But we do know that outside of material costs they have all the usual costs of production, distribution, and administration. They have to pay for factories full of employees to assemble their parts, shipment of products to customers, and they have to allocate all those corporate salaries among every product sold etc.

What Apple will do is divide all their costs into two main buckets. The first is costs which are directly traceable to the products. That would be the material, labor, and factory overhead to produce an iPad. Material is the easiest and that is why you see internet articles only about this segment. Because you can obviously break open an iPad and see what is inside. Labor is fairly simple too because Apple knows how much time goes into each iPad and what that hourly rate is. Overhead is a little harder because you are now allocating the electric bill and plant manager’s salary for the month over every item produced. That can be more of an art than a science at times. These are the “costs of goods sold”.

The next bucket are corporate costs which need to be shouldered by all the products. The advertising budget, cost of building a new spaceship, or Johnny Ive’s skunk works design team have nothing to do with building an iPad Air 2. Yet, it is the sale of those iPads and iPhones which pay the bills. So all those oddball corporate charges get allocated to each iPad, Macbook, or iPhone sold as Selling, General, & Administrative (SG&A) or Research and Development (R&D).

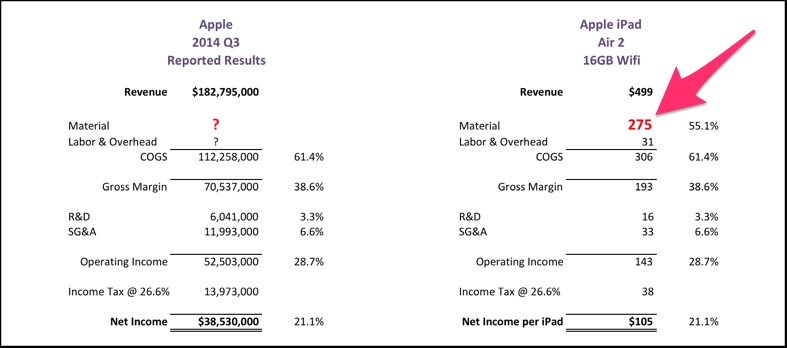

Out of curiousity, I decided to take Apple’s reported percentages for the company as a whole and apply it specifically to an iPad Air 2 and see just how much money was left on the other end. My gut tells me that it is probably fairly close, but I don’t know. The overall numbers reported by Apple would be skewed towards their largest product category, the iPhone, which would have better margins due to greater economies of scale and lower distribution costs. Yet, that could be offset by potentially lower margins on Macbooks or iTunes downloads.

The final result came to $105 of profit per iPad after taxes. Which strikes me as about right. That means it would be impossible for Apple to sell an iPad for less than $394 per unit without losing money.

Which begs the question, how can other manufacturers charge less or close to what is Apple’s material cost only? You can’t quickly dismiss Apple’s selling price as simply the “Apple Tax”. Because if you remove $105 for profit and $49 to fund R&D and pay for any corporate largesse, you still end up with a manufactured cost of $306 per unit. And other manufacturers are going to have similar labor costs and most likely HIGHER overhead costs due to lower volume. That leaves us with either cheaper material or negative margins.

I think it all boils down to “you get what you pay for”.

RSS Feed

RSS Feed