Summary

- Tesla needs to be valued as an automaker first and foremost, as installed base is what matters in the near-term.

- The top 20 auto OEMs globally are aiming to produce 20m BEVs and potentially 30m plug-in hybrids in 2030 vs. total demand of just 28m electrified vehicles.

- Tesla has an intense market share war ahead of it, which could last the better of the next 10 years.

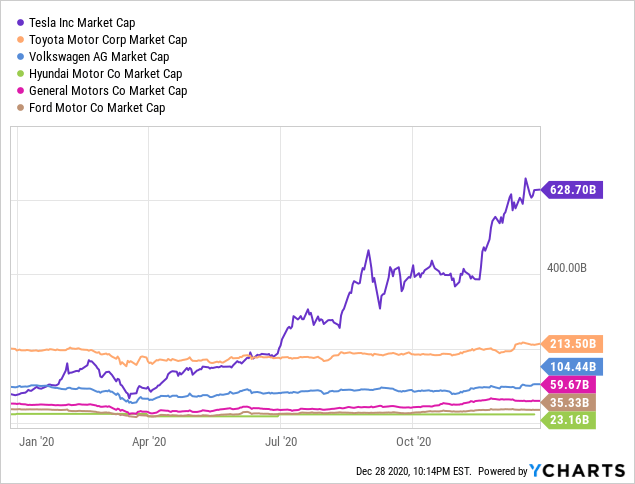

- With Tesla's market cap now 2x the 5 largest auto OEMs combined, downgrades to the sales volume outlook, which are likely in my opinion, could spark a sharp selloff. I am thus negative on the stock.

There has been voluminous debate about Tesla (TSLA) and its valuations; some say it is disconnected with reality while others say this is just the start. The bears look at Tesla's market cap per vehicle sold and conclude that valuations are ridiculous; the bulls say Tesla is more than just an auto company given its potential to become a 3rd-party battery supplier to OEMs and the potential for services revenues. I think both sides hold their own merits, and must be considered in unison.

But let me start with this premise: Tesla must still be viewed as primarily an automaker, at least over the next few years.

Why do I say that?

First, despite the potential for service revenues from futuristic in-car apps and the like, these revenues can only exist if there is an installed base of Tesla vehicles globally. This is similar to what you see with video game console makers - while the margins are made on software, they need to put the hardware in the homes of gamers in order to sell the software (games). With the video game console market effectively cornered by Microsoft, Sony, and Nintendo, getting the hardware into homes has never been a major challenge, albeit with cyclical ups and downs. But with the auto sector so fragmented, can Tesla really ramp up its installed base and capture significant market share?

Second, Tesla's potential as a battery supplier has a cannibalization element to it, and therefore cannot be a key long-term growth enabler. When Tesla sells more batteries to third parties, that implies competitors are producing more cars, which implies lesser Tesla cars being sold. Thus, it wouldn't make sense for Tesla's aim to grow its battery business into too significant a portion of its revenues.

Given the above, I do think that Tesla's first objective is to put as many cars in the hands of consumers as it can, before it can explore further monetization options, and that will be the key driver of its shares for the next 5-10 years.

Having said that, the key point I want to bring up today is that the market may be overlooking the level of competition Tesla is about to face in the EV space, as legacy automakers have set lofty targets for EV sales, and are already making inroads. I'll dive into this further below.

Automakers are targeting to produce more EVs than demanded; a tough battle lies ahead for Tesla

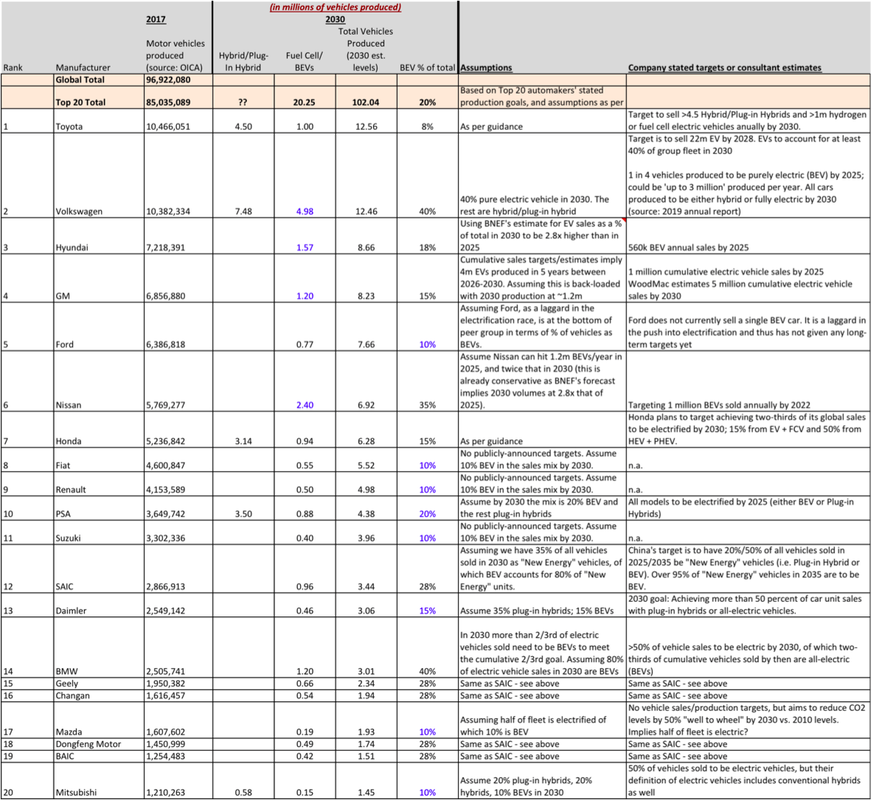

I have compiled the latest guidance on 2030 electric vehicle sales/production targets from the top 20 auto manufacturers globally (this is based on their 2017 rankings, as that was the latest year of data I could find from the OICA; I don't expect the rankings to shift about much). Together, the top 20 automakers account for about 88% of global auto production volumes, so this sample set should be a good representation of the aggregate target for electric vehicle production by 2030. Not all automakers have announced 2030 targets, but a vast majority have done so, or at minimum announced a related target that we can estimate or extrapolate the 2030 numbers from. Note that the top 20 automakers below only comprise the traditional automakers who have been making Internal Combustion Engine vehicles, and excludes pure battery-model companies like Tesla and Nio (NIO).

My key finding here is that in aggregate, the top 20 automakers expect to produce about 20 million units of Fuel Cell (hydrogen) or Battery Electric Vehicles (henceforth referred to at BEVs) annually, of which the vast majority will be BEVs as only Toyota has included Fuel Cell models in its targets. This accounts for ~20% of their estimated total units produced. On top of that, many expect to produce a significant amount of plug-in hybrid vehicles; quite a few of the top 20 are guiding for plug-in hybrids + Fuel Cell/BEVs to amount to 50% of total units sold in 2030. If the pack follows suit, we could see plug-in hybrids amount to about 30 million or ~30% of total units sold in 2030. The remaining 50% would be traditional internal combustion or traditional hybrid vehicles (which use gasoline to charge the battery, and the battery merely serves as a standby/secondary fuel source, with gasoline being the main energy source).

Bloomberg New Energy Finance, in their 2020 Electric Vehicle Outlook, estimates that by 2030, 28% of new vehicle sales will be electric vehicles (plug-in hybrid + BEVs). There should be about 100 million vehicles being produced annually in 2030, meaning that 28 million vehicles are expected to be plug-in hybrid or BEVs. This is only slightly more than half of the c.50 million vehicles that the top 20 automakers alone are hoping to sell annually by 2030. Thus, the first takeaway is that the top 20 automakers seem to have set their expectations too high; the sum of the parts just doesn't gel with the big picture. Competition to gain market share in the electric vehicle space is likely going to be very intense.

I think you can guess where I am going next with this.

Tesla has set a target to sell 20 million electric vehicles annually by 2030. Given the traditional automakers are already going to be flooding the market, not to mention other pure-battery players like Nio and Fisker (NYSE:FSR), is it realistic to assume that Tesla can really achieve this goal? Put in another perspective, against a backdrop of about 28 million EVs expected to be sold in 2030 (based on BNEF's forecast), Tesla selling 20 million would be equivalent to it taking a 71% market share in the EV space! I don't know about you, but that seems like a huge, and pretty much impossible ask to me. Even if Elon Musk backs down and cuts the target in half, Tesla would need to have 35% of the electric vehicle market. This is a feat no automaker has ever achieved.

However you cut the numbers, one thing is for sure: Tesla has better watch its back, as the competition is just beginning to heat up.

After a meteoric rise, watch for stumbling blocks

To reiterate, the analysis above is key to the Tesla story because in order to successfully achieve growth in potentially more lucrative areas like software or subscriptions in the long term (i.e. transforming into more than just an automaker, as the Bulls would point out), it needs to sell its cars and grab market share in the short term. Thus, Tesla must still be viewed - at least over the next few years - as an automaker. And for automakers, sales volume is a key driver of share prices.

Tesla's market cap crossed the US$600bn barrier not too long ago, and it is now worth almost 2x the combined market cap of the top 5 automakers (by sales volume) combined. At the risk of stating the obvious, this means that growth expectations for Tesla are much higher than that of the more 'traditional' auto OEMs, and there is an abundance of high expectations for vehicle sales and growth priced into the stock. So the progress of market share gains (or the lack thereof) would make a much higher impact on Tesla's share price than those of the old guard.

After such a steep rally, I suspect that any downgrades to the outlook would likely result in a sharp correction in Tesla's shares. And I do think that lower-than-expected vehicle sales guidance is one stumbling block that is just waiting to happen, given the intensifying competitive landscape as described earlier.

I am thus negative on Tesla, and would advise investors to take profit, and wait for a better entry point down the road.

RSS Feed

RSS Feed