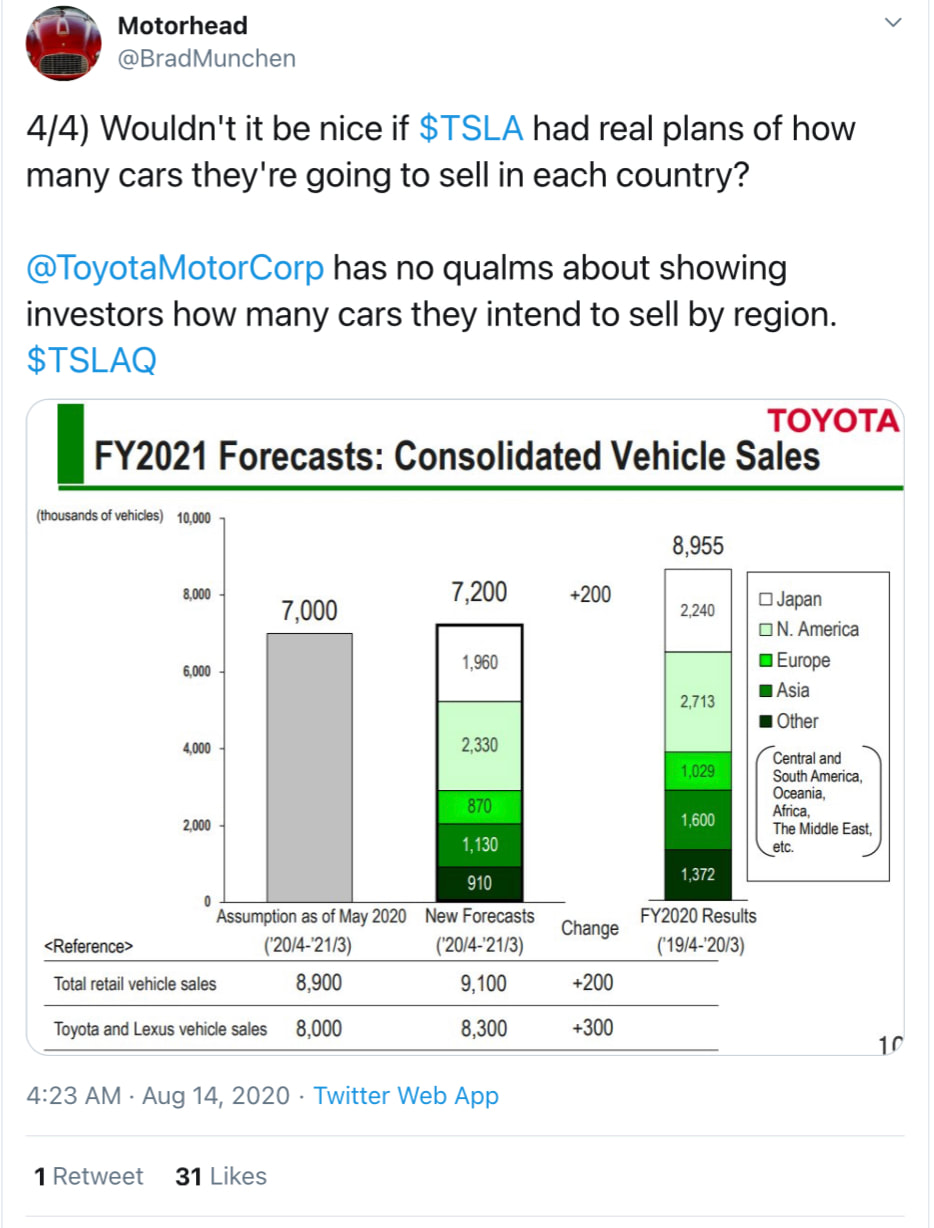

Investing in Tesla is building your house on sand. When the company you are investing in depends on data obfuscation to keep the stock price up, that’s not a good sign. As summarized by @BradMunchen below, Tesla is a house of cards desperately trying to keep the story alive. Good luck Tesla investors. I sincerely hope you time your exit well enough to escape the coming fall.

RSS Feed

RSS Feed