Tesla's global electric vehicle market share plunged to 11% in April from 29% in march, Credit-Suisse analyst Dan Levy wrote in a note Wednesday morning.

It marks Tesla's lowest monthly global market share since January 2019. The "greater than usual drop" came between the last month in Q1 and the end of the first month of Q2.

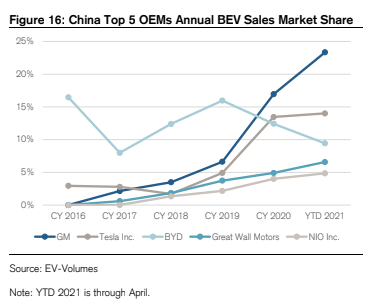

The company's market share in the world's largest auto market - China - collapsed to 8% in April from 19% in March. That drop should be no surprise given the collapse in sales numbers we reported for Tesla in China last month. "GM remained the share leader in China in April, with a 20% share, driven by continued volume traction of the low cost Wuling HongGuang Mini," Levy's note, summarized by Bloomberg, pointed out. — Zerohedge 06/02/2021

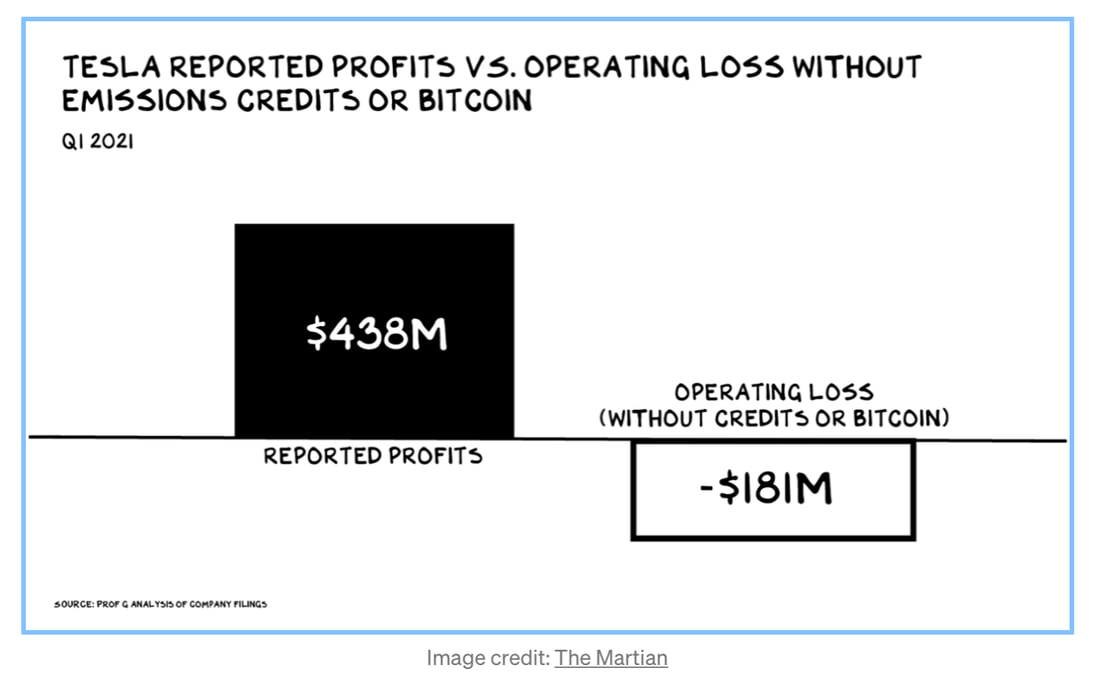

Now, I’m not surprised in the least. I’ve watched Tesla grow revenue at the expense of profitability by opening up new distribution points. That’s the oldest trick in the book. Tesla is following the exact path that I outlined in my 2017 book The Tesla Bubble. There has been a 3 year ramp up of the Model 3 which is now over. Now the damage to the company by shoddy quality and angry customers is blunting their crossover into the mainstream auto market.

I watched this story play out when I was an international inventory analyst for the Amway Corporation in the late 90’s. Amway was chasing growth by constantly opening up into new foreign markets. I helped open up the subsidiaries in India and Venezuela. But eventually you run out of markets to expand into. And then the inevitable slide in revenue growth and profitability begins.

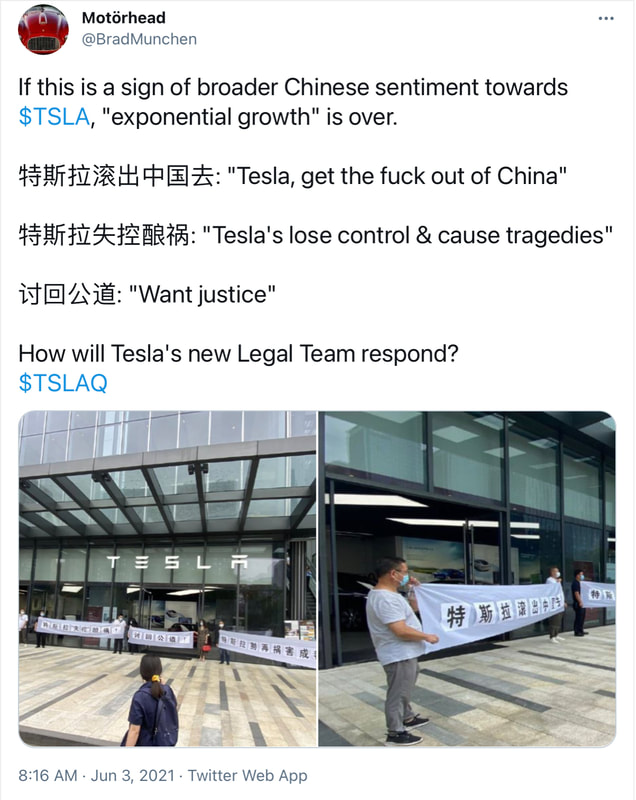

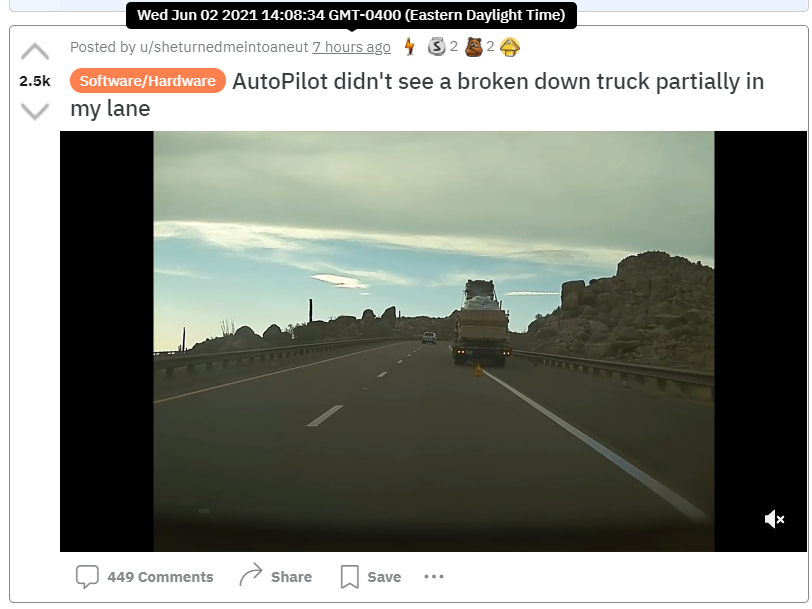

It also proves that non-Tesla EV’s are selling quite well. Tesla fans long claimed that the competition didn’t have that special something that Tesla had. That other EV’s were “boring” and would never catch on with the public. They were wrong and one leg of their investment thesis has evaporated. The competition is coming and they are quite effectively stealing Tesla customers. Perhaps Musk should’ve prioritized meeting quality targets instead of quarterly unit delivery targets.

Now that Tesla’s growth is over, cooler heads at the company will need to start paring the dead weight. All the unprofitable markets that are a drag on earnings will need to be culled. Markets that should’ve never been launched in the first place. It was done as part of an elaborate plan to fool investors into handing over billions more in capital.

But you can’t run a scam forever. Tesla’s market share is imploding just as I had predicted.

RSS Feed

RSS Feed