Tesla just announced their Model 3 and their supposed “pre-orders” have been pouring in like a cooler with a built-in blender. I put “pre-orders” in quotes because people aren’t actually paying for the vehicle like the word implies. They are simply putting down a small deposit that doesn’t obligate them in any way to follow through. At only a thousand dollars, you could spend more on a 13” iPad Pro. With electric cars from other large manufacturers coming available before the Model 3, it will be interesting to see how many of these potential customers are actually willing to wait years for a car that they know little about.

We are getting close to the perfect time to short Tesla stock. Tesla is getting all the positive press from unveiling a new product without any of the accompanying customer complaints, manufacturing issues, or massive negative profit margins. My guess is that the stock will peak somewhere around the time that the Model 3 first delivers and then will go on a downward slide after they start reporting their earnings and volume tails off.

So what downside could there possibly be from a larger influx of deposits? The real danger for Tesla is over-building their manufacturing capacity. This is a very delicate balance that most companies with new products fail to do accurately. Only most companies, unlike Tesla, aren't perpetually losing money and burning through their cash reserves. They can afford to take risks. Tesla can’t.

Companies generally take a conservative approach to investing in machinery and equipment for new product lines. They figure they should minimize their risk. If you spend too much in capital, that product line will bleed red ink in perpetuity until it’s killed off. If you spend too little you will not be able to fulfill sales orders and end up with less revenue than you otherwise could have had. Having too little capacity can hurt you, but having too much can kill you. So underestimating demand is the lesser of both evils.

Sales vs Operations

There can often be a battle between the Sales VP and the Operations VP when deciding what the capacity needs to be. The Sales group is measured on volume, and they come to this battle fully loaded to die on the hill of maximum investment. The operations guys are measured on efficiency and cost per unit. Having too much capacity is like making car payments on a vehicle that you never drive. Those expenses get spread over every unit that you do sell and will make your cost per unit higher than the competition. And the Ops guys will look like they don’t know what the heck they’re doing. They’re the ones who get stuck paying the tab on excess capacity by suffering the massive depreciation charges.

It’s up to the CEO to mediate between the sales and operations groups. If either group gets too much power in relation to the other, the results can be disastrous. If a CEO rises from the ranks of the sales group, he tends to be sympathetic to a build-it-and-they-will come mentality. If he comes from the ranks of the operations group, he tends to be very cautious with investments and keeps one eye on margins at all times.

So where does Elon Musk fall in this spectrum? Is he going to side with Sales or Operations? The Sales group is loaded with ammo now that they have over 300,000 deposits on record. They will push hard for Tesla to damn the torpedoes and build as much capacity as possible to fulfill these orders before the potential customers defect to GM. However, if Tesla invests in enough capacity to build 200,000 cars a year, and after the initial rush, orders settle in at 50,000 orders per year, it’ll be lights out for Tesla. Their losses will widen exponentially, and they will fall victim to what generally kills most new businesses--over estimating market demand and spending too much on capital.

In the face of a mountain of deposits, the operations and accounting guys have a tough job advocating for a conservative approach to investment. Tesla needs to invest for whatever level of on-going annual unit sales that they really think they can deliver. Making the deposits so small and fully refundable simply muddies the water and makes the job of forecasting even more difficult.

Real-World Numbers

Trying to discern what the annual volume is going to be after the initial rush is already a tough job. Everyone knows that volume will settle down after the true believers are through the line. But adding the variable of a huge number of deposits that won’t ever be sales materialized? That was lunacy. The deposit should have been higher, and it should have been non-refundable. This would have given the sales analysts more of an idea of how many cars would need to delivered. A solid sales forecast should be Tesla’s top priority right now.

GM sells about 500,000 Chevy Silverado pickup trucks per year. This is a vehicle which blankets every city and town in America, and in many driveways there are multiple Silverados sitting side-by-side. I think it’s safe to say that the Model 3 won’t get anywhere near the annual volume of the Silverado. But if Tesla Motors thinks that they can sustain six-figure unit sales of the Model 3 on an ongoing basis and invests the capital to do it, they are doomed.

Now it’s up to Elon to side with the operations guys and resist the strong pull of hubris. Is he up to the job? He’s shown poor judgement recently with siding with the sales group and giving the green light for those ridiculous gull wing doors on the Model X. I guarantee the operations group was totally against that option when they realized how difficult it would be to manufacture. He’s also sided with the sales guys when they wanted to make the deposit as low as possible and make it fully refundable. If they overbuild their manufacturing capacity because of this decision, it will have caused more harm than good.

When GM decided to “build a new kind of car company” and setup a wholly independent company within a company, the industry watchers were skeptical. As analysts predicted Saturn’s eventual demise, the rabid fan base gleefully pointed out that all the prediction’s of its collapse were wrong every year. Until they were right. I’m getting a strong sense of déjà vu as Tesla burns through cash and losses mount, yet the Tesla faithful seem to think it’s irrelevant. The Tesla believers have this almost religious belief that eventually the masses will see the light and come to appreciate their overpriced and mediocre cars. Well, that’s what the fan base for every defunct company thinks right up until the doors close.

Tesla must be underestimating the cost of the Model 3

At first glance, how is Tesla making the Model 3 cost that much less than the Model S? I’ve worked in the automotive components industry as a manufacturing analyst, and this I know. Every penny of cost is a battle. I remember Toyota sending in a contingent of engineers because they believed that a part which we sold to them for $.175 could possible be reduced by a full penny.

The more parts you have, the more opportunity you have to nickel and dime your costs down. But Tesla doesn’t have a lot of areas to go to whittle their costs down from a large sedan to a small one. That’s why traditional car makers have always lost money on their small cars. Customers expect lower prices on the little cars but their complexity isn’t all that different from the large ones. Even today, if it wasn’t for pickup trucks and SUVs, most auto makers couldn’t afford to sell their compact cars as a main product line. Compact cars only work as a small subset of a much larger product portfolio.

For Tesla Motors to sell a vehicle like the Model 3 at less than half the cost of the Model S is perplexing to me. They were already losing money on the more expensive Model S. Their losses could explode once the Model 3 is offered for sale even if they do reach the volumes that they want. And unlike Ford or GM, Tesla isn’t wanting to just offer a small car--they want to make it their primary product line. To achieve their cost targets on this car, it will need to be the biggest seller by far. It will dwarf the combined unit sales of the Model X and Model S.

Case Study: The Camaro

To illustrate just how hard it is to compete in the lower level price range consider the Camaro. This is a model that has similarities to Tesla in that it has an intensely loyal fan base and was intended to bring something greater to the masses. Why should only rich people with the means to buy Porsches and Corvettes have all the fun? The fan base for the Camaro has always been absolutely in love with the car, and the amount of clubs, publications, aftermarket support is unrivaled by anything else except for maybe the Mustang.

But the problem that GM has always faced was how to give the masses the performance that they desired at a relatively low price. GM killed the Camaro/Firebird, aka the F-Body because they were only selling about 85,000 units per year. I say “only” because the Mazdas of the world could only dream of having volume this large for a single platform.

But GM killed the F-Body because at 85K units per year this stand-alone platform didn’t make financial sense at its low price point. It was ultimately reborn as more of a world car that shared platforms and components with other product lines. That’s the only way to offer a better car at near economy-car prices.

But Tesla doesn’t have a subsidiary in Australia to share platform costs with. Nor do they have a mass market pickup truck to help pay for power train costs. So how on Earth are they reducing the cost of the Model 3 down to $35,000? Either the Model 3 is headed for massive losses due to being underpriced or the average selling price with options will be closer to $65,000 per car. Both scenarios spell doom for Tesla. The ship that is Tesla is already taking on water and more losses will sink it. If the cost of the Model 3 is closer to $65,000 and the annual sales volume falls below 100,000 units, they won’t be able to sustain the heavy fixed costs that they signed up for.

Is Collapse Imminent?

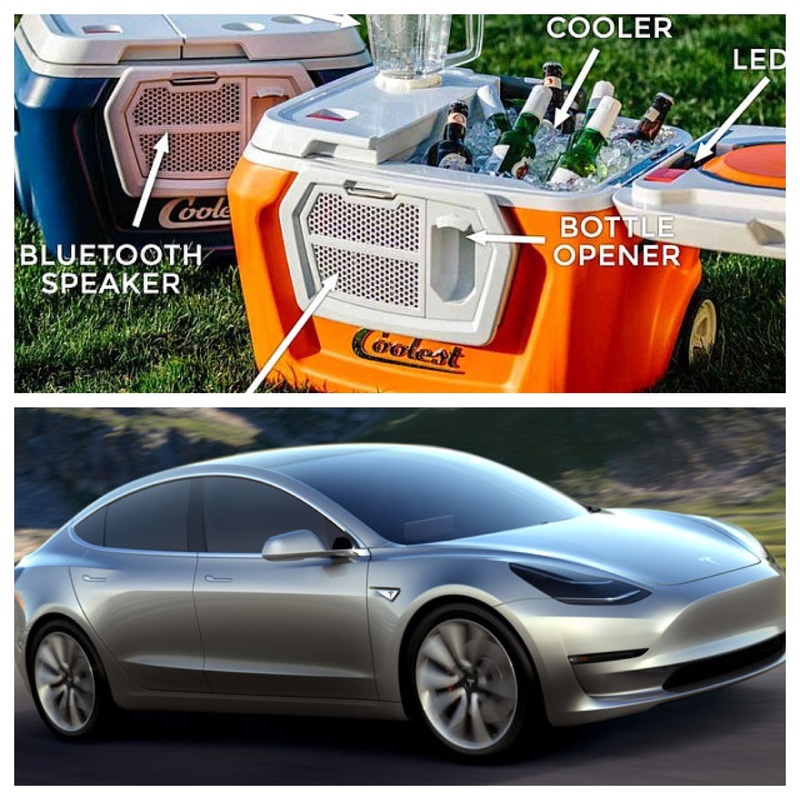

Like the Coolest Cooler, Elon Musk is making promises that he can’t keep. He won’t be able to deliver products to his customers on a timely basis without jeopardizing his company’s existence He’s also advertising a price that he can’t honor. He knows this to be true. The real audience in this kabuki theatre are the investors and potential buyers for the company. Those are the real fish that Elon is after. Outside of more infusions of cash from investors and someone bailing out the company through a purchase, I don’t see a viable path for Tesla Motors.

I feel like the guy in the movie “The Big Short” who predicted the imminent collapse of the housing bubble. I can see this train wreck coming in the future, but everyone else is oblivious. They won’t take a detailed look at the underlying numbers because they don’t understand it or they really don’t want to know.

RSS Feed

RSS Feed