There seems to be a similar dichotomy when observing the private equity markets. On the one hand, fundamentalists value stocks similar to bonds. They try to estimate the future cash streams in order to calculate a present day value. As opposed to technical chart watchers or day traders who simply look at where the money is moving that hour.

Who has the correct view of how to value the equity markets? Just as in astronomy, both views are equally true. Just because the technical chart watchers can correctly observe the hour-by-hour microscopic view doesn’t make the long-term macroscopic view of the fundamentalists wrong. It’s simply a different level of observation.

Everyone understands how the fundamentalists view equity prices just like everyone understands how to plot the movement of the planets. You model what you think the future profits of any given company will be and you discount them to calculate a present value.

But the microscopic view which involves a lot of chaos is much more challenging. Perhaps the best description I’ve ever heard of how to value equities at this level was actually a discussion in the Quoth the Raven podcast of the art market by Scott Lynn, the founder and CEO of Masterworks.

Before you scoff at any comparison which involves the art market, know this. The art market is about $1.7 trillion in size. Which compares well to the private equity market which is roughly $3.5 trillion and gold at $5 trillion. Art is a major player in the movement of wealth in this world.

What drives valuations in the art market? It’s not the actual quality of the painting. There are only 22 Jackson Pollack drip example paintings left in private collections. How good they actually are is besides the point.

Art valuations are divorced from the quality of the art and depend on who else is collecting. First, which gallery is representing the artist? Major galleries have a greater ability to network and place art with collectors. Driving up value. Second, who’s collecting an artist? Important collections increase the value and notability of an artist. Also, which museums and institutions are acquiring the artist?

The whole art market is driven by popularity. If you think something is going to be popular in the future you buy it. Quality does not matter. Which brings me back to the stock market.

Tesla from a quality standpoint is terrible. They haven’t had any real operating profits…ever. The few times that they’ve actually showed a profit was either due to manipulating expense timing or selling government regulatory credits.

But at the microscopic equity pricing level, quality does not matter. It’s all about who is collecting the art and who might want to purchase it in the future. This Musk seems to understand. It’s his raisin d’etre for being on Twitter. Musk knows that he does’t have real profits so he has to treat the stock market like the art market.

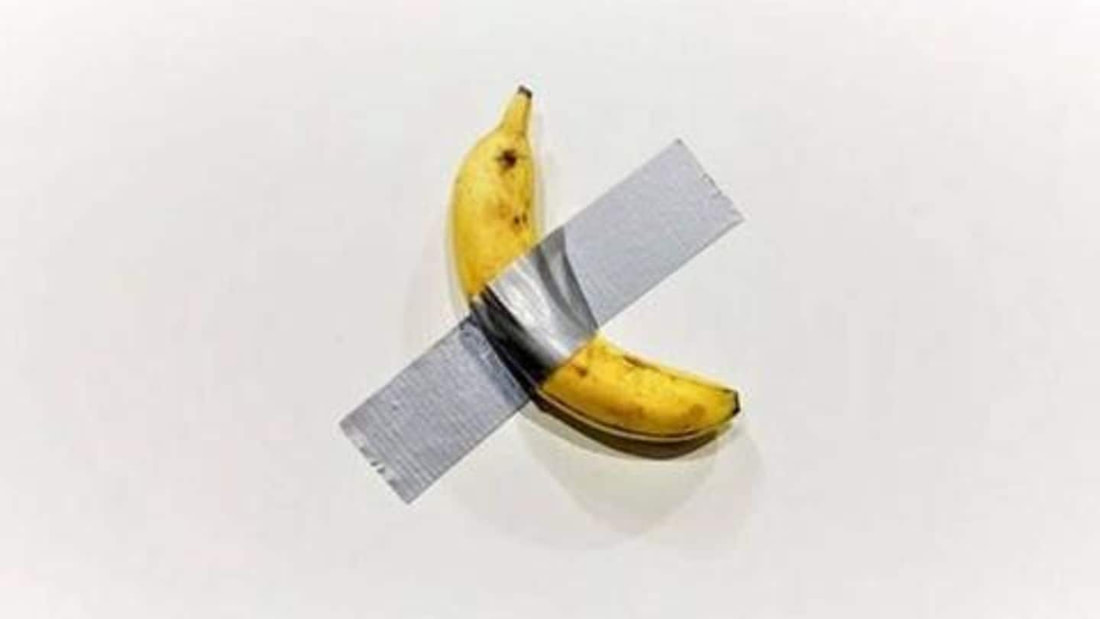

Musk is the stock market version of Banksy. With Tesla, Musk has done the equivalent of taping a banana to a wall and selling it for $120,000. Musk’s “galleries” are Susquehanna Securities and Baillie Gifford and his “collectors” are people like Catherine Wood of Ark Invest.

But Musk’s attempt to play the stock market like the art market is doomed to fail. Because just like you can predict when comet Neowise will return in 6,700 years you can predict what will happen to Tesla’s long-term valuation. As the realization that this is a structurally unprofitable company begins to set in the rosy promises will begin to lose their luster.

The problem for Tesla’s investors is that they don’t realize that they’ve just bought a $120,000 banana. And that eventually, someone is going to rip it off the wall and eat it.

RSS Feed

RSS Feed