Apple doesn’t report profit margins for individual product lines, so you have to glean information from various “events”. When Apple launches new products like the iPhone 6 Plus or the Apple Watch, you can get a clue as to what margins are like based on how the overall average moves. When the 6 Plus was launched, margins were way up. When the Apple Watch was launched, margins were down a bit.

You also can get a clue based on how the average margins move when volume is taken away. And what do we find this quarter? All hardware except for the iPad was way down, and services were way up. Services as a percent of the revenue mix was up from 10.1% last year to 14.1% this year, and margins tanked. I highly doubt that margins for Apple’s services are anywhere near what they are for hardware. So excuse me if I’m not that thrilled that service revenue is way up compared to a year ago.

But gross margins are probably not down only because of mix changes. A big part of the problem could also be fixed overhead absorption. For a highly automated company like Apple, they probably spend way more on equipment and machinery depreciation charges than they do for labor. This is great when volume is up, but it’ll boomerang on you when volume is down. It’s like a group of four sharing the rent when one roommate decides to move out. Everyone else pays a larger share.

Apple invested in a lot of machinery to get that iPhone 6s launched in multiple countries all at once. When sales go down, they’re still left paying the monthly bill. No amount of scale will ever let you circumvent the law of fixed charges. In fact, the bigger you are, the more severe the swings.

Samsung

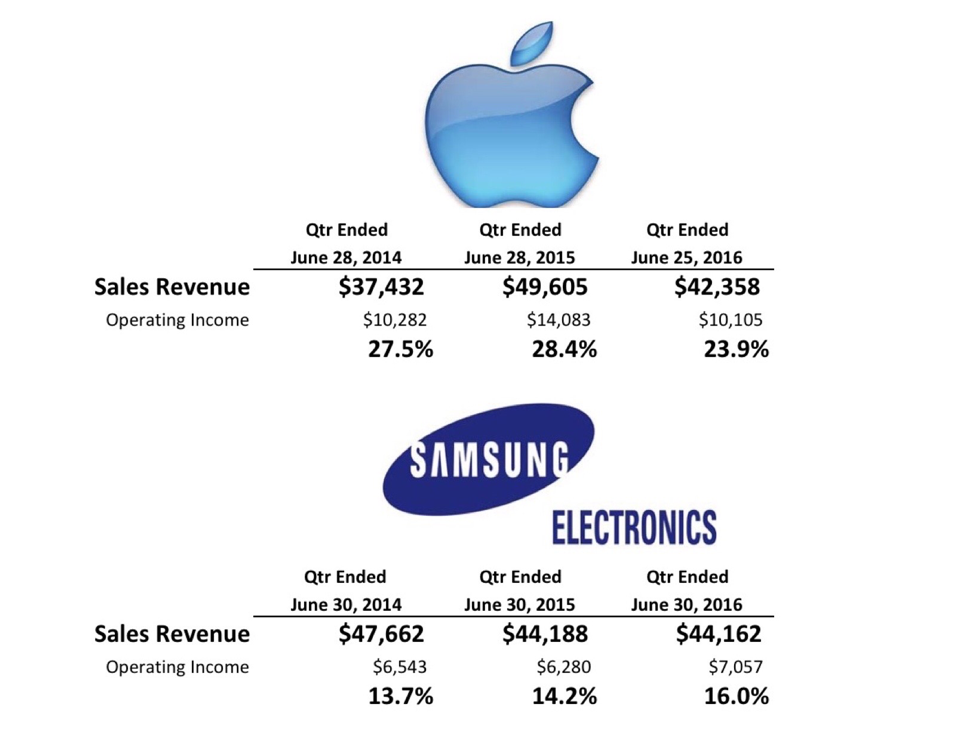

Samsung just announced their Q2 earnings (the same period as Apple’s Q3), and they’re already getting accolades in the press because their profitability is way up. It’s still way below Apple’s “bad” quarter, but hey, everything is relative. However, it looks to me like the latest quarter is the result of a gradual shift in philosophy at Samsung that started over two years ago. This wasn’t some kind of sharp turnaround.

Samsung announced a while ago that they were going to cull their product offerings and get rid of the low volume dogs. They’ve also reduced their marketing and promotional costs. They are now making more money on less sales revenue. Imagine that. They are focusing on higher volume products that bring in higher margins. The days of Samsung bringing anything that they can think of to market are over. They will be more selective from here on out.

It looks like Samsung is still copying Apple.

RSS Feed

RSS Feed