In this case, the difference is who pays for customer service and support. Traditional auto makers sell their cars to a dealer network and it is those independent businesses who handle a great deal of the customer service, not the manufacturers. Not so with Tesla, they own customer service and support from top to bottom.

That’s why if you do a quick comparison of just total SG&A as a % of sales between Tesla and GM, Tesla has a rate that is about 27% higher than GM. This is the part all the Tesla propagandists leave out when they crow about those Tesla gross margins.

But SG&A is only part of the story. It’s actually a lot worse for Tesla. Tesla most certainly has an advantage in general and administrative costs over all the traditional automakers. G&A includes the people costs of the corporate headquarters. And this Tesla advantage is is being greatly outweighted by their disadvantage in selling costs. My point is that Tesla is a lot worse than 27% higher than GM if you only look at selling costs.

So does Tesla capture $1,500 per car that traditional automakers let go to the dealers. Probably. But my point is that this is not all free money. Tesla isn’t getting anywhere near that in terms of a net benefit to the income statement because they have other costs that traditional auto makers don’t have.

Think of all the trips that customers make to dealerships for small things like squeaky windows or misaligned parts. Tesla pays for all of that. But GM? Probably not because the dealer will handle it. And it’s not all charged back to the manufacturer.

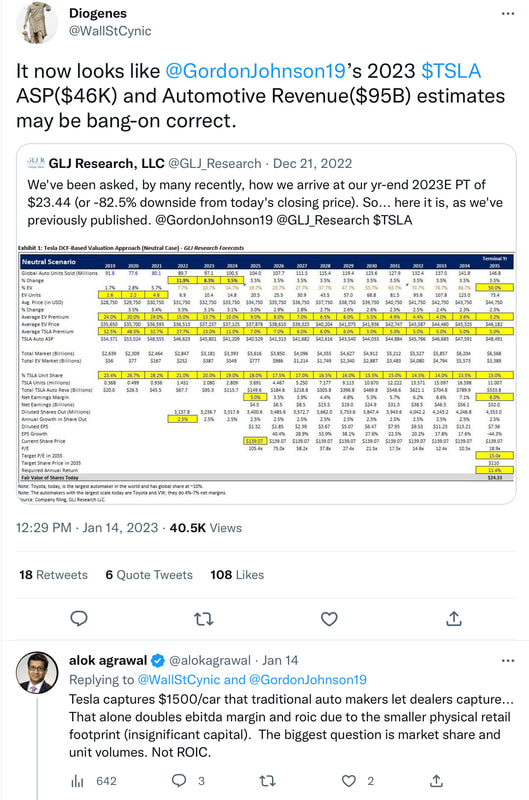

I see a tweet like that from Alok Agrawal and I can laugh out loud. But for people who aren’t steeped in financials as their day-to-day job and have no frame of reference to question the logic it might look reasonable. Alok’s tweet makes absolutely no sense and is completely misleading. I just wish more people could see that.

Here’s the full context of that joke of a tweet…

RSS Feed

RSS Feed