There’s no other way to describe Apple’s (AAPL) iPhone sales volume in Q1 other than they were great. The first wave of articles written about Apple’s earnings release all dwelled on the fact that iPhone sales volume was down year-over-year. However, the major fact about there being one less week in 2018 (13 vs 14) was relegated to a quick footnote.

This brings you to a restated Q1 2018 target of 72.7 million iPhones sold based on 13 weeks. Any internal target negotiations would have began at this 72.7 million starting point. The iPhone beat this revised target by over 4.6 million units to achieve sales of 77.3 million units. That’s amazing considering that the average selling price was UP over the Q1 2017 quarter.

In all of my years of observing large manufacturing companies, I’ve developed one hard and fast rule. Which is this. All things remaining equal, as prices go up, volume comes down. If a company wants to defy this rule, it needs to create additional perceived value. Which Apple appears to have successfully accomplished.

IPhone X Profitability

There was some conjecture, which I rejected, that the iPhone X was going to be much less profitable for Apple despite the higher price tag. The theory was that the iPhone X was so expensive to manufacture that even with the price increase Apple wasn’t going to to recoup all their additional costs. Apple doesn’t release gross margins by product line so it’s kind of hard to definitively say what happened.

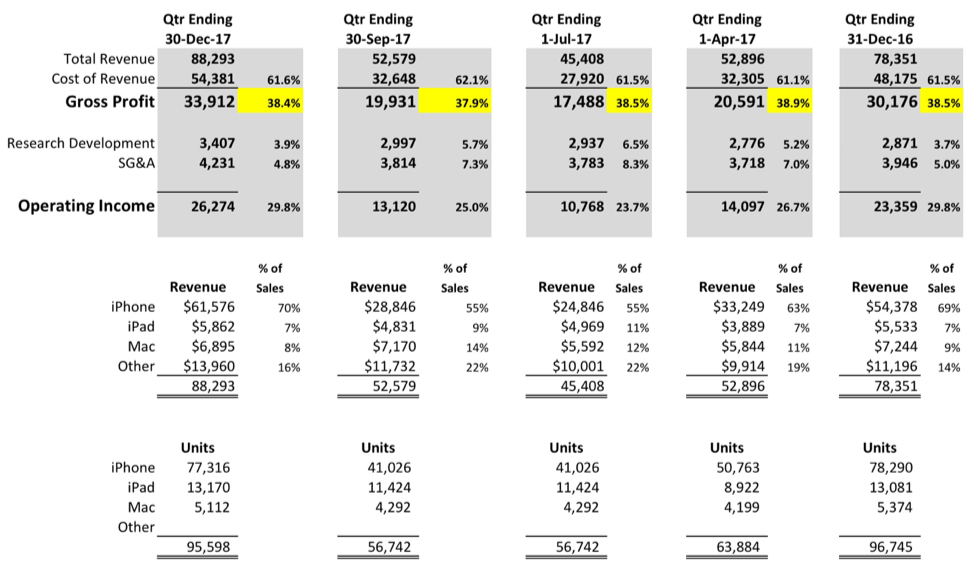

It looks to me like the iPhone X is just as profitable as any previous iPhone model if not more so. With a big increase in Apple Watch unit sales, any degradation in iPhone gross margins would have resulted in a much larger drop in gross margins. The iPhone made up 70% of Apple’s revenue mix this quarter so any hiccup would have been impossible to hide. Even if high margin services were up, it wouldn’t be enough to offset any downturn in iPhone margins. In fact, Services and the Apple Watch seem to cancel each other out. They’re both growing but impact the average margin in opposite ways.

Q2 Outlook

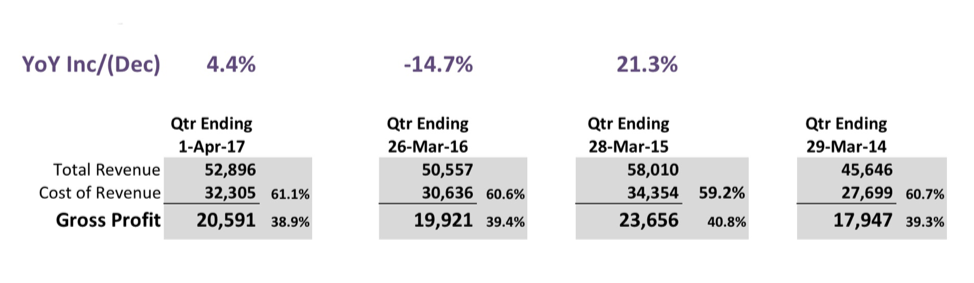

Even at Apple’s “reduced” Q2 guidance of $60-62 billion Apple is still looking at double digit growth year-over-year. Considering that is up from $52.9 billion in the same quarter in 2017 this actually a pretty healthy increase. Even if you take the lower end of Apple’s guidance of $60 billion that is still over a 14% increase YoY.

If you look at Apple’s previous Q2s to see what previous increases or decreases were like it puts the guidance into a much better light. Last year, Apple had only a 4.4% YoY revenue gain. The year before, it was actually a YoY decrease of -14.7% when compared to the iPhone 6 Super Cycle.

Now available in iBooks —> The Tesla Bubble

RSS Feed

RSS Feed