My plan today was to write an article about Tesla's Q4 2018 earnings, conference call and the departure of long-time CFO Deepak Ahuja. However, this morning Tesla announced they were acquiring Maxwell Technologies ($MXWL) for $218 million in stock, a 55% premium to its closing price on February 1, 2019, and thus, my plans changed. Why did they make this acquisition? More importantly, why did Tesla pay a 55% premium for a company on the brink of bankruptcy?

The stated purpose of this acquisition was to enhance Tesla's charging capabilities and battery technology. Wait, I thought Tesla was already years ahead of the competition in battery/charging technology. Well, according to this article from Fortune, "Maxwell has been developing patented dry electrode technologies that can be used to create ultracapacitors that store large amounts of electrical charge without losing energy."

So, buying this company for $218 million seems like a steal for Tesla, right? This should immediately help with Supercharging times, right?

Its Not Quite That Simple

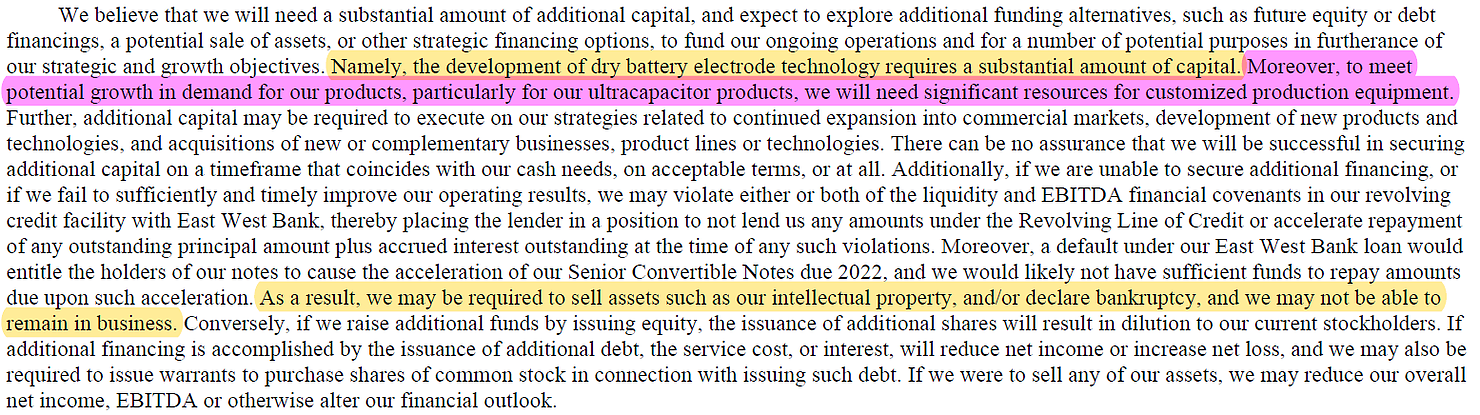

If you take a look at Maxwell's most recent quarterly SEC filing (Q3 2018 Form 10-Q) and read all the way to page 44 (of 49, by the way) you will see this pesky little detail: "Namely, the development of dry battery electrode technology requires a substantial amount of capital. Moreover, to meet potential growth in demand for our products, particularly for our ultracapacitor products, we will need significant resources for customized production equipment."

It's Still Not That Simple

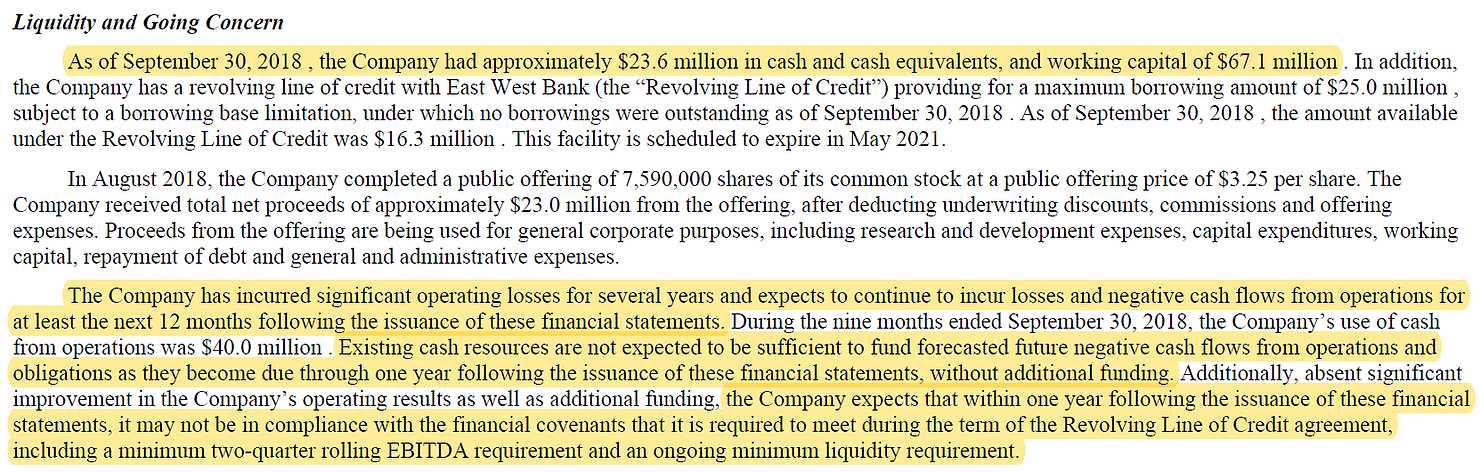

With the above complications in mind, let's take a look at the deal itself. Maxwell's stock closed at $3.07 on February 1, 2019. Today, Tesla agreed to buy them out for $4.75 per share, a 55% premium to the previous close. I found this to be very odd, considering page 10 of Maxwell's most recent 10-Q featured a liquidity and going concern line, which essentially means that the company is on the brink of bankruptcy. It states the following: "The Company has incurred significant operating losses for several years and expects to continue to incur losses and negative cash flows from operations for

at least the next 12 months following the issuance of these financial statements." and goes on to say "Existing cash resources are not expected to be sufficient to fund forecasted future negative cash flows from operations and obligations as they become due through one year following the issuance of these financial statements, without additional funding."

You can read the entire statement below:

"This Place Called Shanghai"

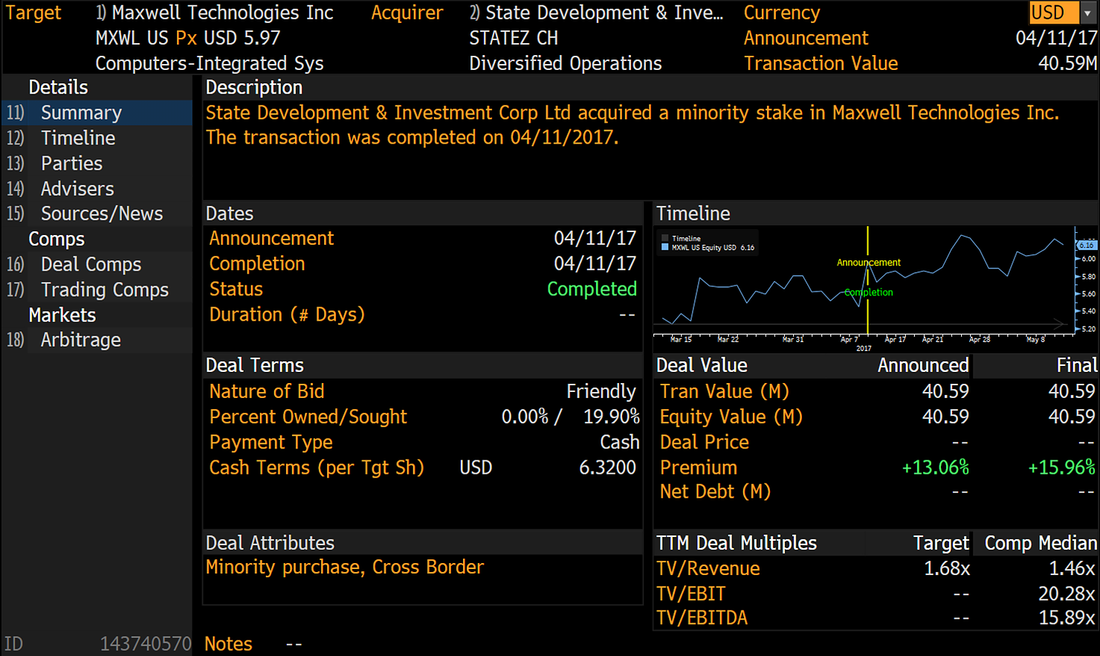

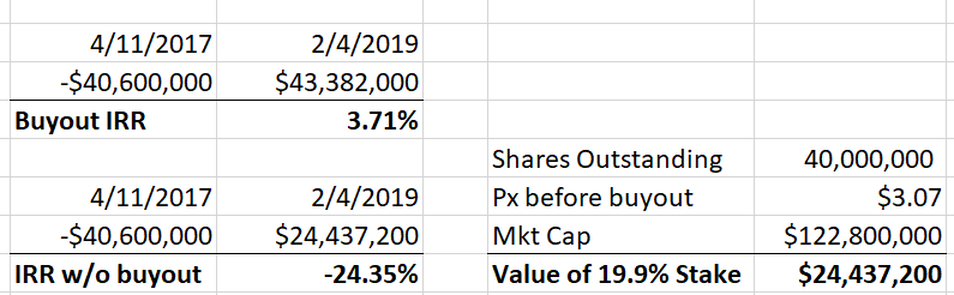

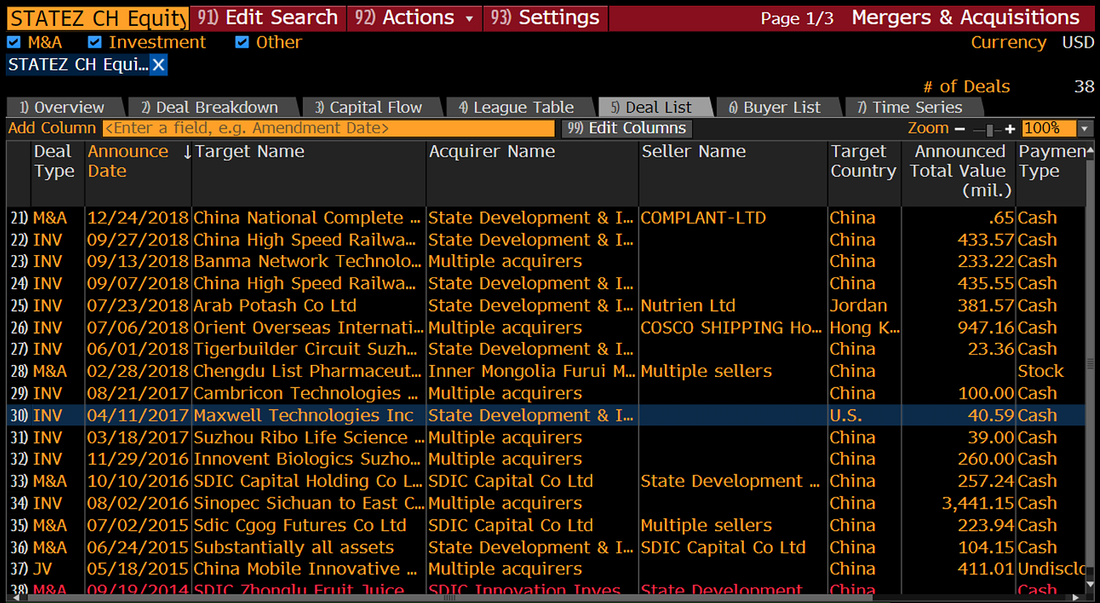

It just so happens that on April 11, 2017, China's State Development & Investment Corporation (SDIC) bought a 19.9% stake in Maxwell Technologies for $40.59 million.

It appears that, in addition to voicing his appreciation on the conference call, he may have shown his appreciation in the form of a bailout for China's state-sponsored investment fund - who, thanks to the 55% premium paid by Tesla, was able to make a 3.71% IRR on their Maxwell investment.

Disclosure: I am short the stock of Tesla ($TSLA) and this is not investment advice, I am not an investment adviser and no financial decisions should be made on the basis of this article. See my full disclaimer in the "about" section.

RSS Feed

RSS Feed