Why are gross margins such a focus when it’s not the bottom line net income? Because when a company is evaluating it’s product portfolio profitability, this is the level at which all of the controllable costs associated with producing iPhones or iPads are tallied. If you start including costs further down on the income statement you end up with expenditures that don’t really have anything to do with specific products.

In my earlier blog post regarding Apple’s income statement superstars, the A5-based iDevices, I discussed the concept of depreciation. Basically it’s that all the costs of producing a new SOC such as engineering, tooling, and machinery are spread over the shortest reasonable useful life. Probably twelve months. So that after that twelve months is over, the product overhead charge for producing those SOC’s goes down dramatically. In the world of manufacturing, labor costs and depreciation have an inverse relationship. That is when one is up, the other is down. The more automated production is, the less man-hours you have to pay for but the more you spent on machinery and software. I’ve never taken an in-depth look at SOC production specifically, my expertise is more with final product assembly, but I doubt that SOC labor costs are very significant compared to material and overhead.

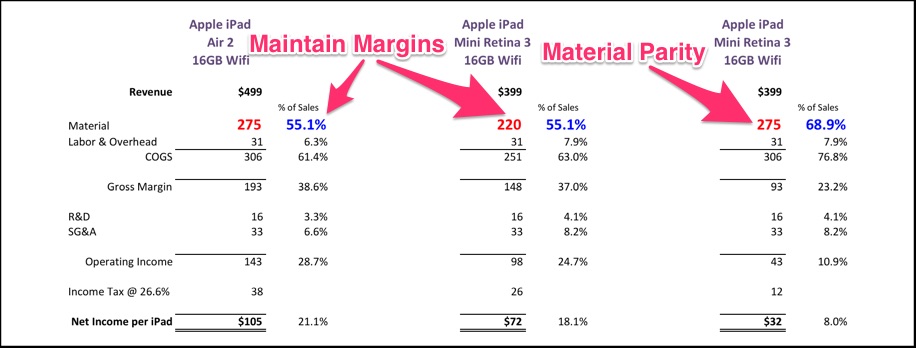

If I bring back my theoretical iPad Income Statements based on the Apple Inc. Income Statement percentages we see the following. By virtue of charging $100 less for an iPad Mini 3, that product has a lower budget with which to pay for materials. That means for a $399 iPad versus a $499 iPad, you just lost $55 to buy components. And when your total material cost was $275 to begin with, that is huge. I’m guessing that the SOC is probably the most expensive component in an iPad. So any product manager trying to meet internal gross margin targets is forced to evaluate the need for using the latest, most expensive, SOC available. Could Apple simply offer the latest SOC and accept a lower gross margin? Yes, but when you’re total estimated net income on an iPad Mini is around $83 dollars and you decide to absorb a material increase as high as $55, you just lost 65% of your profitability.

When the iPad product manager stood before Tim Cook to go over his 2013 product performance I’m sure gross margins came up. Financial performance at all levels is always compared to the previous year and when this was done for the iPad, you would have seen a significant drop in gross margins due to the parity of specs introduced with the iPad Mini Retina. The product guys caught the financial guys flat footed and slid through some nice upgrades to the iPad Mini. But when the financial results for the year came in, top management found out exactly what the financial ramifications for that decision would be.

So if Apple isn’t going to accept lower gross margins than they either have to use older tech or charge a higher price. The onus now moves to the buying public, would they vote with their wallets and pay a higher price for A8 equipped iPad Mini’s? I think Apple has calculated that in a world of $199 small tablets, that is a risk too big to take.

RSS Feed

RSS Feed