Yes, Tesla did have “record deliveries”. But after the earnings release, everyone knows why, they are selling cars at a loss. The following two statements about Tesla can’t be true at the same time.

- There is an insatiable demand for Tesla’s cars

- Tesla is selling cars at a loss

If there was a tue pent up demand for Tesla’s cars limited only by manufacturing capacity, Tesla would have more pricing power. Tesla could have priced their high-volume model 3 so that it grew into profitability. That was their plan which was stated back in 2017. So why isn’t it working? In short, because Tesla has dropped prices to keep up the artificial façade of growth. If they hadn’t dropped prices, Tesla’s sales would have fell.

If you look at a company that actually does have an insatiable demand for it’s products you will find healthy profit margins. Look at Apple. They know that they can’t make enough units to satisfy demand. So they carefully price their products to sell as many as they can make but at the highest possible price.

Why doesn’t Tesla price their cars to make at least a tiny profit? Because if the growth story collapses, so does the stock price. And nothing scares Musk more than a collapsing stock price. And that’s saying a lot. Musk literally runs a company which decapitates and burns people alive.

About Those Record Profits

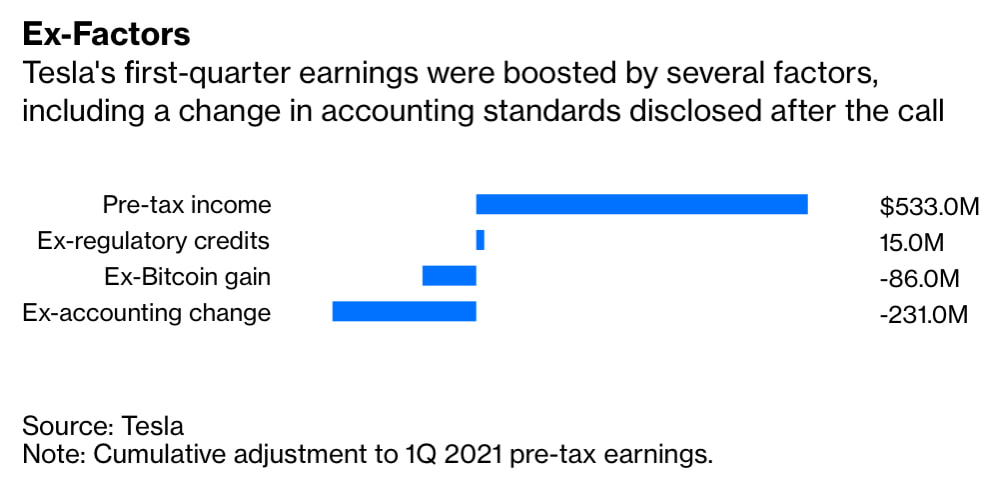

If you look at the following graphic, you can see that most of Tesla’s “profits” was once again regulatory credits. If you back those out alone, Tesla is almost at zero profit. Than if you back out the bitcoin gains and accounting changes, you can see where Tesla stands with actually making and selling cars. A $231 million loss for 3 months. In spite of the growth in deliveries, Tesla still is losing over $75 million per month.

Remember, when you buy stock in a company, you are buying a share of future profits. Without profits, that stock is worthless. The only reason you are able to sell Tesla stock to someone else is because the next guy believes that profits are coming in the future. As soon as everyone realizes that Tesla is just a mismanaged company in a terrible low-margin business the party is over. All the talk about Tesla being a tech company or revolutionizing the energy and ride share industries is just fluff by people who want the gravy train to keep going.

It’s quarters like these that give people the idea that this company is all smoke and mirrors. If you’re a Tesla believer and you wonder why people are down on the company and call it a house of cards. This quarter is a perfect example of why. Judging from this quarter of losses from the automotive side of the business, the fairy tale stories are one quarter closer to being unmasked for what they really are. Fairy tales.

RSS Feed

RSS Feed