This is relevant when discussing Apple’s push into services. Regardless of how many iPhones Apple can sell in the current quarter, they can still sell services to customers who purchased iPhones one or two years ago. However, after reading much of the tech news, I get the sense that many believe that the installed base only grows and grows. That’s not true.

I’ve had a hand in calculating warranty reserves for billion-dollar corporations. One of them being the Gateway Computer company of cow-spotted box fame. This involves calculating an estimate of the active installed base of units that exist. I’m simplifying a bit, but it’s basically creating a layered model of units by year. Each new year entails adding new units but also dropping off old units.

Apple’s services business will grow in the short term for two reasons.

- Their installed base of iPhones grows

- Their services $/customer grows

I wrote last week that Apple’s world still revolves around the iPhone because they are growing their $ per iPhone owner revenue. But that can’t last forever. I mentioned that Cabela’s found out that once your customer base is saturated, that extra revenue comes to an end. Gateway computers also found out the same thing when they rolled out their “Beyond the Box” service revenue initiative. They quickly found out as one Gateway VP put it, “that without the box, there is no beyond”.

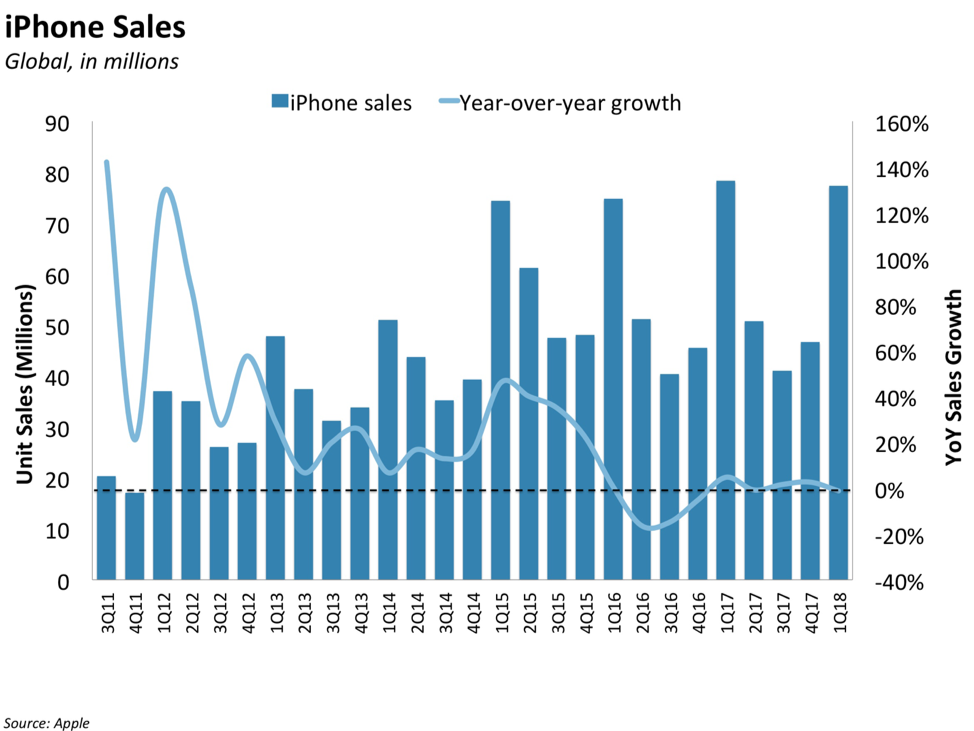

But it’s not a foregone conclusion that Apple’s installed base of iPhones is growing any longer. Remember, you have to drop off old layers with each year. As long as the new layers are bigger than the old layers, you’re ok. But is that true for Apple? And if it is, for how much longer?

But now iPhones from 2015 are going on four years old. That was the year the iPhone 6 was released and guess what significant event just happened? Apple just dropped the iPhone 6 from the upcoming iOS 13.

It’s a perfect storm for the iPhone installed base. There was a huge super cycle in 2015 when the larger screens came out and these iPhones will be obsolete in about a month. Apple is about to subtract the largest layer ever from their installed base financial models. And going forward, all the layers that Apple drops off will be as big if not bigger than the layers that they add.

And with the iPhone ASP being at its highest ever, it’s hard to see the installed base growing any more. I’m going to make the contention that Apple’s installed base of iPhones is going to start contracting. Which is no big deal if Apple remains more of a hardware focused company, because the iPhone gross margins have trended up over this same time period.

But for a services focused company, this is a big problem. Because the iPhone price has no relevance in how many $9.99 subscriptions you sell. Unless Apple reaches out heartily to Android users, Apple services has a shrinking market.

I’m still not convinced that Apple’s focus is all that gung-ho on services as many would have you believe. Surely, Apple has better insight into where this is all headed than I do. And they can see the big problems on the horizon with their installed base and customer saturation.

Apple services make the hardware a better product. And they offer a nice bump in sales revenue in the short-term. But selling Apple hardware is going to be a nice profitable business for many years to come even if they don’t expand into other areas. For the value stock investors, this is exactly where they want to be.

RSS Feed

RSS Feed