|

Tesla’s standoff with local authorities over whether they would shut down operations is only the latest example of their cavalier attitude towards authority. Tesla has also ignored autopilot safety recommendations from the NHTSA which were made after two previous fatal auto accidents. It also appears that Musk continues to ignore an SEC ruling that he is prohibited from tweeting information that is of a material nature towards earnings without being approved first by the board of directors. Local authorities from all over the country continue to petition Tesla for access to information on Tesla servers that could help them investigate auto accidents. All ignored by Tesla.

A big thanks to @CoverDrive12 for retweeting the following hilarious advertisement for a lemon Tesla Model X for sale in Norway. That is one ticked-off owner.

Writing for MarketWatch, Paris Kellermann summarizes how the famous mathematician Nassim Nicholas Taleb slammed Elon Musk. Taleb was the author of the book “The Black Swan” which foreshadowed the 2008 global financial crisis. Here is some of what he had to say:

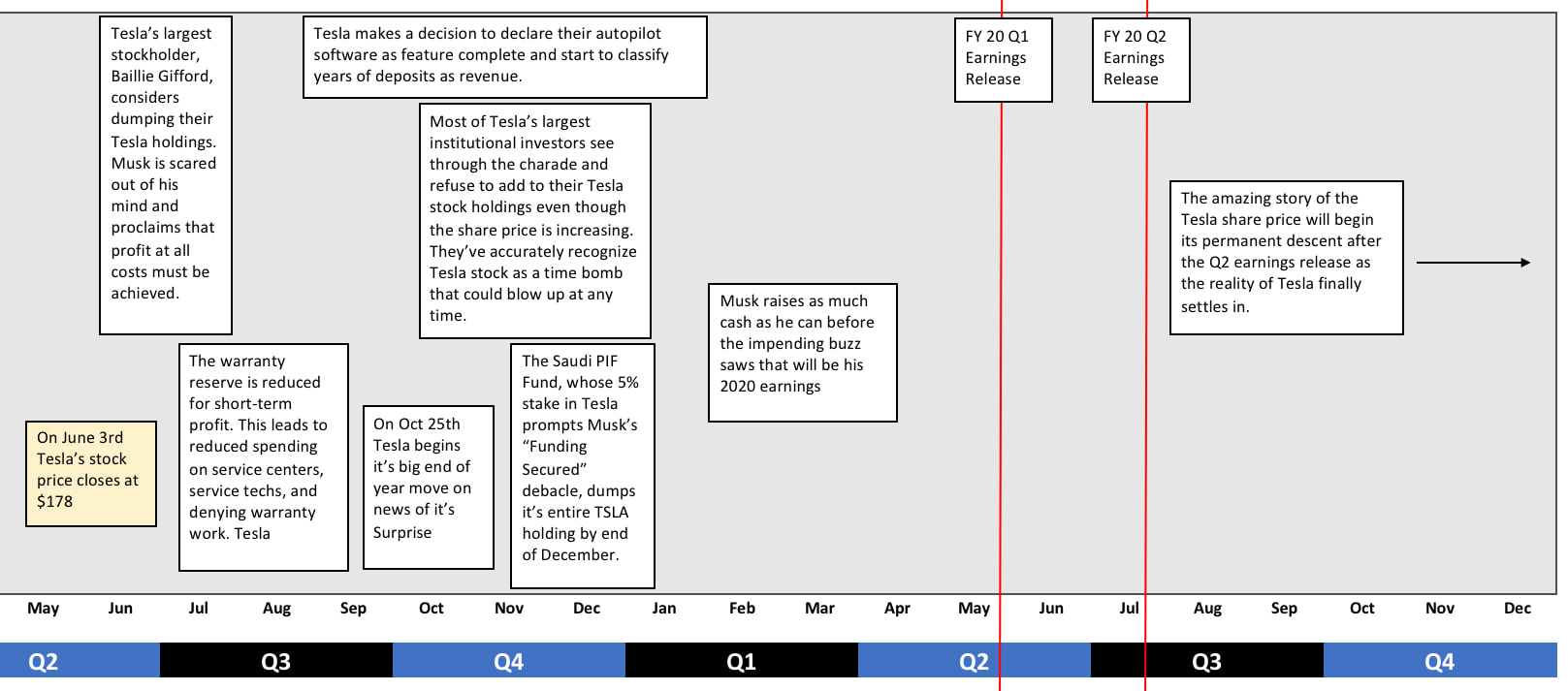

The most amazing thing about the rise in Tesla’s s stock is the fortuitous timing. Less than a year ago, after a horrific Q1 earnings release, Tesla had fallen to $176 per share. Their largest stockholder, Baillie Gifford, has now admitted that they were considering eliminating their stake in Tesla around that time. This would have been “Game Over” for Musk if this had happened. Because Musk is up to his eyeballs in loans to the bank which would have come due if the stock price cratered even further.

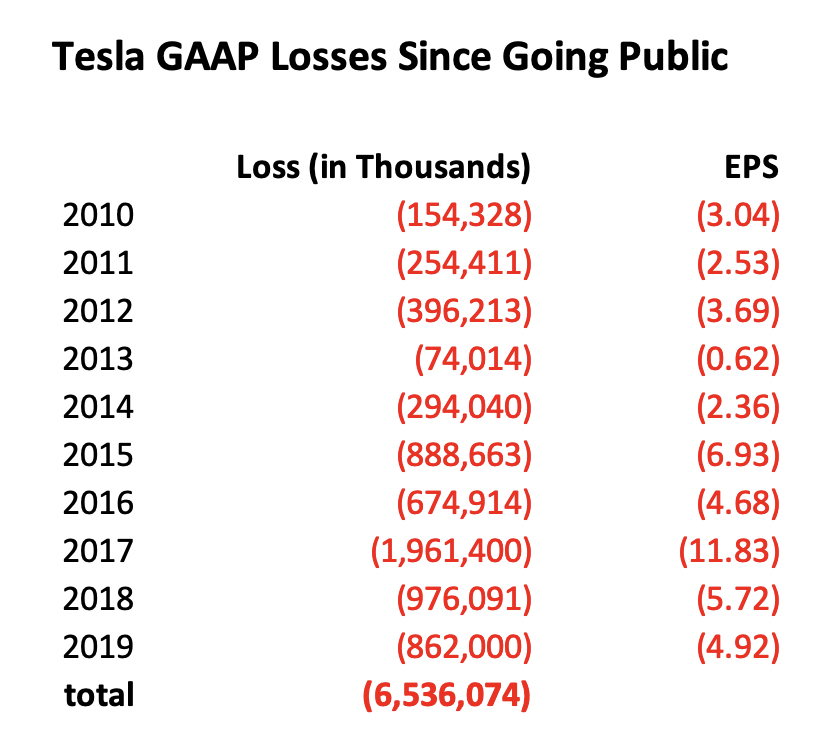

When this bubble pops, it’s gonna be a doozy. The problem with Tesla is that they show no signs of ever learning how build cars profitably. Look at their annual losses since they went public. Did they improve over the previous year? Actually, no.

Profit Is Down On Greater Subsidies and Unit Deliveries Ha! Tesla just reported their latest quarterly financial results and the company’s financial position continues to deteriorate. I stand by my prediction, this stock will be under $170 per share by November of 2020.

The most intelligent analysis regarding Tesla’s financial position seems to be done by those who think the company is on the road to oblivion. As opposed to the Tesla Bulls which seem to have almost blind faith that somehow Elon will figure it out.

Why Tesla Is Suddenly the Most Shorted Stock Again Anton Wahlman has a brilliant article which highlights what I’ve been saying about Tesla. This company is in a deteriorating position. When you look at the equivalent of “Same store sales”, the growth is over.

I’m watching the inflation of the great Tesla stock bubble with great amusement. I never dabble in the stocks which I write about so I can afford to spectate with anticipation of the grand finale. The higher it goes, the more compelling will be the story of its downfall. It’ll make for a great book one day. How did Tesla’s stock get to this point and who was driving the big deception?

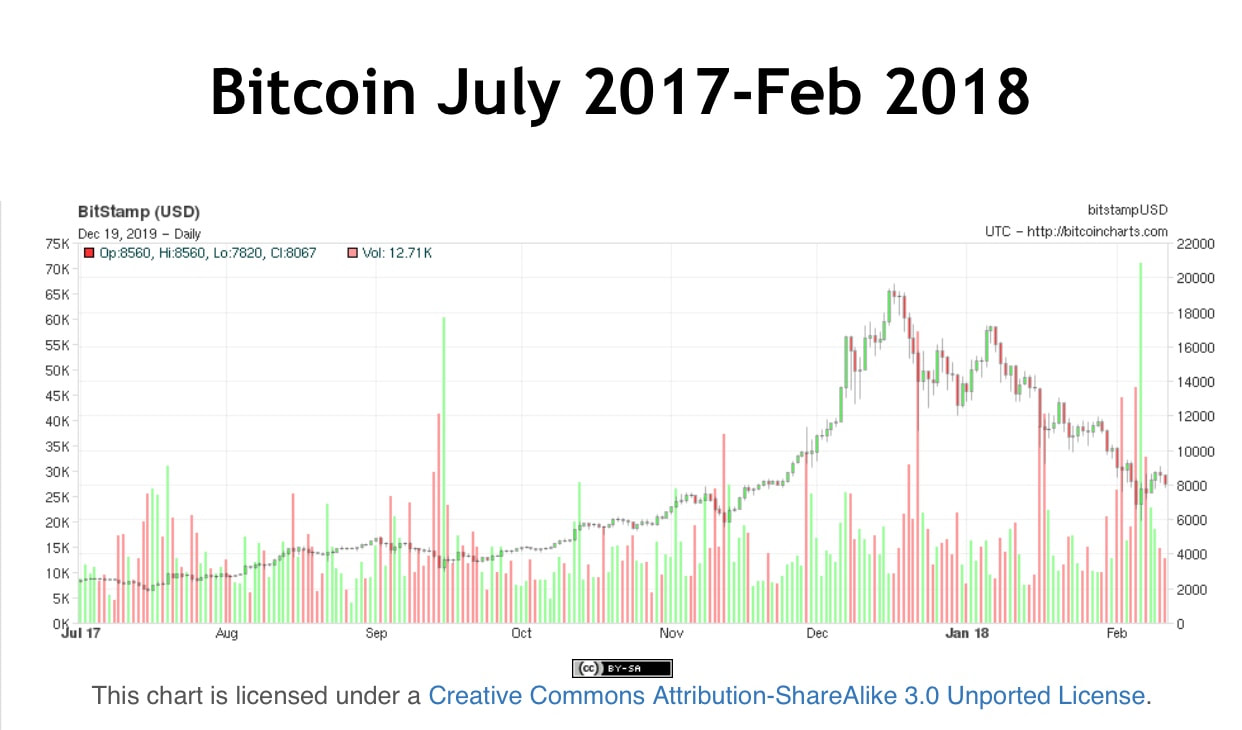

I’m a big believer that some kind of crypto currency will own the future. Although, I don’t necessarily think that Bitcoin is that currency. But even so, even I acknowledged that the big Bitcoin price rise of 2017 was a bubble waiting to burst.

|

Categories |

RSS Feed

RSS Feed