What Does Video-Streaming Success Look Like?

What would success in the video-streaming arena look like? By all measures, it would look like Netflix. Netflix had first-mover advantage, and you can find the Netflix service available on almost any piece of video hardware. In fact, Netflix is so dominant, that on a list of the most-streamed TV shows of 2018, the top 5 were all from Netflix.

When speaking about the state of on-demand media, most analysts say the race for video services is not to replace Netflix but to be that 2ndor 3rdservice that people are willing to pay for in addition to Netflix. Netflix is so entrenched that it’s hard to see anyone this late in the game knocking them off of that pedestal.

For the purposes of my analysis, I assumed that Apple would become the new Netflix. This way, no one can say that I shortchanged the prospects of potential streaming video revenue. But in reality, Apple is unlikely to achieve the same level of widespread usage Netflix has. Apple doesn’t invest as much money to acquire content as Netflix does, nor will they ever have as many distribution points.

But if Apple could achieve Netflix-like success, what would that look like? Everyone who crows about Apple’s new love for services steers clear of talking about real money. How much opportunity is really there for Apple to pick up new revenue by selling media content?

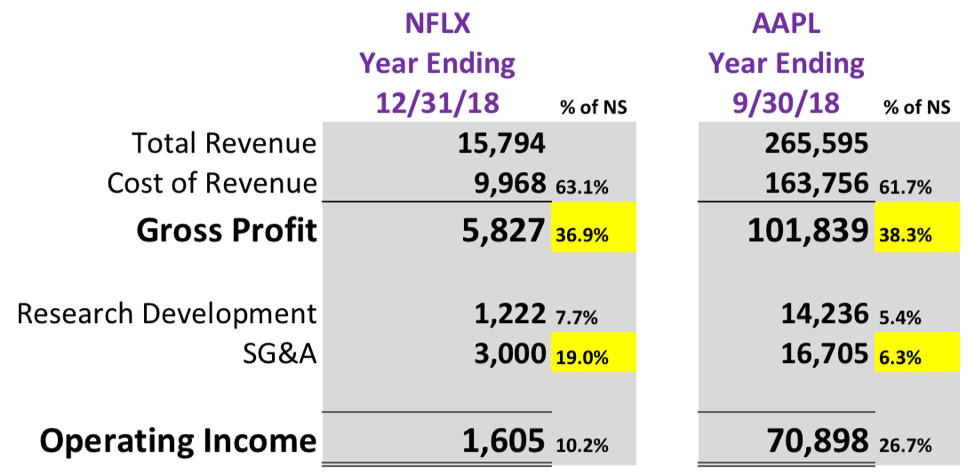

Gross margins are encouraging though. Netflix is in Apple territory with a healthy gross margin of 36.9%. This is how much gross profit there is in video streaming after you subtract the cost of acquiring shows from the monthly subscription fees. Netflix famously drops billions of dollars at a time to purchase new content. Yet, they still maintain healthy gross margins.

But SG&A (selling, general, & administrative costs) is another story. Apple’s SG&A is much lower than what Netflix spends, surprising when you consider that all the costs for Apple’s bricks-and-mortar retail empire go into SG&A. And yet, on a percentage basis, Netflix’s SG&A dwarfs Apple’s at over double the rate. Many people have the mistaken notion that services are cheaper and easier to maintain than hardware, which is not necessarily true. I wonder what kind of selling and marketing costs Netflix incurs? Whatever they are, they’re huge.

Quantifying Apple’s Options

It’s no secret that Apple has been investing billions of dollars with the best names in the business to produce new media content. But the question has always been how will they monetize this? Apple can either go after a pure media-streaming business model like Netflix or use this as a weapon to poach Android market share.

I’ve made my case that Apple should use this original media content to steal Android market share. Digital media content is one thing that can never be duplicated by your competition. And it is one thing that has proven to change people’s notoriously stubborn buying habits. But as of late, Apple is showing signs of opening up their media to all platforms and sacrificing hardware revenue in return for service revenue. Why?

If Apple could convert only 1.7% of that Android market share to new iPhone users, that would translate to an estimated $19 billion in additional revenue. That is over 20% more revenue than if Apple could replace Netflix as the new dominant streaming service in the world. Advantage: hardware

So, it only takes a pickup of 1.7 points from Android to handily beat what is considered spectacular success in the media-streaming business. Why did I pick 1.7% as my data point? Because I assumed that Apple would only go after the premium side of the Android business. My numbers assume that the premium Android market is one-third of the total Android market share and that Apple can take a modest 5% of that.

Of course, stealing 1.7% of the Android market share is my low-end estimate. If I do a typical low, middle, and high analysis, the numbers only get worse for Apple pursuing a services-first strategy. Any way you slice it, there is far more opportunity with Apple pursuing more hardware sales rather than services revenue.

And I’m not even taking into account the potential lost hardware revenue from people feeling like they no longer need to buy Apple hardware, what I like to think of as the “Mac cloning” effect. If Apple services are more widely available on Amazon or Android, there could potentially be a decrease in future iPhone sales. And for certain, Apple’s HomePod and Apple TV will take a hit. I would think that at this point, Apple would consider killing these products. They are essentially moribund now that they’ve been neutered by Amazon and Samsung.

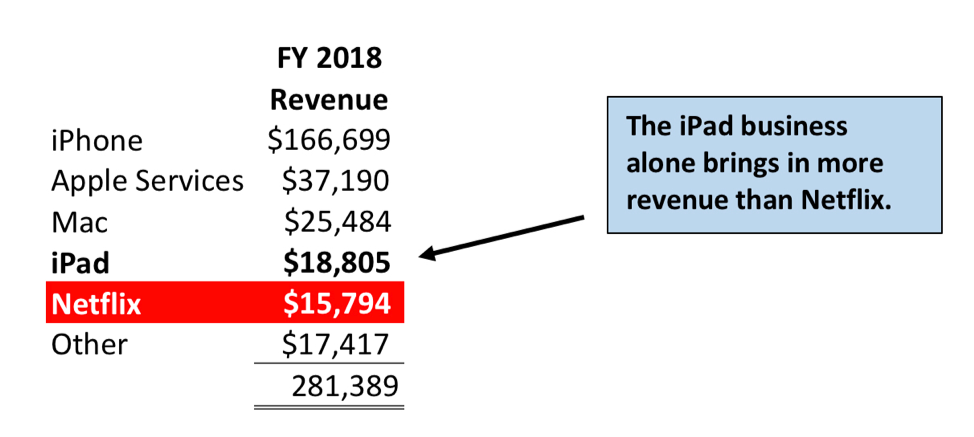

I fail to see the allure of Apple opening up their services to other platforms in exchange for a paltry $15-billion opportunity. In fact for 2018, the iPad business alone raked in almost 20% more revenue than all of Netflix. The iPad business! How many analysts speak derisively about the “stale iPad business” only to wax poetic about Apple’s exciting new services opportunity? Do these guys even know how to use a spreadsheet? I think they’re just excited about having something new to write about.

Most of the speculation on what Apple might do with their upcoming video content has centered on two extreme scenarios. One side which I’ve advocated for is to keep all content exclusive to iOS in order to steal market share. The other side is to open up everything and go “all in” on services revenue.

Judging by the moves that Apple has made with Amazon and television manufacturers, I don’t think they’re going to stick to an all–Apple-centric model any more. But judging by my financial modeling, I also don’t think there is a big enough opportunity for Apple to start thinking like a services-first company.

It appears that the future may lie somewhere between the two extreme scenarios. Apple may try to harness the best of both worlds: they are opening up their services more widely, but they are still keeping some major advantages exclusive to iOS. This will not be an easy road to follow, and it appears to have more risk than reward.

RSS Feed

RSS Feed