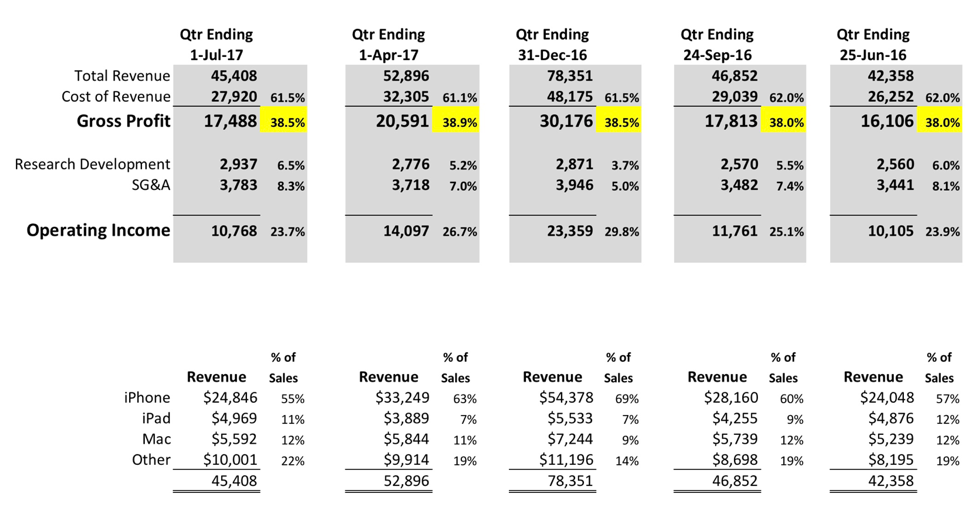

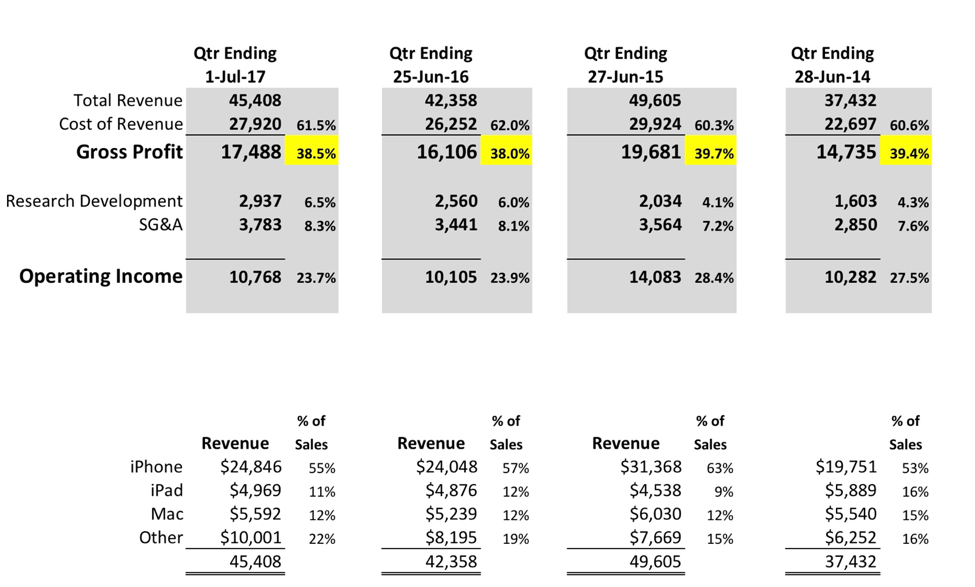

If you do this with Apple, you see a few things that stand out. Their product mix is skewing more profitable. Apple is in a tough business where electronic hardware is perpetually in danger of being commoditized. Many analysts wonder if Apple can retain their premium design edge and avoid the “race to the bottom”. Not only are they retaining their famously fat margins, they’ve increased them. And it’s not all due to the iPhone either.

Now comparing the more recent Q3 to last year’s Q3 (25-Jun-16), you see gross margins are up a half point with the iOS duo of iPhone and iPad being down from 69% of the revenue to 67% of the revenue. Some of this could be due to the small price increase on the iPhone 7 Plus. Macs are also more expensive. But if you look at the biggest change in product mix, the addition of the services pops out. I combine services into “Other”, but it is the biggest gainer when compared to last year, $5,976 to $7,266.

So, Apple Music could be more lucrative than I have given it credit for. Although, in my defense, this is the kind of thing that becomes more profitable only after you cross a certain threshold. There are a lot of fixed costs up front that need to be covered, but after you get past a certain volume, it’s all gravy. This figures differently than hardware, where going up in volume always means more material, labor, or maybe even more capital.

Gross margins are up, but Apple’s overall profitability is not. Both R&D and SG&A are up, bringing operating income down when compared to last year. SG&A is mainly two things, the cost of the retail stores and the cost of the corporate headquarters. You can’t blame this uptick on the new Apple campus though, because those costs are being capitalized on the balance sheet and will be allocated back in the future after it is complete.

Proper context also demands that you keep seasonality in mind, especially for a company like Apple that tends to have dramatic swings at different times of the year. I always find it funny at my own company how some people are surprised every year when profitability dips in the summer, which it does every summer due to the change in our product mix. That is why it is helpful to compare a quarter to the same quarter in previous years.

I know I have a lot of journalists that read this blog. So if one of you would pick up this format for reporting Apple’s quarterly results I’d appreciate it. I’d love to immediately see the full picture by reading one of your articles as opposed to having to first open up my spreadsheet and loading the numbers.

Now available on iBooks —> The Tesla Bubble

RSS Feed

RSS Feed