Nothing has changed. Tesla is still losing over $100 million per month making cars. The Model 3 has failed. The thesis that Tesla could convert to a mass market EV manufacturer and make a profit on enhanced economies of scale is dead. That’s why all the Tesla pumpers have tried to switch the focus to revolutionizing the self-driving world. Because Tesla took their best shot at making cars and has fallen far short.

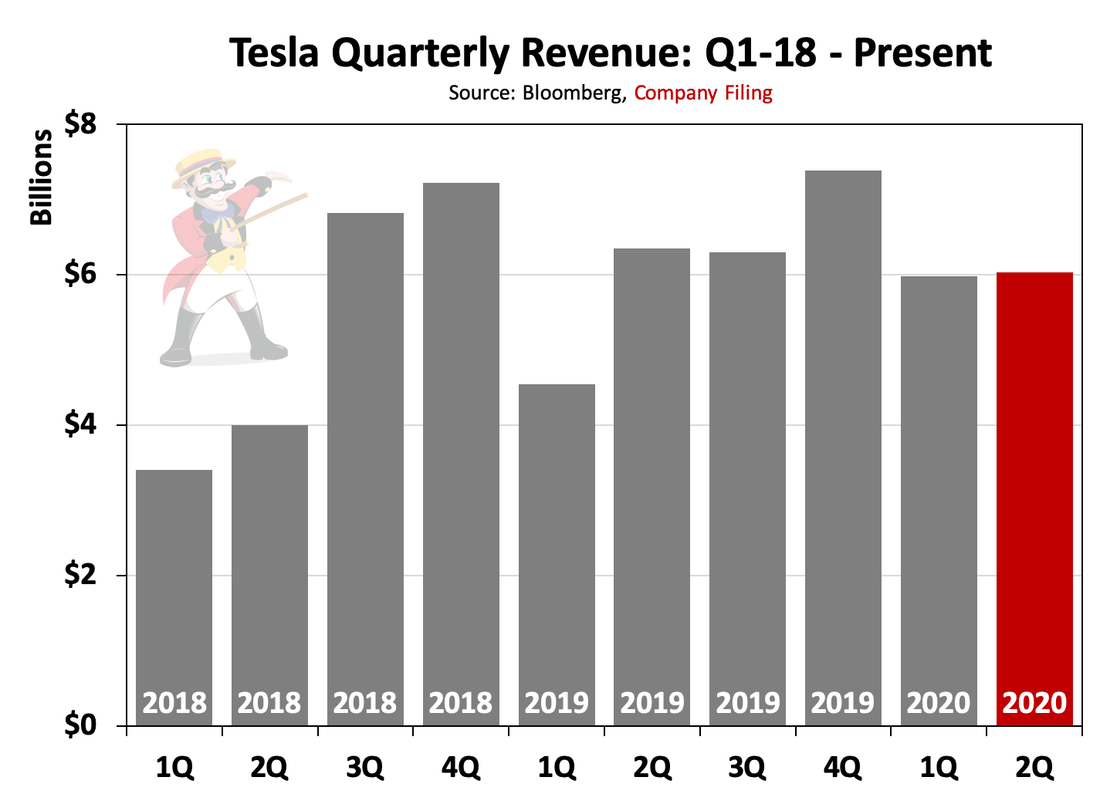

It doesn’t matter whether Tesla is added to the S&P 500 or not. That’s not going to help them learn to make cars efficiently. It’s also not going to help them raise auto prices. Which is the crux of their predicament. See the chart below, Tesla’s growth is basically dead so there isn’t much coming in the way of economies of scale. So they need to figure out how to raise prices before the regulatory credit gravy train comes to an end. Which it probably will in 2021.

Whether the market understand how much of a basket case Tesla is remains to be seen. But I’m confident in my assessment that Tesla is still on the road to nowhere. The question isn’t whether or not they are added to the S&P 500, the question is what do they do next now that their best efforts at converting to mainstream products has failed?

RSS Feed

RSS Feed