What Is Depreciation?

What do I mean by a big price tag? In a word, depreciation. If your kid spends $20 on lemons and sugar and then sells $30 of lemonade in his shiny new lemonade stand would you say he made a profit? What if he spent $100 on materials the day before to build the stand? Depreciation is the charge for the "capital assets" of wood and nails that are used to make the stand.

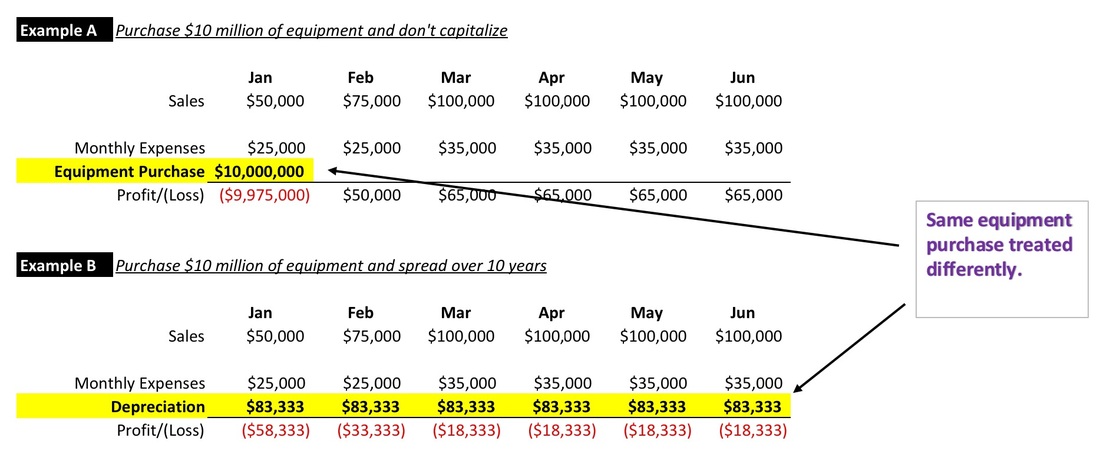

Here is the simple rule for what needs to be depreciated. Basically, if an item will deliver a benefit to the company in the future, it needs to be depreciated. A machine used in assembly can bring many years of usefulness to the company, so its costs are spread over those years. Since raw materials and packaging are one-and-done items, they aren't. This distinction makes a huge difference as you can see from the following illustration.

The Parts Bin

One of the things about Apple that seems to delight accountants but provoke anger in tech enthusiasts is their habit of reaching into the parts bin to use an older processor in a new product.

The phrase "parts bin" probably originated in the automotive industry, but it basically means a group of parts that were designed and paid for by a preceding product. Let's say that GM engineers designed a new wiring harness that could withstand high heat and humidity for their new Silverado pickup truck. All the startup costs associated with producing those new harnesses which would include new tooling, dies, additional manufacturing capacity, software controls, etc., would get spread over each Silverado sold for a set period of time. This charge would be the monthly depreciation hit. However, after a set period of months, those monthly depreciation charges come to an end. At that point, the wiring harness would take a serious drop in cost, making it much more economical to use in all GM products.

So the engineers working on the next generation Chevy Suburban could either design their own custom wiring harness and absorb the depreciation costs or reach into the parts bin and take the harness that was developed for the Silverado pickup truck and enjoy the lower cost and higher margin.

The Financial Case

Apple's use of the parts bin when it comes to processors has been pretty widespread. And it makes a lot of sense considering that the processor is one of the most costly items in any of their products. When the iPad Mini 3 was introduced with an A7 chip instead of the then-current A8, it raised a lot of eyebrows. Or more recently, the new fourth generation Apple TV was introduced with last year's A8 chip. It could be that Apple is forced to use the older chips simply because they can't produce enough of the new ones to satisfy anything other than the iPhone. However, that doesn't mean that they aren't reaping a huge benefit from using parts that are fully paid for.

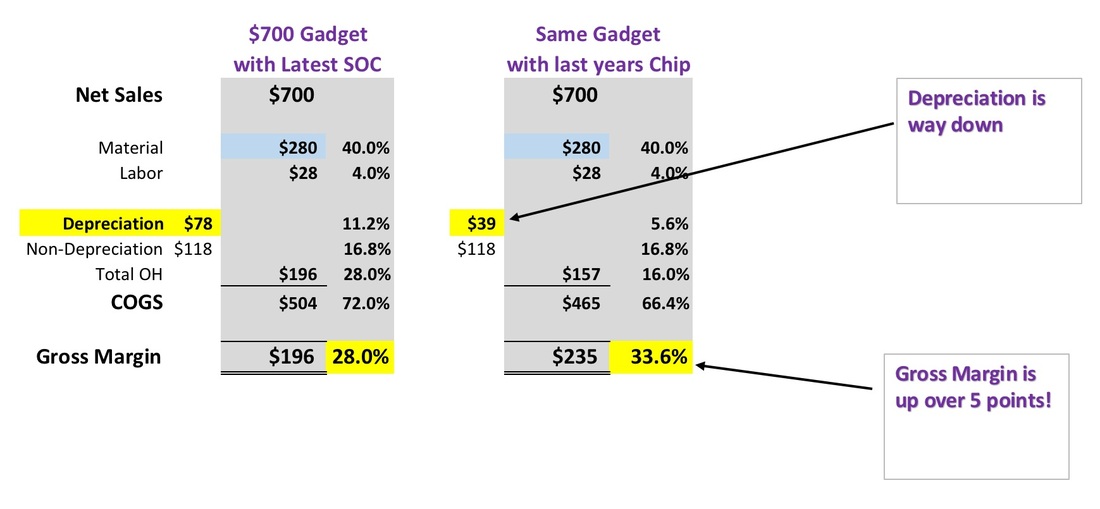

I thought it might be interesting to put together a financial model to see just how significant the impact of using the parts bin can be. I had the iPad Mini in mind when I did this, but the percentage impact would be applicable to other product lines. In fact, it would be much more significant in a lower priced product like the iPod Touch where the processor would be a larger percentage of the sales price.

If my guesstimates are close, then it looks like the use of the parts bin for a major part like the processor would result in a gross margin uptick of well over five points. That would be a 20% increase in margin, allowing the company some flexibility with bringing the price down while enjoying an increase to the bottom line at the same time. A pretty tempting proposition, assuming that sales volume won't get hurt.

No one outside of Apple has access to this level of financial detail. I worked up a model based on my experience in tech hardware manufacturing with ratios of material, labor, and overhead and tried to account for Apple's ability to pull in premium pricing. Based on Apple's reported quarterly earnings, I don't think that I'm far off. But even if I was, you can still get a picture of how significant the depreciation can be. Kind of like a bathroom scale that is off by ten pounds. It may not be right, but if you get on the same scale a week later you have an idea of how much weight you've gained or lost.

Material vs Depreciation

Just because Apple bids out their manufacturing to someone like Foxconn doesn't mean that they don't carry the depreciation on their books. When I was working with Gateway computers, we also contracted manufacturing to Foxconn for laptops, and they were adamant about not paying for the depreciation. It is fairly common in the manufacturing industry that the company who designed the product will purchase and own the assets that physically reside at the contracted manufacturer. So even though Gateway hired out all of its laptop manufacturing to Foxconn, we had hefty depreciation charges each month on the equipment. If a new product is a sales failure, whoever is carrying the depreciation costs carries the most risk.

So the true cost of parts could show up in two different places. You know those insane articles you read every year with sensational headlines about how Apple is charging $800 for an iPhone that costs them $232 to build? They do that by only looking at material pricing. That would be items in my graphic highlighted in blue. Depreciation always shows up in overhead and not material for the manufacturer. So those sensational articles actually raise more questions then they answer.

In Conclusion

I'm not saying that Apple shouldn't try to diversify their revenue stream. I just want to explain how Apple is much more profitable than a company like Samsung partly because they are not diversified. They can spread capital costs over the iPhone's massive volume which will boost margins on other product lines. The iPhone is like a massive bulldozer clearing the way for other products behind it.

I suppose it would be nice if Apple had three or four other product lines as large as the iPhone, but that is much easier said than done. Most companies never get one product like the iPhone, let alone cultivate two or three more on demand. From what I can see, the iPhone's place in history may be up there with the invention of the light bulb or the airplane.

RSS Feed

RSS Feed