Check out this doofus from Twitter.

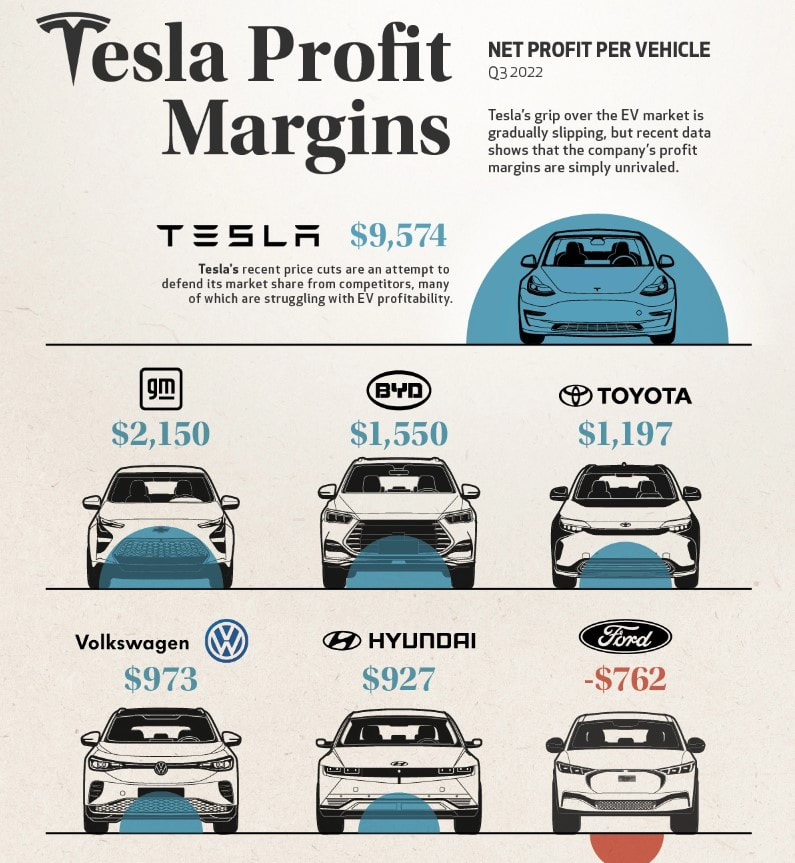

Problem #1 with this graphic is that everyone is in market penetration mode. That means that they are all deliberately undercutting Tesla to steal market share. And the fact that Tesla is cutting prices means that the old line automakers are being quite successful at stealing customers.

Problem #2 is that, like all Tesla stats, it is carefully constructed to show a false narrative. It is deliberately omitting all car models EXCEPT the EVs. But all other automakers make the bulk of their profit from gas-powered vehicles.

The only car company in the negative is Ford. But the stat is constructed to omit the fact that they have the best selling vehicle in America, the F-150. And they are making an average of $13,000 in profit on every truck that rolls off the line. That is over 35% BETTER than Tesla. And GM is making roughly the same, if not better margins on their Silverados. Tesla isn’t even close to making the most profit per vehicle.

The reality is that the old line automakers can afford to wage a price war with Tesla because they subsidize their EV pricing with profits from their bread-and-butter lines. But the Tesla idiots are clueless because they keep hearing from their propaganda websites that Tesla “has the best gross margins in the auto industry”. As I keep repeating until I’m blue in the face, Tesla is comparing retail revenue to wholesale cost of sales.

Tesla’s gross margins are overstated in comparison. That is why the old line automakers can beat Tesla on total net profit. They have much lower SG&A. Tesla is saddled with huge customer support and selling expenses that Ford or Toyota don’t have. Tesla has no dealership network which means that they foot the bill for a myriad of things other automakers don’t have too. Plus, the supercharger network is a giant cash sucking sink hole. Can you imagine if Chevrolet or Toyota had to resort to paying for free gasoline if you buy one of their cars?

Tesla peaked in 2022. With the onslaught of competition from every direction and lower selling prices, Tesla’s profitability is only going to deteriorate from here on out. And no, the tiny volume bumps aren’t going to help them when the price of material, labor, and overhead are all going up. If you’re invested in Tesla, I have only two words for you “Get Out”. While you still can. It’s going to get ugly.

RSS Feed

RSS Feed