There are three points of truth.

1. The Apple Watch has gross margins below the corporate average.

Tim Cook has stated that in the short term, the Apple Watch isn't going to get the same level of gross margins that its established products are bringing in.

2. Apples corporate average for gross margin is around 40%.

This is a weighted average for all the products sold by Apple. However, since the iPhone is 69% of the sales, it exerts the greatest influence. So Tim's comment regarding the Apple Watch makes sense. Apples highest volume product is able to spread its costs over more units than the iPad or Mac yielding the lowest overhead. But the funny thing is, Tim's comment is probably just as applicable to the iPad, Mac, or iPod. What he said was nothing earth shattering, what the tipping point for it needing to be said is. More on that later.

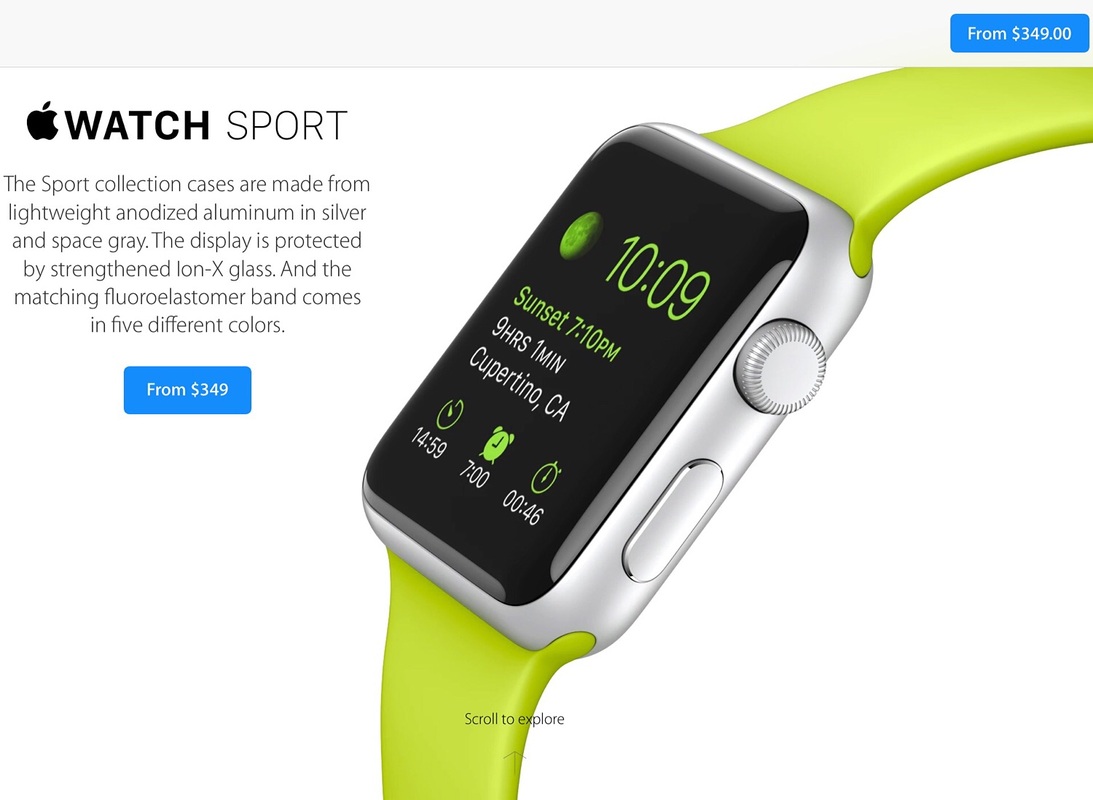

3. The manufacturing cost for the Apple Watch Sport would have to be greater than $207.

If we know that Apple's gross margin in Q2 was 40.8% than the other 59.2% must be manufacturing cost. That means for a $350 Apple Watch Sport the cost must be over $207. No, it's not $84.

Now for the wild speculation. Why would Tim Cook let this little margin tidbit out? I'm sure it wasn't an accident. This margin information isn't a flattering fact for Apple and not really the type of thing you'd want to broadcast unless you had no choice. I'm guessing it's because we are about to see some significant negative movement in Apple's average gross margins when the Q3 results come out in July or August. At that point, the investors conference call is going to zero in on gross margins like Republicans to another Hillary Clinton scandal. Releasing this information now allows Tim to defuse a future panic by saying that they knew this was going to happen and it's all part of the plan. As proof, he'll remind them that he brought this up at the Q2 earnings release.

If this scenario is true. That means a relatively small part of Apple's business is about to exert a relatively large impact on gross margins. That means the cost to manufacture the Apple Watch is probably significantly above $207. By my calculations, Apple is making at best around an 11.0% gross margin on the watch if not losing money outright. If Apple ships five million watches in Q3, and that may be too generous, there is just no way that this relatively small part of their business can cause more than a one point drop in the overall gross margins. I'm going with Investors Business Daily's estimate that the Sport is making up 65% of the watch mix.

If the impact was less than one point, Tim wouldn't have felt compelled to get ahead of the gross margin story at the end of Q2. If you look at Apple's recent history, you'll see that margin swings of up to a point are not uncommon. What further makes me think that perhaps the Apple Watch is losing money is the fact that when the management team huddled to discuss what margin information that they'd be willing to share at the conference call, they completely discounted the fact that any increase in iPhone 6 Plus sales wasn't going to be significant to margin. You can statistically prove that the 6 Plus has lifted gross margins over the last two quarters and if the Apple Watch swings consumer choice even further in favor of the 6 Plus, that mitigates any negative impact from the watch.

It's possible that Tim doesn't believe that the watch will alter the ratio of 6 to 6 Plus sales but I find that unlikely. Even myself, a diehard exerciser who wouldn't ever have considered the 6 Plus before, is now thinking that with my shiny new Apple Watch, I might finally be able to give the larger screened behemoth iPhone a try. I think it's more likely that the Apple Watch is losing so much money that it completely eclipses the favorable 6 Plus impact.

Would I be concerned if it was true that the Apple Watch was earning Apple negative gross margins? Not really. As a financial insider for many corporations, I've had the inside scoop on product line profitability and I'd say that it's not that uncommon for a new product which hasn't reached expected volumes yet. But that's a whole other article for another day.

Consumers don't care what Apple's gross margins are. They just want to feel like they are getting value for their money. And based on my own stainless steel Apple Watch, I'd say that this little gadget successfully carries forward Apple's tradition of well thought out design using premium materials. It's absolutely gorgeous.

RSS Feed

RSS Feed