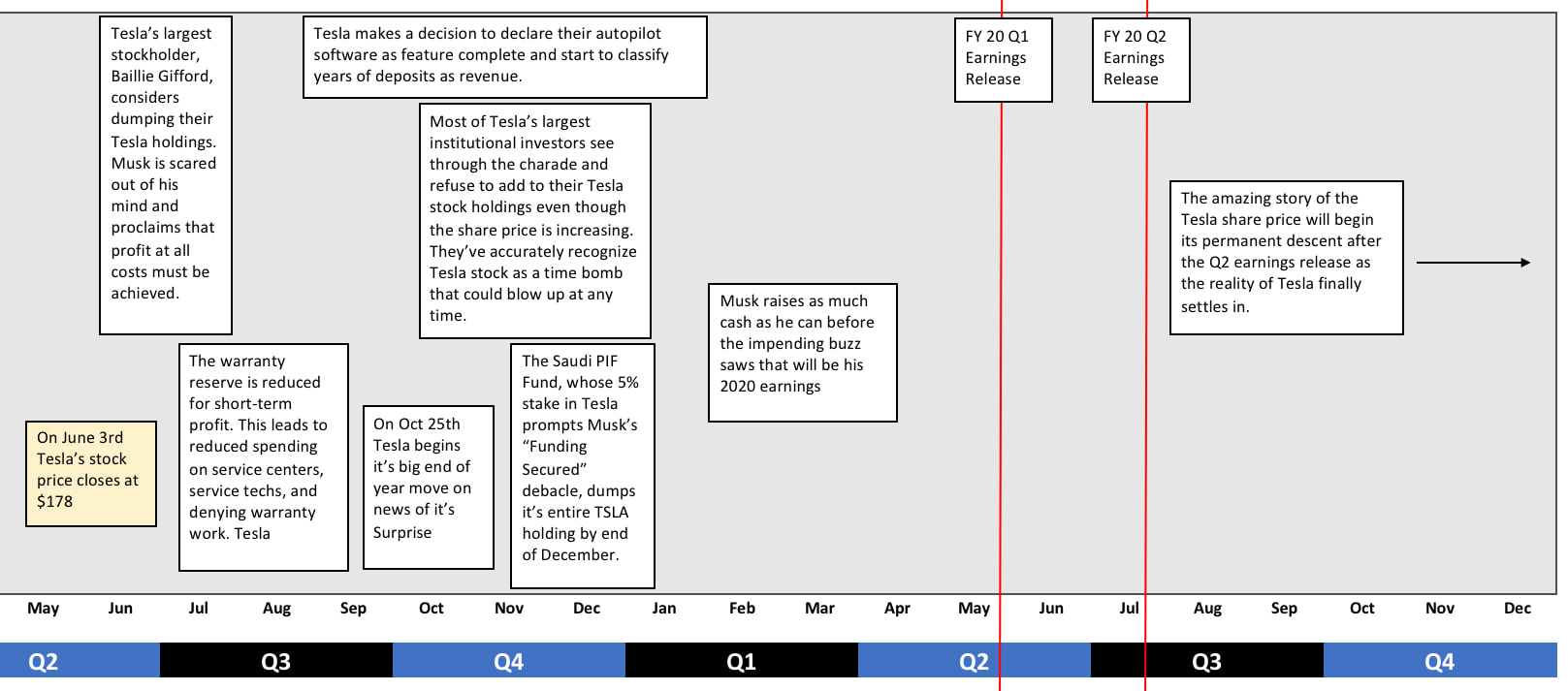

Ever since the end of October, the price of Tesla has been on a swift move upwards. And yet, a funny thing happened with most of the current institutional investors. They didn’t want to add to their Tesla holdings. In fact, the Saudi Public Investment Fund (PIF) completely dumped their stake in Tesla by the end of December during this price increase upwards. The smart money hasn’t been fooled by this short period of stock price delirium.

There’s a good reason why everyone is waiting for Tesla to turn their first full annual profit. That’s because individual quarters, or even two, can be swayed by short-term accounting changes. But smart investors, are able to see through the smoke and mirrors. And anyone who takes a hard look at Tesla during the past 6 months can see that this company is in terrible shape. Revenue in their largest market was down YoY by 30% and their most profitable products, the Model S and X, are in a sales free fall worldwide.

But no matter. The thing that always brings Tesla stock down is about to happen again just like clockwork. The Q1 earnings release. I have been scrutinizing corporate income statements for over 25 years and I can tell you with certainty what happens every time a company pulls demand forward. Pulling demand forward means that customers buy earlier than they would have otherwise due to a looming deadline. Without fail, you have a boom quarter followed by a swing in the opposite direction.

Unsophisticated retail investors who believe all of the propaganda are going to be shell shocked in April when this happens. They’ve been reading stories for 6 months about how demand for Tesla is unlimited and they can’t build enough cars. Furthermore, with the Model 3 production ramp over, year-over year comparisons are going to show a company in decline. Lower revenue and lower unit sales are going to burst the growth company story. Even now, Tesla has reported lower revenue compared to the previous year for two quarters in a row. And this is during a period of increased unit sales. Imagine what next year will bring now that the ramp in America and Europe is over and China is dealing with a pandemic?

Tesla is looking at a 2020 with no more tax incentives in their two largest markets and increased competition from every side. It’s no coincidence that they just raised $2 Billion dollars. The cash balance that they’ve been touting the prior two quarters isn’t real. We know this by looking at the size of their accounts payables and interest income. This means that they are withholding payments to vendors until after the last day of the quarter and then all the checks get mailed. If Tesla truly had an average cash balance of $5 billion in the bank there would be much more interest income.

Tesla defenders like to say that Musk is optimistic with his timelines but he always delivers in the end. But Musk has claimed for years that they would eventually get to the point where cash from their cars would self-fund the business. They could use free cash from customers to finance all of their projects. It hasn’t happened yet. And it never will. This company is structurally unprofitable.

Tesla has just issued over $2 Billion in new stock to finance their business. Guess what that means. Any future profit from Tesla, the driver of stock valuations, is divided by millions more shareholders. Tesla was already overvalued at $200 per share. Musk just signed up the company for an even larger and more impossible future that they can never deliver on. Why would he do that if he truly had $5 Billion in the bank and unlimited demand for this cars in 2020?

The answer to that question is obvious. Musk knows that within months his company is back to reporting losses. Any future bank loans would be under onerous terms.

But some may ask, even if Tesla does go back to reporting losses in the short-term, couldn’t they achieve “escape velocity” through this capital raise. They could fix their quality problems and service network couldn’t they? No, here’s the problem.

Even if you give Tesla the benefit of every doubt. If you assume that with the extra money that they can learn to miraculously build world-class quality cars at a profit within the 24 months. What do you end up with? A low volume car company with small profit margins. That does not justify a market cap greater than GM and Ford combined.

Here is what I think is going to happen. The stock price will meander until April. There’s a good chance it’ll start to go down in March if investors decide to reduce their risk. Tesla has a terrible history with Q1 earnings releases. That will be the first domino to drop. The stock price will then slowly climb upwards until the Q2 earnings release in July. A quarterly loss in July will be the start of the true realization that Tesla is unsalvageable for many investors and they will start to head for the exits.

The new money that has been pouring into Tesla lately is due to momentum investors who have only a shallow understanding of their investments. Like a pack of locusts, they move from one green field to another leaving an empty husk in their wake. Even if the Tesla stock price is slowly rising, they will lose patience and move on in search of greater percentage gains elsewhere.

Sooner or later Tesla will be valued like an automaker. And when that happens, you don’t want to be holding the stock.

RSS Feed

RSS Feed