Perhaps Tesla’s problem would be easier to understand if I use the housing market as an example. The Housing collapse is a few months ahead of the auto collapse.

If you compare housing stats for 2022 versus 2021 everything looks great. More houses sold at higher prices. However, the bottom started falling out in June. So even though the YoY stats look great, you’d be hard pressed to find anyone forecasting anything but pain in 2023 for the housing market.

Higher interest rates have decimated the housing industry but sales were so strong in the first part of the year that the YoY comparisons don’t tell the full story.

I predicted that higher interest rates would do to luxury cars what they did to luxury homes. And I was right. Tesla’s Q4 shows a huge slowdown and unsold inventory piling up. That’s even with Tesla giving huge discounts on their cars.

But wait, that’s not all. Analysts were lowering their guidance for Q4 almost every day. And Tesla still missed against all of the lowered expectations. This is going to rattle Wall Street.

Tesla’s Market Cap Is Based on Dominating the EV Industry

The Tesla fans don’t understand Wall Street. And that’s partly Musk’s fault. He said that the “fundamentals are sound and don’t get distracted by the market craziness”.

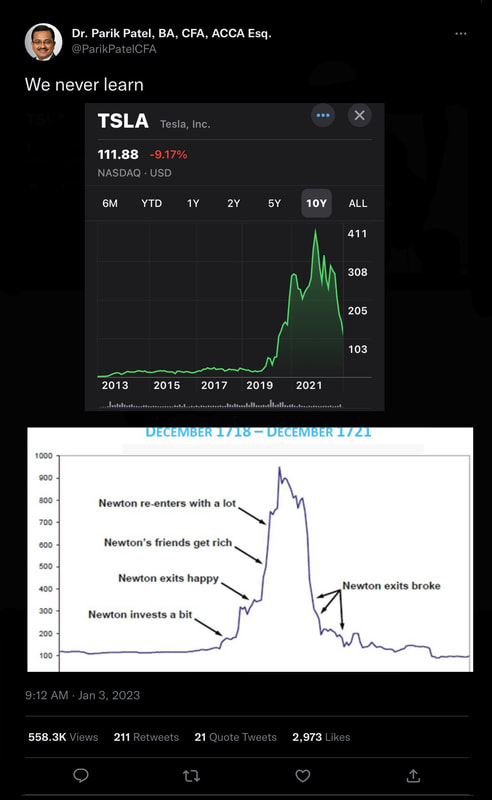

But what Musk didn’t say is that if Tesla’s stock price was based on its fundamentals, it would be about $15 per share, like Ford. Musk conveniently leaves out the fact that the stock price is based on Tesla eventually gobbling up the whole car market. Further, for Tesla to justify it’s market cap, it would also have to expand into other industries like ride-sharing, energy storage, and residential solar power and grow these into huge hundred billion revenue generators. That’s never going to happen.

Slowing demand means that Tesla may never dominate the auto industry but may remain just one of several companies sharing the pie. There are great EV alternatives coming from Kia, Ford, GM, Volkswagen, and BMW. The stock price didn’t expect this to happen. Some Wall Street analysts 2 years ago were literally saying that the mainstream automakers were going to start going out of business one by one.

So my dear Tesla fanboys, it’s not enough for Tesla to make a small profit. Because if that’s all that they do in 2023, this stock is going down the toilet. But even “a small profit” is doubtful in 2023. Skimping on R&D and going into 2023 with an obsolete product line, horrendous build quality, and the worst customer service in the industry is going to finally catch up with them.

And I haven’t even mentioned any potential margin loans that Musk may have taken against his Tesla stock to finance Twitter. Because if Twitter starts to implode and Musk needs to sell more stock to meet his margin calls it’s going to be “Katie bar the door” time.

RSS Feed

RSS Feed