This reminds me of my days in college when I worked part time at a little Caesar’s Pizza restaurant. At times, parts of the dough would get separated from the underlying crust and big bubble of hot air would form. We were supposed to be on the lookout for these in the oven and pop them when they arose.

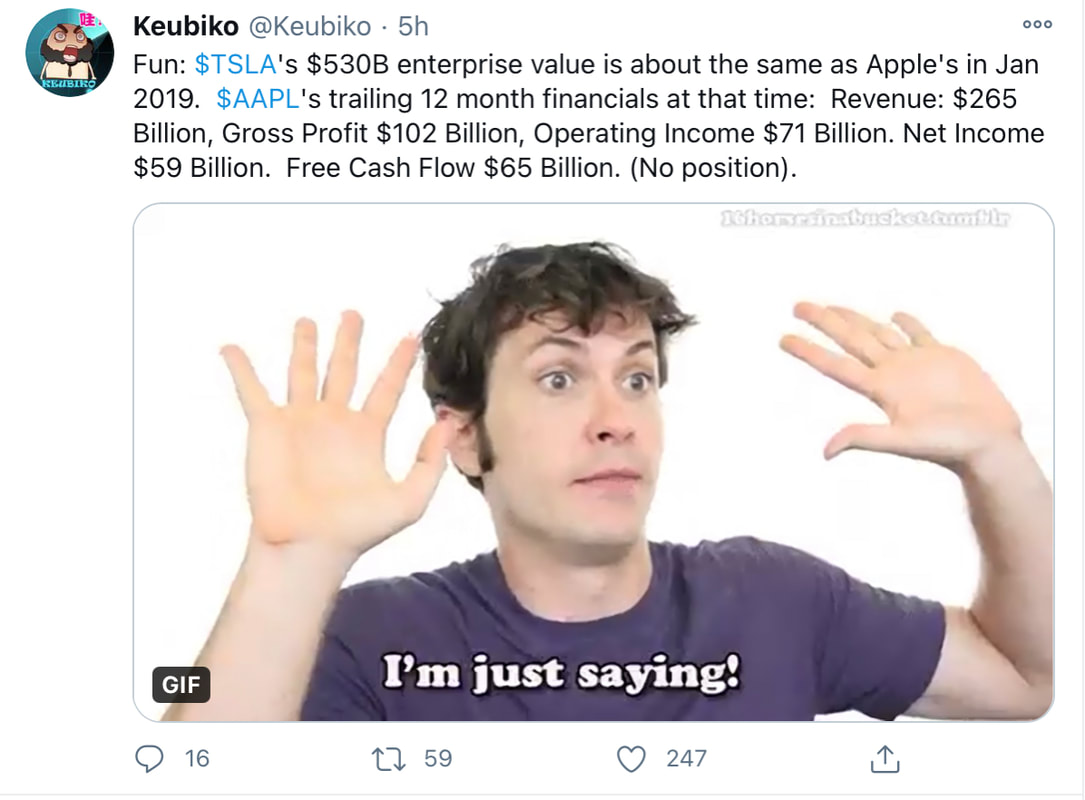

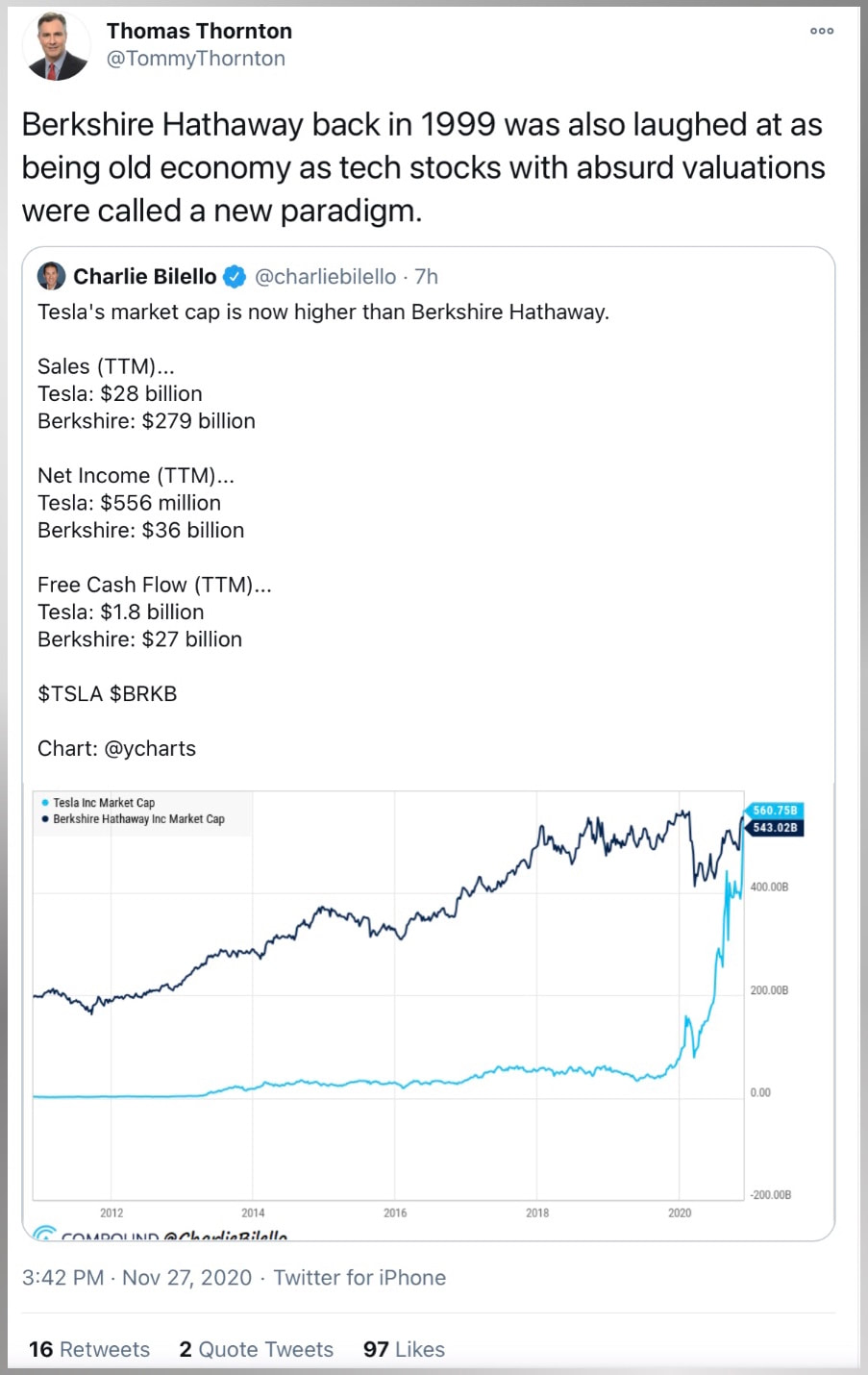

There needs to be a clear path to profitability which supports the stock price. For four years I’ve been listening to the best theories from Tesla proponents on how they are going to do that and it always boils down to this. Fantasies of the future which transcend the automotive industry. Even the most die-hard Tesla believers concede that making cars is a dreadful business that doesn’t support the stock price.

I don’t think the small retail buyers pouring into Tesla stock are aware that the biggest Tesla defenders freely admit that the car company which is Tesla Automotive isn’t worth anything near $500 per share. I don’t think they realize that what they’re really buying are theories that Tesla is going to revolutionize the energy, Taxi, and mass transit industries simultaneously and in under 10 years.

Yeah, and Kodak was going to change the world with KODAKCoin. It’s all hot air with the intent of blowing up the bubble. Some bubbles just last longer than others. All Tesla is doing is proving that with a large twitter following, you can prolong the bubble longer than what was possible in the past. The power of social media can convince millions that the earth is flat, the moon landing never happened, and that Tesla’s vehicles will appreciate in value as they operate as robo-taxis.

The valuation of a stock reflects future profits, not past performance. But when a stock valuation isn’t a bubble, there is a credible record of solid past performance. Meaning, the future plan isn’t taken on face value without a solid foundation. This is what is missing from Tesla and what caused so much internal debate at Standard & Poors.

If I’m generous I’d say that the stock purchasing of Tesla due to it’s inclusion into the S&P 500 will all be over by the end of March 2021. Probably sooner. After that, it’s going to be fun to watch what happens to Tesla’s valuation. But if you truly believe that Tesla will put electricity companies out of business and that their cars will earn you money while you sleep, by all means invest now. Because the stock price is based on these fantasies, not the crappy business of selling Model Y’s or Semi-Trucks.

If you buy into Tesla’s sky high stock between now and March 2021, Good luck, and make sure you only invest what you can afford to lose.

RSS Feed

RSS Feed