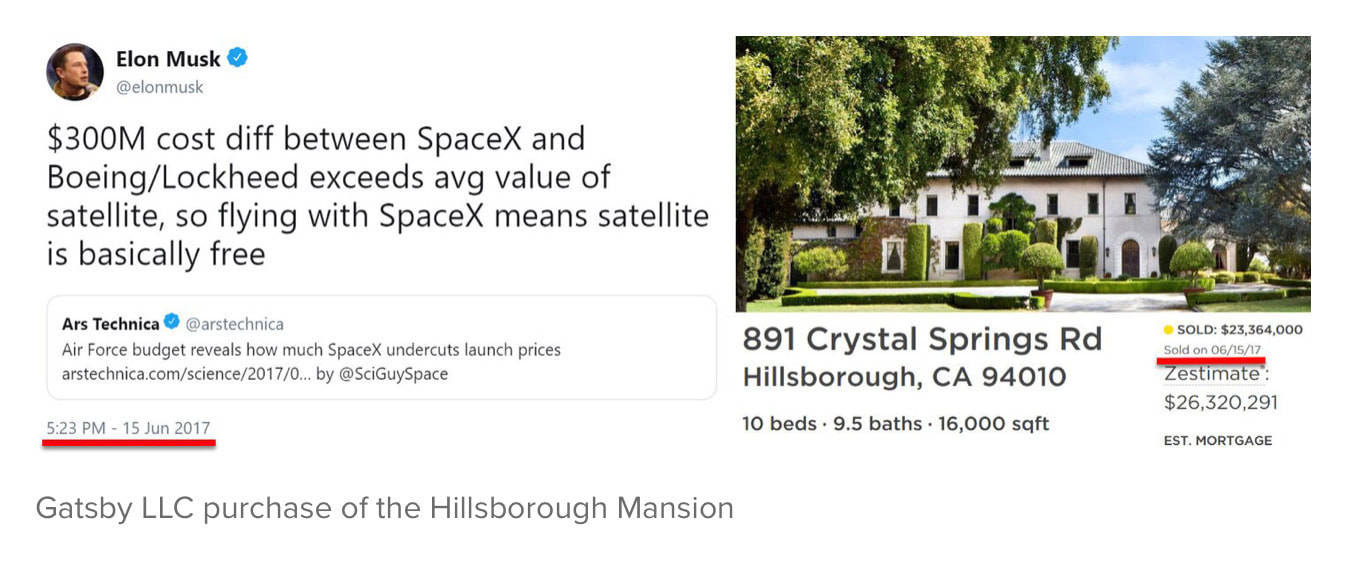

The news that broke on this day launched Elon Musk into a frenzy as he rushed to cover up financial improprieties tying his empire of companies to his personal holdings.

The events may have serious implications for regulators and may lead to laws governing settlements made between the Securities and Exchange Commission and those who violate federal securities laws.

The Dec.17-21 timeframe stands alone as a very major event involving all companies and personal holdings. There are more points we are analyzing now that further support the desperate hunt for liquidity.

December 18, 2018 Morgan Stanley Private Bank Loans ($61mm)

- APN 4369028001 - $19.5mm - Callisto 100 LLC

- APN 4369006013 - $14.95mm - Camellia Ranch LLC

- APN 4369021009 - $6.83mm - Callisto 100 LLC

- APN 4369029003 - $2.83mm - Duck Duck Goose 100 LLC

- APN 038200020 - $17.23mm - Gatsby LLC

January 16, 2019 (est) $50-55mm

Sale of N158X, Falcon 8X Jet

N158X, LLC DUNS 10792329

216 Park Road

Burlingame, Ca 94010

In the background, however, the article that would change everything was being written.

It was not.

- SpaceX

- Tesla

- Boring Company

- Musk's Personal Loans

- 6:10 am EST (3:10 am PT) - IBs Simultaneously Post Tesla Notes

- 9:14 am EST (6:14 am PT) - WSJ posts article on new SpaceX raise

- 9:39 am EST (6:39 am PT) - SpaceX scrubs launch "Out of Family Reading"

- 11:00 pm EST (8:00 pm PT) - Boring Company "Product Launch"

- During the day: LA county filing shows Musk mortgages 5 properties to Morgan Stanley ($61mm)

Tesla is a heavily followed and tracked company whose CEO was sued by the SEC seeking a permanent ban from public markets in 2018. Following the settlement with the SEC the next day, major discrepancies in official filings and Elon Musk statement exist between verifiable public data.

RSS Feed

RSS Feed