Another big red flag is the size of Tesla’s accounts receivable. There was a big slowdown at the end of March and customer activity fell to zilch all around the world. And yet, Tesla reports A/R that is one of the largest in it’s history? Something doesn’t smell right.

Could Tesla have started down the dangerous road of fleet sales? For a company that purports to do things differently from the traditional automakers Tesla seems to make all the same mistakes. Fleet sales have been a double-edged sword that GM and Ford have tried hard to get away from. Why? Because these volume purchasers demand big volume discounts. And then a year later, they flood the market with low-priced used cars that compete with your new car inventory. New car makers are forced to heavily discount their new inventory. It’s a vicious cycle.

The fact that Tesla’s accounts receivables has gone up when most car shoppers decided it was a bad time to buy a car and showrooms were closed is big red flag. Has Tesla sold it’s soul to the fleet sales devil in exchange for a short-term boost?

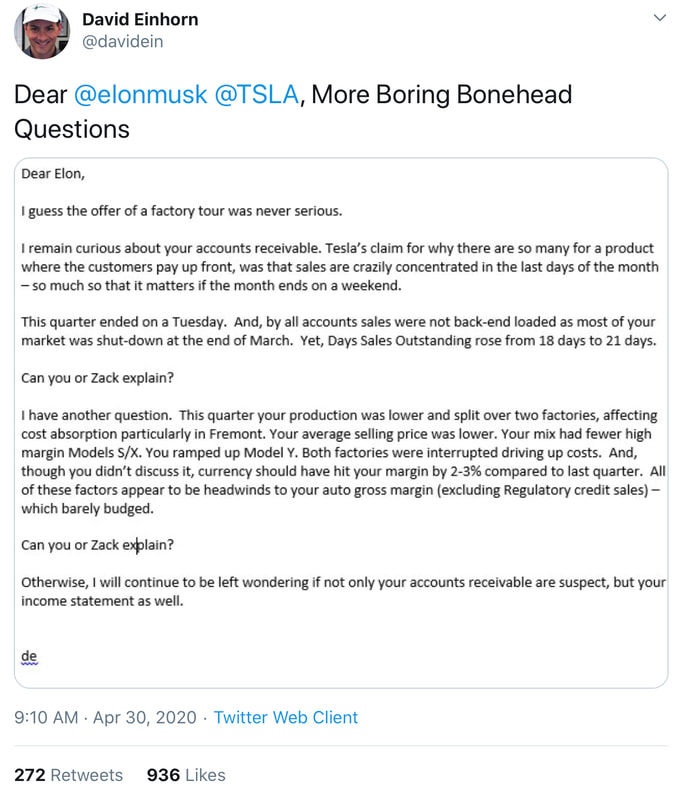

And this bad news is assuming that Tesla’s financial statements are 100% legit. But one thing you can always bank on with Tesla, things are always worse behind the scenes than what they report. Famous Tesla short David Einhorn can see that Tesla may have gone a bit too far this quarter and he’s so sure of it that he publicly called out Musk immediately after the Q1 earnings release.

Here is what to watch out for to see who is right about Tesla’s future. We already know who has been right about the past. If the Bears are right and the financial statements have been “creatively” massaged. Tesla will stage another major capital raise in Q2. That means the company is in huge trouble and their cash balances aren’t real. The bulls all say that Tesla has plenty of cash to weather the storm and trot their models out to prove their point. We’ll see who’s right in a month or two.

When Tesla CFO Zachary Kirkhorn was asked by Adam Jonas of Goldman Sachs to provide some commentary on what their cash balances were like after March 30th, Kirkhorn refused to provide any info. I’ll leave you with that.

RSS Feed

RSS Feed