Japanese cars had quietly garnered themselves a reputation for being rock solid reliable. No, they weren’t particularly fast or flashy, but they would startup every morning and not leave you stranded on the side of the highway. It turned out that this is what most of the car buying public values above anything else.

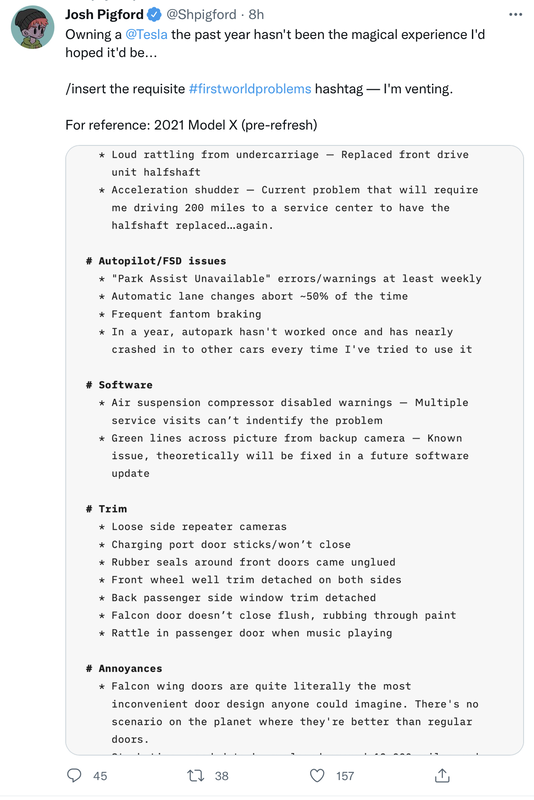

I say “most” because Tesla has tapped into the niche that doesn’t value quality. The Tesla of today is like a throwback to the 1970’s. Tesla thinks that flash and features is the way to win the automotive market share wars. It’s not and never will be.

What they have done is find an under served niche market. But it’s still just a niche.

Ever since the 1980’s, the automotive industry has all been chasing quality and reliability as their top priority. The Japanese because… they’re Japanese, and the Americans, Germans, and Koreans because they see it is the ticket to lasting market share success.

But lo and behold, every industry has its share of dumb money. And that’s where grifters go first. So it’s natural that any company run by Musk is going to dig that well.

The big problem for investors of Tesla is that they think Tesla’s sales success with dumb money is going to translate into global domination. It’s not. Global sales success in automobiles has never favored any company that put anything above quality as their value proposition.

Analysts from JP Morgan et al are making a serious mistake with their future profitability models when it comes to Tesla. They think that because Tesla has found quick success with the quality-doesn’t-matter crowd that they can extend that sales trend out to infinity. But they can’t. That’s like saying since it was 30 degrees at 8am and 70 degrees at noon, than it should be 150 degrees by 8pm. You can’t ignore the parameters of your population sample.

JP Morgan is ignoring the parameters of Tesla’s population sample because they don’t realize that Tesla is a niche automaker and always will be. Furthermore, they don’t even realize what that niche is.

You can already see the cracks in Tesla’s sales façade growing. They are losing market share in Europe and in America it’s come to a standstill. Tesla sales growth is now running on fumes by opening in newer smaller countries but they are going to run out of those soon. And these new additions are only going to hurt future profitability because they require a disproportionate amount of overhead in relation to their unit sales.

The big disconnect between Tesla bulls and bears now is this. The bulls think that quality doesn’t matter and an automaker with one of the worst quality records can steal market share from the quality conscious Japanese. This is a terrible bet to make and almost certainly a losing one.

The Tesla bears have been right all along. It’s only taking a little longer for Tesla’s valuation to catch up. I always say “Don’t bet against quality”. And that pretty much is true for every industry I’ve ever worked in. Tesla bulls used to say “Don’t bet against Elon”. But they are ignoring the fact that by going long on Tesla, they are betting against quality. That’s a losing bet.

RSS Feed

RSS Feed