First, comparing Spotify to Netflix is like equating ComCast to Disney. There’s a big difference between those who create original content and those who are simply a dumb pipe. Comparing Netflix to Spotify is a bad comparison, but Neil bases his entire thesis on it. I agree with Neil that purchasing Spotify simply to take the lead in music streaming would have been a mistake. But unlike Spotify, Netflix isn’t just about distribution.

Netflix has crossed over into the magical realm of being able to reliably crank out appealing original content. Don’t underestimate how hard that is to do. Some studios can do one or two projects at a time, but to create a system and infrastructure that rivals a network which is producing lots of original content concurrently is amazing. It’s the difference between someone who can cook a good meal in their own kitchen versus someone who can run a five-star restaurant.

Apple Doesn’t Need to Buy Streaming Revenue

I agree with Neil on this point. Paying $60 billion to acquire a revenue stream that brings in $185 million in net income per year makes absolutely no financial sense. This is also why there are very few good candidates to buy Netflix. If you buy Netflix, you need to bank on the fact that its original content will help you sell something else entirely apart from streaming videos. Something with very high margins. This is why Netflix is such a good fit for Apple. When you have a device with only 20% global market share that is raking in nearly 40% gross margins, it doesn’t take a huge increase in sales to justify what most people think is out of reach.

Apple doesn’t need to buy a paltry service revenue stream, but they do need help cracking their global smartphone market share ceiling past 20%. This is where the real money is. The great smartphone land grab is over. Almost everyone has made their choice on a smartphone ecosystem, so now both Android and iOS are going to shift their sights, trying to entice people to switch. And unlike Android, iOS has proven to be very, very sticky. Anything that convinces people to drop Android for iOS is worth its weight in gold.

Apple Was “Purchasing” Jimmy Iovine, Not Beats

Neil makes the case that instead of buying a dumb music streamer that Apple went after Beats to acquire Jimmy Iovine’s vision and connections with the music industry. In essence, they valued in-house talent over simple distribution. But there would be a similar parallel with purchasing Netflix.

Apple already has a vision for video. They don’t need someone else’s fresh ideas. What they are missing is the content. It’s already rumored that Apple has a vision of offering a low-cost alternative to the cable companies. Why? Two reasons. First, because their customers hate dealing with the cable companies. And second, Apple makes money by removing friction from their customers getting their content. So what is Apple to do if the various networks refuse to play ball with them on any kind of video distribution? The only alternative is to do what Netflix did and produce your own.

Jimmy Iovine’s music connections are valuable in an environment where the content creators are willing to allow Apple to be their distributor. But the video realm is different, and if the content creators are resistant to letting Apple be the distributor, there needs to be different plan of attack. Acquiring Reed Hastings, CEO of Netflix, through an acquisition would be the logical adjustment. But Apple would still be pursuing the same goal as they did with Jimmy Iovine. That would be getting its hand on original content that people are willing to pay for by the millions.

Apple doesn’t need a relatively small $185 million in annual streaming profits. What they do need is someone who can oversee the system of content acquisition and creation. Reed Hastings and his management team have set the gold standard for the video business and have challenged the networks like no one else in the world has been able to do. Further, with their exclusive access to a growing mountain of data on viewer habits, they are getting even better. Netflix has an enormous data analytics advantage over Apple which allows them to single out potential hits from a sea of potential content with uncanny success.

$60 billion is a huge premium to pay for video content when there are cheaper options. But that’s the price you pay for a management team with a proven track record of success that can go on to be a self-sustaining division. Smaller studios are cheaper because they’ve had less success and are much more risky. They haven’t mastered the art of scale, and they may not even be around for the long haul.

Sure you can buy or work with a bunch of small studios, but who is going to manage all that? That would be like building a house and still being your own general contractor. Apple would need to spend a great deal of time and effort working with their band of small studios.

Apple’s current executive management team is all tapped out. They can barely manage their current product portfolio. What they need to do is buy a management team that can take on this mission with a reasonable expectation of success. This is why small studios would be a much harder route to take. Plus, that is going to take a lot more time. Purchasing Netflix gets you a two-year head start. One well-oiled machine like Netflix is going to be much more efficient than assembling and cultivating a disparate band of studios.

Apple needs a five-star restaurant, not a bunch of high-maintenance gourmet cooks.

Apple Music Is 20% Netflix’s Size with No Video

Neil is missing the point that purchasing Netflix wouldn’t be about growing service revenue. It’s about boosting hardware sales. Apple Music could have twice the subscribers of Netflix, and it wouldn’t change the rationale for purchasing Netflix.

That’s because Apple Music doesn’t offer much that you can’t get anywhere else. Apple Music doesn’t move the needle when it comes to getting people to switch smartphone platforms. It simply removes the friction for their current customers in accessing the music that they love. That is still a worthy purpose, but Apple Music was more a defensive play in replacing declining music download revenue. It was never meant to be an offensive move against the competition.

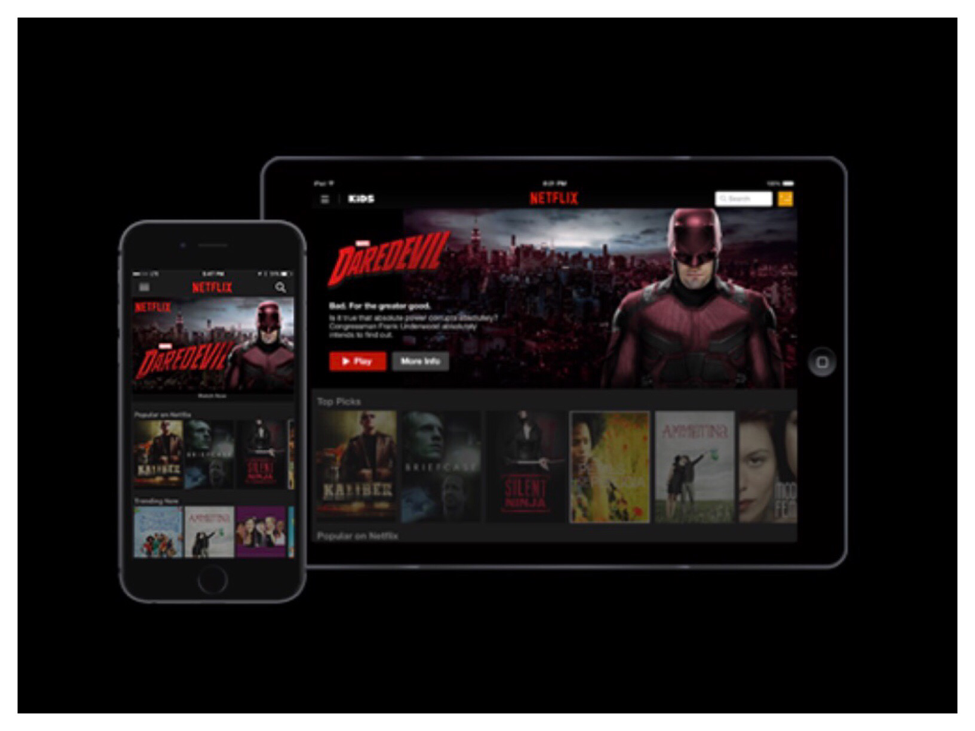

Neil equates Netflix to Spotify as being just a dumb pipe for other people’s content. He doesn’t see how it fits with Apple’s vision. But Apple’s vision is about their devices becoming invisible to the user. People buy Apple devices to speak with their mother, create things, or watch movies. People don’t buy a new iPad because the camera has 12 megapixels or the RAM is up to 2GB. They are buying a little piece of mind on a hectic business trip when they can relax on a long plane flight with their favorite TV series. This is why Apple wants to get a low-cost TV package off the ground. It would make the user experience simpler and easier.

The Sixty-Billion-Dollar Question

To me the question isn’t whether Netflix makes sense for Apple. The real question is whether Netflix is worth $60 billion. Netflix brings a host of benefits, but do they outweigh the cost?

I deal with corporate vice presidents all the time who are asking me to consider a huge investment in order to attack some new product niche. Before I do a lot of analysis, I find it’s often helpful to provide them with a quick break-even point that illustrates the volume required to make their idea work. A lot of the time this will kill any further discussions when he or she realizes that the cost outweighs the benefit.

If I was a finance guy at Apple advising on the Netflix purchase, I’d tell them what I always say. I can’t make that decision for you, but I can tell you what the breakeven point is. It’s up to you marketing and sales guys to decide if that’s a reasonable goal to surpass.

The Breakeven Point

Even if Apple were to pay cash for Netflix, which they easily could, they aren’t going to report it on their income statement all at once. It would be amortized over many years. Just like when you are mulling over whether you can afford a house. You don’t divide the full cost of the house by twelve to come up with your monthly payment. Sometimes large capital purchases aren’t so daunting when you look at the annual numbers on paper.

My rationale involves making Netflix exclusive to iOS. So when I did my cost model, I assumed that Netflix revenue will implode and that they will lose 50% of their subscribers. But the financial case behind increasing hardware sales is so strong that Netflix revenue could plummet to zero and it wouldn’t change the numbers too much. I also assumed that they wouldn’t get any cost synergies from an Apple purchase and left their COGS and SG&A at full amounts.

The bottom line is that Apple would need a 13.4% increase in iPhone unit sales to break even. At any less, it doesn’t make financial sense. This would be equivalent to about a 2.7-point increase in global market share.

In Summary

I think exclusive content could propel Apple from 20% global market share to 30% or more. This is a big vision with big rewards and not for the faint of heart. But if Apple were to get to 30%, that would amount to an additional $15 billion per year in net profits. That’s a 33% increase over where they are today. It’s hard to imagine any other way that Apple could do that.

Neil is correct that going after small studios as opposed to the big flashy acquisition is more Apple's style. But in this case, that would be a mistake. It's time for Apple to get out of their comfort zone and try something new. Big rewards come with big risk. Small risk yields small rewards. Apple could go the small studio route and be very successful. But they’ll be just another video provider in a sea of offerings, and people won’t change smartphone platforms to get it.

So, could Apple reap more than a 13.4 increase in iPhone sales if they bought Netflix and made it exclusive to Apple devices? Obviously, I think that Apple could easily do that and more. There are few things more powerful than exclusive content when it comes to enticing people to switch platforms. Just ask Howard Stern.

Related:

Apple's Media Aspirations

Content Is King

Media Content vs Machine Learning – What Would Sell More iPhones?

RSS Feed

RSS Feed