Next to my beloved Pebble, however, the Apple Watch looks like a glossy black and silver Lamborghini with power and appeal. I can only imagine what the developers are going to do with this larger retina screen, more robust specs, and total iOS integration. But is a new product with one of their lowest starting prices going to move the needle for Apple? How many watches does Apple need to sell for the product to be relevant?

Herein lies Apple’s problem. The spectacular success of Apple’s iPhone and iPad has led to the wonderful accumulation of cash. This cash has to either be returned to the stockholders or reinvested into the company. If it is reinvested back into Apple, investors raise expectations. This is the part that non-financial types don’t seem to understand. They constantly talk about Apple as if they should be happy with having $150+ billion dollars in the bank, and from that point on perhaps the computer giant should start to give back to the people who got them there.

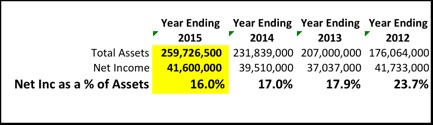

Look at Apple’s total assets for the last three years, and you will see that it is steadily increasing, mostly due to cash and investments. Yet Apple’s net income as a percent of those assets has actually been on a downward slope. So, yes, Apple’s bank account continues to grow; but from the standpoint of return on investment, they’ve been declining. Apple’s stock is at an all-time high right now, but this is not due to their current performance. Stock price is an indicator that investors think that the company has found a path to much greater profitability IN THE FUTURE.

So below we see that while Apple is accumulating $25-$30 billion a year in cash, the net income is not keeping pace. Can the Apple Watch hit high enough volumes to fill the gap?

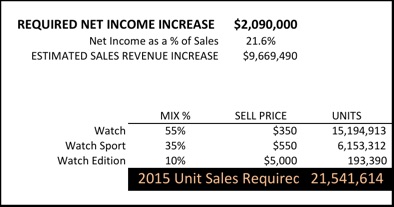

Assuming that Apple maintains its net income margin of 21.6% of sales, the Apple watch would have to bring in an additional $9.7 billion in top line sales revenue.

Can Apple sell over 21.5 million watches? I don’t know, but the iPad sold 15 million units in its first year. And the watch doesn’t necessarily have to do all the heavy lifting by itself. The larger iPhone 6 is expected to have a banner year in 2015.

The Apple Watch is probably engineered to earn a healthy gross margin at the unit level. But gross margins alone are not enough. With an additional re-investment of $25 to $30 billion dollars of new capital per year, what is Apple doing to justify all that cash? Remember my example from earlier: the more money you invest, the more you expect in return.

RSS Feed

RSS Feed