However, I thought it might be interesting to discuss how a company evaluates such a huge decision and the importance of financial modeling.

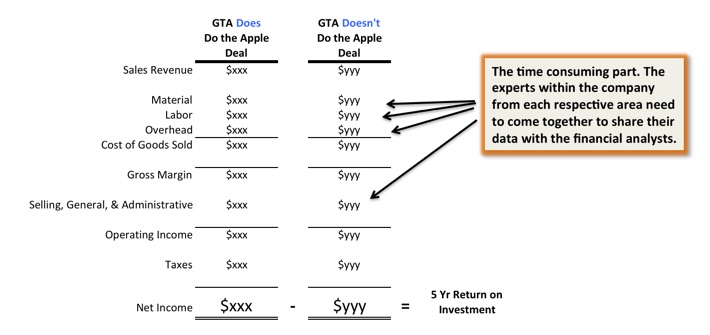

So what should have taken place? First, the group negotiating the deal with Apple would give finance a clear direction on what future volumes to expect. It always starts with volume. Then the finance group will take those volumes to all the internal departments to get an estimate of any incremental additions and subtractions on the yearly income statement.

- Purchasing – What will incoming raw materials cost?

- Manufacturing Assembly –New hires? Square footage needs? Additional buildings? Yield & Scrap issues?

- Manufacturing Engineering – What kind of tooling & machinery will you purchase? Future warranty costs?

- Logistics – Outbound freight costs will be what? Are distribution assets adequate?

- Administration – Any incremental order fulfillment or customer service costs?

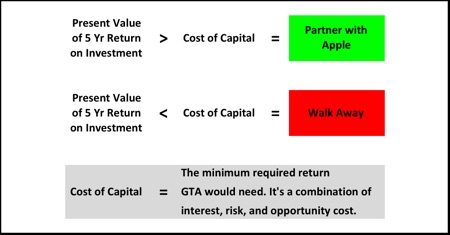

Assuming that GTA had a good financial model of what to expect in terms of future revenues and expenses (if they even made it this far in the analysis), they would then compare their estimated future profits to a scenario in which they didn’t do the deal. So if GTA would earn $5 billion in profits, they must deduct the $4 billion they would have earned anyway. So only the $1 billion in incremental profit counts in the analysis.

But wait, that’s not all. A billion dollars in the future is worth less than a billion dollars today. GTA would have to buy those furnaces today with more valuable present day dollars. So that billion dollars of profit over five years is then discounted back to present day value, which will make it a lower number. NOW we can make our comparison.

I’ve worked with financially disciplined companies who use this methodology when evaluating potential new products, building new distribution centers, or investing in new manufacturing technologies so this is not any earth-shattering, new voodoo. It just takes time, a lot of it.

RSS Feed

RSS Feed