In December 2019, Tesla sold a whopping 12,053 Model 3 units in the Netherlands. It was 13% of Tesla’s entire global automotive unit sales for the entire quarter.

Which is worse, the decline in absolute numbers or the loss of BEV market share? Tesla isn’t even leading the BEV sales charts in the Netherlands anymore.

New competitive models from Volkswagen and Volvo/Polestar have now matched or overtaken Tesla in short order. Hyundai too.

Tesla is increasing sales in China, but in places such as the Netherlands, it’s losing both market share and absolute numbers of unit sales. Competition in Europe is growing fast.

This year, as of December 24, Tesla is on track for a 60% decline in the Netherlands. Mind you, that’s a 60% decline in absolute numbers.

Which is worse, the decline in absolute numbers or the loss of BEV market share? Tesla isn’t even leading the BEV sales charts in the Netherlands anymore.

New competitive models from Volkswagen and Volvo/Polestar have now matched or overtaken Tesla in short order. Hyundai too.

Tesla is increasing sales in China, but in places such as the Netherlands, it’s losing both market share and absolute numbers of unit sales. Competition in Europe is growing fast.

Tesla (NASDAQ:TSLA) has had a well-known quarterly pattern of deliveries, starting already near the end of 2013: The first month or two, there are relatively few, and then in the third quarter, Tesla sells more than 50% of its automotive unit volume.

The reason this has been the case is that Tesla from its factory in Fremont, CA, has started out the quarter making cars for overseas markets, which require long transport time. They typically arrive near the end of the second month of the quarter. Then, roughly around the middle of the quarter, Tesla starts manufacturing cars for the North American market, which requires only a few days of transport.

The result of this is that "it all hits" roughly around the end of the second month of the quarter, with full force culminating in a monster third month of the quarter. At no time may this have been more extreme than one year ago, in the fourth quarter of 2019, when Tesla sold 12,053 units of the Tesla Model 3 in the December month alone - in the Netherlands.

Yes, that was 12,053 Model 3 units in a single month - not the quarter - in a single (small) country: The Netherlands. That was 13% of Tesla's 92,620 cars sold - all models combined - globally for the entire fourth quarter of 2019. You have to understand and appreciate how extreme that was.

One year later, where does Tesla stand in terms of those Model 3 December monthly sales in The Netherlands?

As I write this, we have registration numbers through December 24. Last year, Tesla had registered 8,723 units of the Model 3 during December 1-24 in the Netherlands. Here is the data source for all daily car registration numbers for the Netherlands, Norway and Spain that people have been using for several years now: EV registration statistics for the Netherlands, Norway and Spain

One year later, by December 24, 2020, Tesla had registered 3,460 units of the Model 3 in the Netherlands during December 1-24. Same data source as always, referenced above.

A decline from 8,723 units to 3,460 is a decline of 60%.

Even some Tesla bulls will from time to time assume or at least recognize that Tesla will not maintain EV market share over time - but this is a 60% decline in "absolute numbers" - not market share.

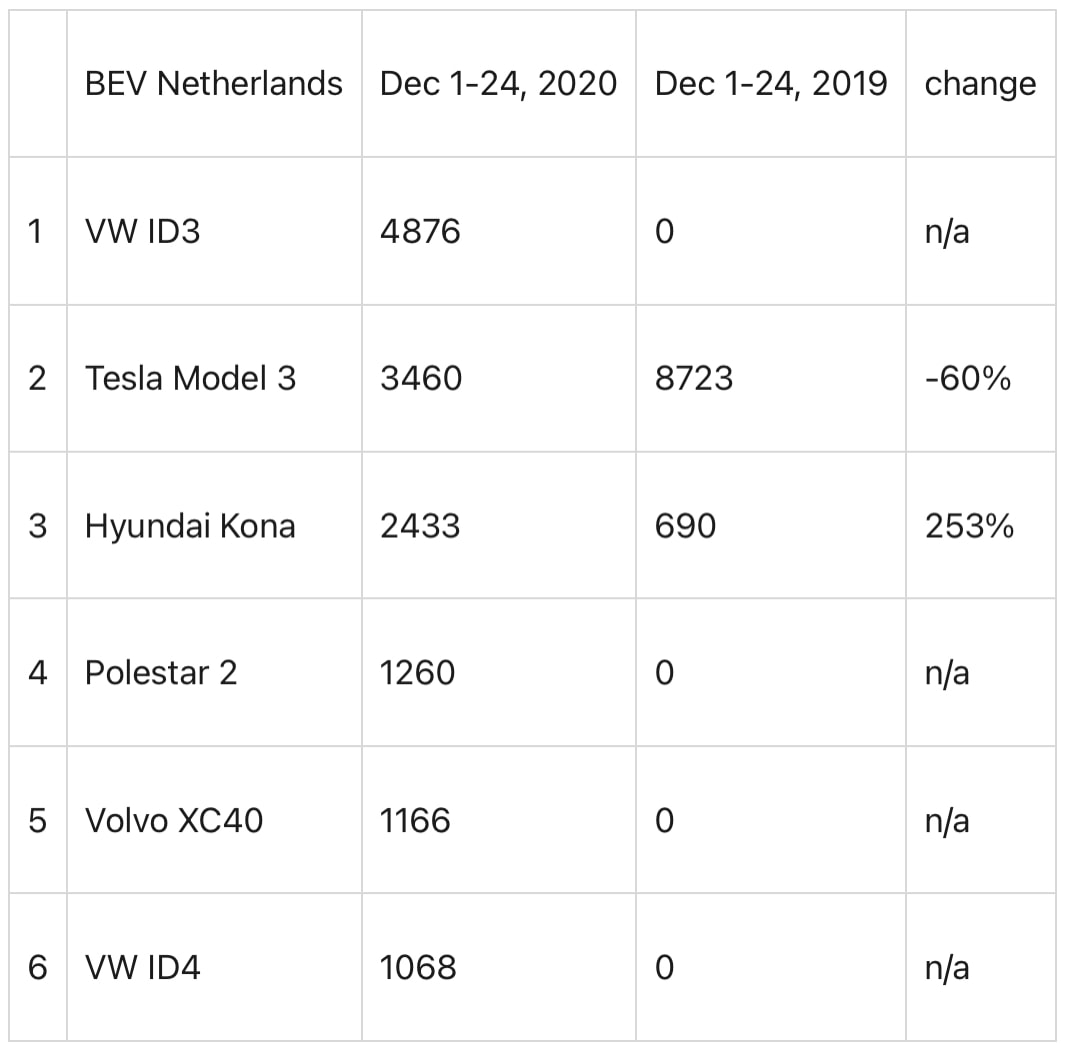

Of course, Tesla is also losing market share. Let's take a look at the top six best-selling battery-electric vehicles (BEVs) in the Netherlands this month, December 2020 - with data through December 24. Mind you, I am not even including the other kind of electric vehicle (EV), which is the plug-in hybrid (PHEV). The definition is this: EV = BEV + PHEV.

- Even if Tesla had absolutely zero competition, a 60% decline in absolute numbers is the kind of decline we saw in AOL's dial-up subscribers in 2000-2001 electric cars, just like internet connectivity, is supposed to be a growth market, right?

- Only one of the other top-six BEVs sold in the Netherlands was available a year ago: Hyundai Kona (OTCPK:HYMLF). Unlike Tesla, which was down 60%, the Hyundai Kona was up 253% over last year. What does that tell you?

- All the other four BEVs became available only late in 2020. Let's look at how extreme this recent onset of competition has been:

Polestar 2: Deliveries started at the beginning of September 2020.

Volvo XC40 (OTCPK:VOLVY): Deliveries started at the beginning of November 2020. The Volvo XC40 BEV and the Polestar 2 are essentially the same car under the skin.

VW ID4: This one is the extremest of them all, because the first regular consumer delivery in the Netherlands took place either on December 17 or 18. It's been in the market for only a week! Yet, it has already catapulted into sixth place for the month in the Netherlands.

Many new players, many new models, many new headaches for TeslaWe are not debating here whether Tesla is a great car or not. I drive almost all new cars that enter the market, and these days there are few and far between that are not at least very good. There just aren't any bad cars anymore. Okay, there are perhaps 5 out of 100 that I don't like all that much, but you see the larger picture: 95% of them are somewhere between very good and wonderful.

Rather, the main point here is this: Because all the new cars are so good, the sheer number of competitive entries has a huge impact. It's not like the wildebeest is an inferior animal to a hyena. A wildebeest can fend off a single hyena - perhaps even two or three. But five? Fifty?

No. And that's the problem for Tesla right now. Where Tesla is met with competition from relevant brands and models in the local markets, Tesla's sales fall straight down the tubes. In the Netherlands, Tesla isn't just losing more than half of its market share, it's even losing absolute level of sales in the BEV market, which is where it has 100% of its automotive sales.

Caveats: Things change, every dayIt's not possible to write this kind of article without pointing out what ought to be obvious, but perhaps isn't to many: In an era of sudden fleet sales hitting the books (and therefore the car registration authorities), all of these numbers could change suddenly and dramatically, especially in the last week of a quarter.

In the last week of a quarter that's also the last month of the year? That probability is even higher. Last year, Tesla had sold 8,723 Model 3 units in the Netherlands by December 24, but by December 31, it had sold 12,053. That's an increase of 38% in a week.

If Tesla matches that percentage increase in 2020 over 2019, then perhaps it may narrow the gap vis-a-vis the competition. However, such an increase would still put it down 60% for the month. Here is the math: 12,053 divided by 8,723 is 1.38. Multiply 3460 by 1.38 and you're at 4,775. 4,775 divided by 12,053 is 40%. So, still down by 60%. In other words, being up a whopping 38% in the last week of the December 2020 month won't cut it. That was last year's pace.

However, if the competition increases less than 38% in the last week of the quarter, but Tesla grows by 38%, then Tesla's Model 3 market share shortfall in the Netherlands this quarter would narrow accordingly.

Conclusion: Massive new competition is eating into Tesla's salesI have been talking for over half a decade about the new competition that is arriving in the market. When I started hammering away at this, around September of 2014, I did so knowing that there were huge development programs underway among most automakers that would start to bear fruit roughly in the fall of 2018. That's because the automotive development cycle is normally at least four years.

Some of those programs were delayed by, say, a year or so, but the basic thesis has not changed: There are literally over 200 models, from essentially all automakers, that are coming onto the market, and some of these are already eating into Tesla's Model 3 sales in places such as the Netherlands. And this is just the tip of the iceberg.

The Volkswagen ID4 just started selling barely a week ago, and look at its huge market impact already. The Ford (NYSE:F) Mustang Mach-E is next, and in 2021, we will get such important vehicles as the Nissan Ariya (OTCPK:NSANY), Audi Q4 eTron, Hyundai's Ioniq 5 and an all-new model from Kia (OTCPK:KIMTF). In Europe, I expect the SEAT el-Born and Skoda Enyaq to be best-sellers. The list just doesn't end.

I've said it many times before, but it's really happening right now: The wildebeest is a majestic animal in its own right. It can fend off a hyena or two. But when five of them show up, let alone 50 or 500 hyenas, you should know where the story ends. The hyenas are now ravaging Tesla's BEV sales numbers in the Netherlands and in many other (mostly European) countries. And this will only get worse every single month going forward.

Norway and the Netherlands are the canaries in the coal mine for what investors should expect to happen in Asia and Europe. There may be a two-year lag almost exclusively for reasons of regulatory discrepancy. But water runs downhill, so the end outcome should not be in doubt.

RSS Feed

RSS Feed